Food producers using electric vehicles and equipment can claim low-carbon-fuel credits

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

Editor/author note: The value received by the customer will depend on who they partner with to claim LCFS credits and how that partnership is structured (i.e. open to market fluctuations or not). As there are no universal values in the LCFS market, the revenue in the examples provided are based on PineSpire services and the incentives paid to its existing customers.

Food producers using electric vehicles and equipment have a valuable opportunity to claim low-carbon-fuel credits. Here is what to know to get started.

Low Carbon Fuel Standard (LCFS) Credits: Turn Charging Costs Use into Charging Revenue

If you own or lease electric equipment (such as forklifts, pallet jacks or yard tractors), your company is eligible to receive revenue from the LCFS program. While the ins and outs of the LCFS program can be complex, this summary will introduce you to the fundamentals of the LCFS program so your company can consider adding revenue from these credits to your bottom line.

Eligibility

The LCFS market can create revenue for agricultural, processing and shipping operations in all portions of the product chain from field to shelf. Importantly, LCFS credits can come from new or existing equipment, and can typically be combined with other grants and rebates. This program should also be considered when planning for the future conversion to electric equipment, particularly as new California Air Resource Board (CARB) standards come into place for forklifts in the near future.

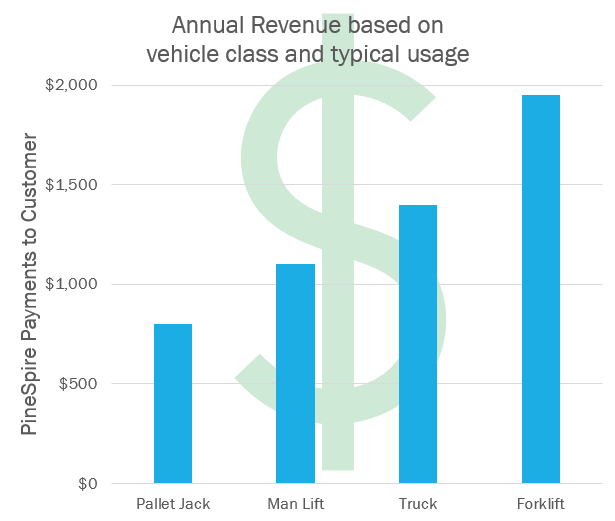

Value of LCFS Credits: The More You Charge, the More You Make

At a fundamental level, the LCFS program is designed so that the more you charge your e-vehicles, the more credits and value you create. The value of LCFS credits depends on market conditions at the time of trading. The LCFS market is relatively complex and benefits from having specialized partners to claim and monetize credits in the marketplace. To give a sense of the value of the LCFS credits, this chart provides the annual revenue generated by different types of equipment, based on PineSpire’s LCFS services. Larger equipment, like electric yard truck, are substantially higher revenue generators, averaging $10,000 per year per unit.

At a fundamental level, the LCFS program is designed so that the more you charge your e-vehicles, the more credits and value you create. The value of LCFS credits depends on market conditions at the time of trading. The LCFS market is relatively complex and benefits from having specialized partners to claim and monetize credits in the marketplace. To give a sense of the value of the LCFS credits, this chart provides the annual revenue generated by different types of equipment, based on PineSpire’s LCFS services. Larger equipment, like electric yard truck, are substantially higher revenue generators, averaging $10,000 per year per unit.

Regulatory Background: “How it Works”

The Low Carbon Fuel Standard (LCFS) program, administered by the California Air Resources Board (CARB), is a cap-and-trade style program aimed at lowering the carbon intensity of fuel used in transportation. Based on the standard set by CARB, fuel producers such as major oil and gas companies are required to reduce the carbon in their fuel, buy credits from users of clean fuels or face penalties. Every time you use a low-carbon fuel (such as electricity), you generate credits that can be sold to the high-carbon fuel producers to help them comply with the targets. The value of an LCFS credit (in dollars per metric ton of carbon ($/MT)) is determined in the market based on supply of credits and demand of high-carbon fuel producers.

