Once in a lifetime

For supply chain professionals, 2018 was a year unlike any other as they tried to navigate through tight transportation capacity and high rates. Now shippers and carriers alike are trying to dig their way out of the aftereffects and bring back a sense of normalcy.

LOGISTICS AND SUPPLY CHAIN PROFESSIONALS will not soon forget 2018.

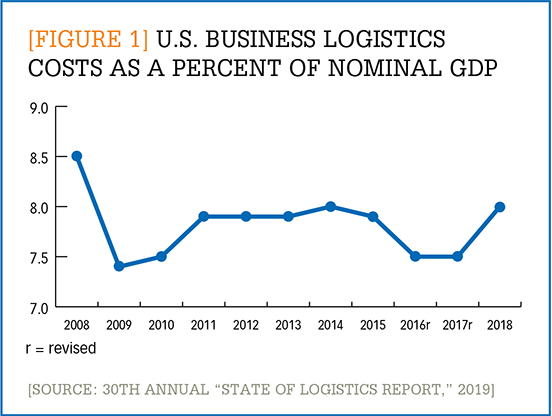

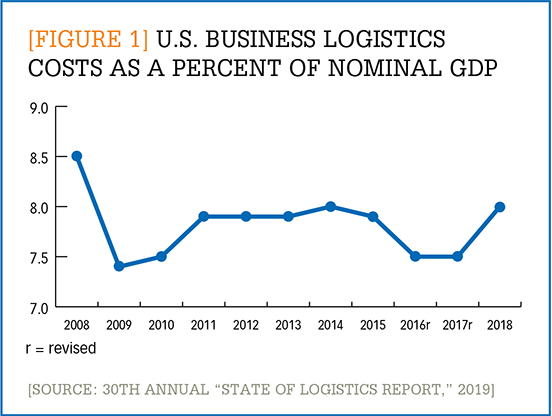

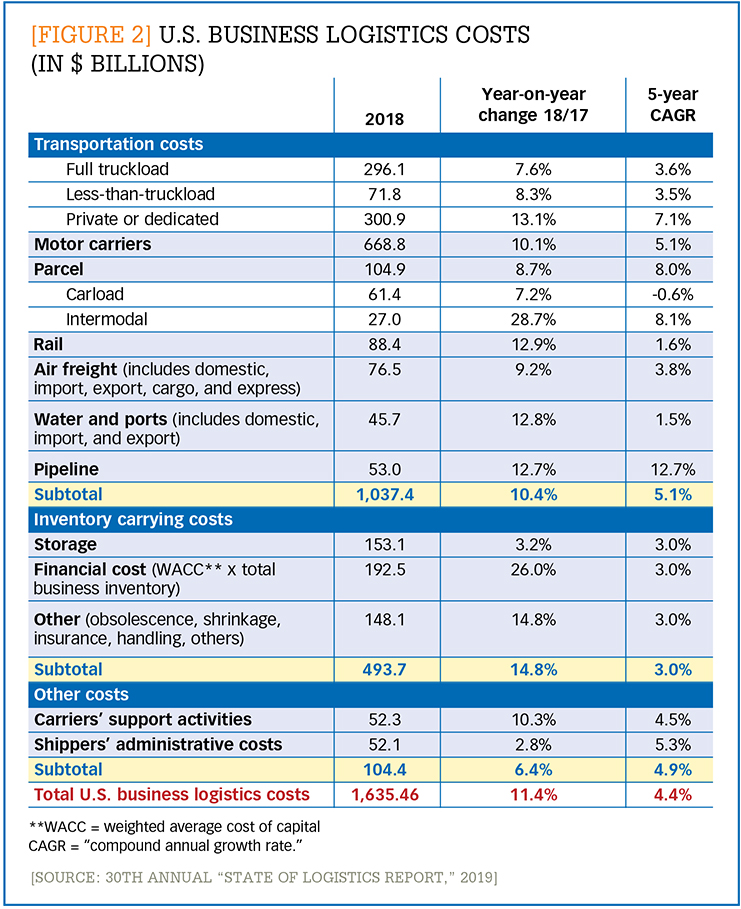

Rate increases and capacity constraints were the name of the day across all segments of the logistics market last year. As a result, overall U.S. business logistics costs jumped 11.4% in 2018 to a total of $1.64 trillion, or 8.0% of the U.S.’s $20.5 trillion gross domestic product (GDP). (See Figure 1.)