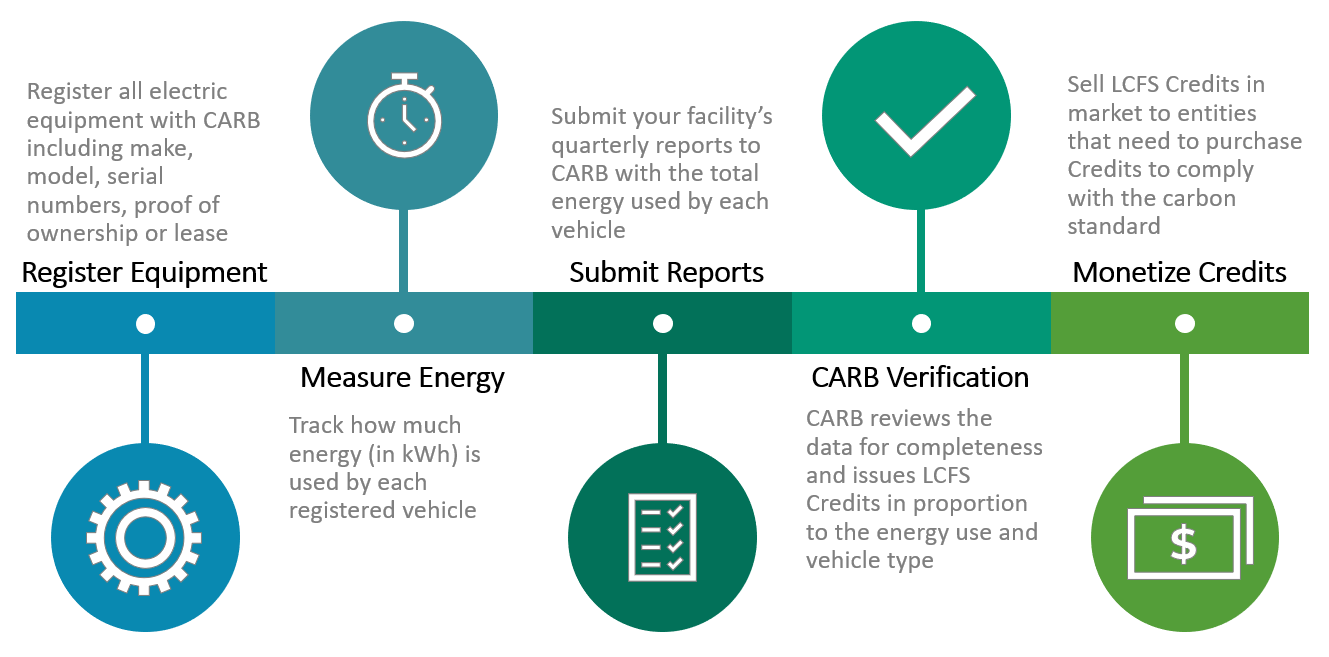

Claiming Your LCFS Credits

The following figure shows the steps to claiming and monetizing LCFS credits; partners like PineSpire can manage this process from beginning to end for you.

Emissions Regulations: the Carrot and the Stick

The revenue opportunity from the LCFS program is the "carrot" in the proverbial "carrot and stick" of regulations. On the other side of CARB regulations is the "stick" of emissions controls and engine requirements. The following are examples of two areas that CARB is currently developing new regulations that could create penalties for conventional fuel vehicles:

Truck Refrigeration Units (TRUs), aka Reefer Truck Units: CARB has drafted regulations to amend regulations on TRUs in order to reduce emissions, particularly when vehicles are docked. This includes obligating the facility to provide electric TRU chargers for any vehicles using their loading stations. While the infrastructure of installing e-TRU chargers will be an upfront cost (the "stick") to facility operators, the potential revenue from electric chargers and LCFS credits can outweigh this cost (the "carrot").

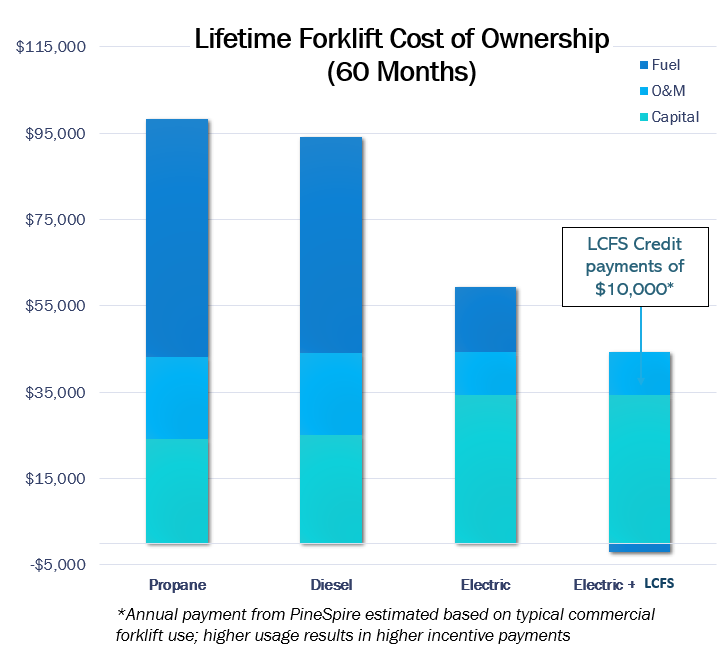

Forklift Emissions: CARB has initiated a zero-emissions forklift measure that would roll out requirements for low-to-zero-emission forklifts by 2025. This measure currently proposes retirement of conventional forklifts based on their age and emissions. To be proactive in your fleet management, take into account the cost of vehicle compliance or retirement versus the benefit of LCFS revenue from electrification.

Benefits of Electrification

As many food processors have already discovered, there are many benefits to electrification, as shown in in this case study graph. While it can require a larger upfront capital investment, the cost of owning and operating an electric forklift or other electric vehicle can be significantly lower compared to propane or diesel over the life of the vehicle. This is largely due to the dramatically cheaper fuel costs (electricity compared to liquid fuel) as well as lower operations and maintenance costs. Electric equipment, without an internal combustion engine, is less likely to need maintenance or have downtime. Electric equipment also creates a safer (and more comfortable) working environment by dramatically reducing noise and improving communication. It also improves the air quality for staff working with their vehicles and in areas (particularly indoors) where vehicles could be operating. The lack of emissions also eliminates the possibility of damage or negative impacts on food products.

As many food processors have already discovered, there are many benefits to electrification, as shown in in this case study graph. While it can require a larger upfront capital investment, the cost of owning and operating an electric forklift or other electric vehicle can be significantly lower compared to propane or diesel over the life of the vehicle. This is largely due to the dramatically cheaper fuel costs (electricity compared to liquid fuel) as well as lower operations and maintenance costs. Electric equipment, without an internal combustion engine, is less likely to need maintenance or have downtime. Electric equipment also creates a safer (and more comfortable) working environment by dramatically reducing noise and improving communication. It also improves the air quality for staff working with their vehicles and in areas (particularly indoors) where vehicles could be operating. The lack of emissions also eliminates the possibility of damage or negative impacts on food products.

Another way to evaluate the cost-benefit of electric equipment is to look at a monthly breakdown. One industry tool that helps to quickly visualize life time costs and can be catered to your fleet needs and finance terms is EPRI’s Forklift Comparison Calculator.1

Additional Information

This article was provided by PineSpire. For additional information or consultation on LCFS Credits and Revenue for your business, please contact Ryan Huggins at PineSpire: RHuggins@PineSpire.com or 559-691-4284.

1 https://et.epri.com/ForkliftCalculator.html?ver=1.0