In spite of early warning signals in 2017, many shippers were caught by surprise by the intense rate hikes. As a result, many major shippers—such as Kraft Heinz, General Mills, Whirlpool, and Coca-Cola—reported that they exceeded their supply chain budget spending in 2018 and that freight rates resulted in a negative impact on earnings. And for many logistics and supply chain professionals, 2018 (at least in terms of cost and capacity availability) was the most challenging year of their career—the equivalent of a 100-year flood.

So maybe the Council of Supply Chain Management Professionals’ (CSCMP’s) “30th Annual State of Logistics Report,” presented by Penske Logistics, should come with a warning label. Written by the global management consulting firm A.T. Kearney, the report provides an overview of industry trends and U.S. business logistics costs of the past year as well as a review of macroeconomic factors affecting logistics costs, analysis of each major logistics sector, and insights from industry leaders. All of this may make the report uncomfortable reading for those shippers who would rather not relive the past year. Indeed, Ken Braunbach, vice president of U.S. transportation at megaretailer Walmart, said that reading the report was like “watching a bad movie again.”

The report digs deep into all the components that make up business logistics costs, which it categorizes into three sections: transportation costs, inventory carrying costs, and other administrative costs. (See Figure 2.) It states that all three of these components increased last year. In the past, an increase in U.S. business logistics costs would be read as a sign that logistics efficiency across the country had decreased. Last year, however, the increased costs were more tied to the inflationary nature of the market itself, said the report’s principal author Michael Zimmerman of A.T. Kearney.

For this reason, Derek Leathers, president and CEO of motor carrier Werner Enterprises, argues that while the data in the report is accurate, it should be interpreted cautiously. Speaking during a panel discussion reviewing the report in June, Leathers said the supply chain of 2018 cannot really be compared to the supply chain of 2015 or 2016.

“We’re comparing apples to oranges,” he said. “As e-commerce continues to grow, as people expect everything—including toilet paper—to be delivered next day, you are having to do more work. Supply chain providers are being stretched and expected to expand their portfolio in ways and at a pace that’s really never been seen before. So yes, supply chain costs went up, but it’s a much more robust supply chain that we’re talking about.”

Runaway transportation costs

The largest portion of those costs is made up of transportation costs, which the report authors estimate reached $1.037 trillion last year. Every transportation mode saw a significant increase in costs in 2018, from rail, which saw costs rise by 12.9%, to air freight, which saw a boost of 9.2%. Let’s take a closer look at the key trends in each mode.

Motor carriers. Shippers were particularly hard-hit when it came to the trucking segment. Overall spending on trucking saw an increase of 10.1% over 2017, reaching $668.8 billion. This increase was driven by tight capacity and high rates. The report acknowledges that carriers raised rates partly to cover the cost of complying with increasing government regulations and rising driver wages. But it says that rates mostly rose due to tight capacity caused by robust demand for loads, which was driven by strong consumer spending and the growth in e-commerce.

Carriers were able to capitalize on rate increases and saw improvements in profitability (measured by operating ratios) and productivity (measured by revenue per truck). Meanwhile shippers struggled to contain spend. In many cases, they responded by turning to dedicated fleets to guarantee access to capacity, implementing “shippers of choice” programs to make their freight more desirable to carriers, and placing more emphasis on understanding total cost of ownership by evaluating not just their contractual costs but also spot market rates and accessorial charges. Indeed, spot market rates were especially volatile last year, increasing nearly 25% from February to the summer peak before dropping back down 20%.

Parcel. Driven by the rise in e-commerce sales and the increase in business-to-consumer (B2C) deliveries, parcel expenditures continued their steady growth rate in 2018, reaching nearly $105 billion, an increase of 8.7%. This rise will likely continue as e-commerce sales are expected to have a compound annual growth rate (CAGR) of 12% for the next five years.

While spending has increased, parcel shipping providers are now contending with the increasing challenges caused by e-commerce deliveries, such as longer and less efficient routes, greater volatility (with shipments jumping sharply during the holidays), and more irregularly shaped items that require special handling. On top of these pressures is the continuing push for faster delivery times. These challenges continue to place intense pressure on margins for carriers as they face competition from new sources such as Amazon. In response, providers are turning to automation, machine learning, and artificial intelligence to improve efficiency, forecasting, and route and network optimization. Shippers, for their part, are focusing on product and customer segmentation to determine what type of services to offer, offering in-store pickup of online orders, and partnering with same-day delivery startups such as Shipt, Roadie, and Deliv.

Rail. America Class I railroads benefited from the tight trucking market in 2018, seeing increases in carload shipments year-over-year and revenue per segment. At the same time, the railroads were also seeing decreases in their operating expenses due to their embrace of Precision Scheduled Railroading. This operating philosophy requires precisely timed departures and arrivals, emphasizes asset and labor productivity, and involves a tight focus on improving operating ratios.

But the transition to Precision Scheduled Railroading has not been seamless. Some locations in the network have experienced service failures and longer transit times. These problems may ease as rollout of the concept continues and the railroads invest in new technology. Railroad companies must also make sure that in their rush to improve operating ratios they don’t overlook infrastructure investments.

Air freight. Many carriers, such as Atlas Air, United, American, and Delta, saw record revenue from air cargo in 2018 as airfreight rates increased by about 5% for East-West lanes. The carriers were able to raise rates and increase revenue in spite of the fact that capacity grew by 5.4%, outpacing demand, which grew by 3.5% (a significant decrease from 2017’s 9.7 growth rate). This slowdown in volume is expected to continue into 2019, with the International Air Transport Association (IATA) forecasting a 0% growth rate. While near-term demand is softening, the report anticipates that specialized cargo and e-commerce shipments will continue to drive long-term growth.

Recognizing the growing e-commerce demand, cargo carriers are working to convert older passenger jets to cargo planes and are scrambling to introduce digital technology that can increase efficiency and reduce delivery times. At the same time, providers will continue to contend with volatile fuel costs.

Water and ports. Ocean carriers saw increased demand in 2018 as shippers tried to build up inventories ahead of the tariffs imposed by the Trump administration. In Q4 of 2018, for example, imports rose an astonishing 13% year-over-year. However, even though demand increased by 4.4%, it did not outpace capacity growth (5.7%). However, carriers were disciplined about how they deployed that capacity and even cancelled some scheduled voyages. As a result, ocean shipping also saw record-high rates in 2018.

Demand is expected to ease this year, but rates are still high. A big area of uncertainty and concern for this market segment is the International Maritime Organization (IMO) 2020 sulfur regulations, which require ships to either install scrubbers or switch to low-sulfur diesel fuel to lower emissions. These regulations may lead to a bump in fuel prices.

Pipeline. The major trend for the pipeline segment was an increase in capacity, which helped ease constraints caused by record-high oil and gas production. Ten new pipeline projects resulted in 10 billion cubic feet (BCF) per day of additional capacity, and 29 expansions added another 7.5 BCF per day. Another 30 BCF per day of capacity is planned for 2019.

The rise of inventory, other costs

While not representing as big a portion of business logistics costs as transportation, inventory carrying costs did see the biggest increase in 2018. U.S. business inventory levels rose 4.6% year-over-year, reaching an all-time high of $2.75 trillion. As a result, inventory carrying costs rose 14.8%. These increases were driven not by poor inventory management practices but by companies pulling forward inventories in response to impending tariff increases. At the same time, warehousing rents increased roughly 4% as demand continued to expand faster than supply.

In addition, support activity costs and administrative costs (shown as “other” in Figure 2) also rose by 6.4% in 2018. Support activities include such services as freight transportation arrangement, customs services, and packing and crating. As supply chains grow increasingly complex and trade conditions become even more volatile, shippers are increasingly turning to freight forwarders and third-party logistics providers. The benefit of these third-party partners is that they are often able to leverage their relationships with carriers to better ensure capacity and find innovative ways to handle increasingly complex logistics challenges. Meanwhile rising wages certainly had an effect on shippers’ administrative costs.

Future trends

The good news for shippers is that 2019–2020 will not be a repeat of 2018. Instead many economists are expecting slower growth this year, in part because companies will be decreasing shipments due to last year’s big forward pull of inventory. For example, Jill Donaghue, vice president of supply chain at Bumble Bee Foods, says that the canned seafood company is actively trying to reduce its inventory, which involves shipping more directly to the customer and importing less.

While this decline in the growth rate is not good news on a macroeconomic level, it will provide some relief to shippers, which are already benefiting from the opening up of capacity and less volatile rates.

In addition to the slowing economy, the report anticipates the following trends to have a big impact on the logistics space in the next few years.

Continued growth of e-commerce. Direct shipments of e-commerce sales to the consumer will continue to be a big growth driver for logistics companies, according to the report. The report authors anticipate that this trend will bring about an increase in intermodal shipments and contract logistics for last-mile deliveries as well as more smaller-format warehouses in urban centers.

Continued volatility in trade relations. As recent events have shown, tensions between the United States and many of its trading partners, particularly China, show no sign of easing. The continuation of tariffs imposed early in 2019 and the possibility of more being added will have a negative impact on logistics demand going forward. This decrease in demand should affect not just ocean and air shipments but also rail and trucking. Additionally, the new sanctions on Iran may bring increased fuel costs.

Increased focus on environmental concerns. Environmental issues could also foster change in the logistics industry. For example, the ocean freight sector is dealing not only with the upcoming IMO 2020 regulations but also with the effects of China’s decision to stop the importation of recycling materials. Meanwhile the trucking industry continues to experiment with renewable energy technology such as electric and hydrogen fuel.

The increased importance of emerging technology. Faced with large macroeconomic pressures such as the shortage of labor and the growth in e-commerce, the logistics industry has become much more open to adopting new technology. Indeed, new technologies such as machine learning tools, automation, and robotics are becoming necessary just so that companies can survive, let alone thrive, in the current economic environment. Only the adoption of technologies such as telematics, the industrial Internet of Things, and predictive analytics will allow companies to cost effectively meet the demand for faster deliveries. As a result, supply chain professionals will want to closely watch the rollout of the 5G mobile broadband and communication standard. Many of the emerging technologies that companies are banking on will depend on the faster speeds, reduced latency, and greater device density that the new standards will provide.

Finally, the authors foresee increased partnership across all elements of the industry. The benefits of collaborative relationships and “shippers of choice” programs have long been talked about and promoted in the industry. But all too often, shippers and carriers found themselves falling back into traditional adversarial roles. The economic upheaval of 2018, however, seemed to provide a tipping point, according the report’s authors, and these strategies are being more fully embraced by larger swaths of the industry. It may be that these relationships will serve as the key to unlocking the full potential of the supply chain and reducing logistics costs in the years to come.

The silver lining

Even though 2018 was a painful year for many shippers, the “State of Logistics Report” ends up sounding an overall optimistic note.

The main thrust of this optimism is that many shippers and carriers responded to the tight capacity, rising rates, and difficulty of finding drivers and warehouse workers by embracing greater collaborative relationships. Many shippers pursued “shipper of choice” programs that strove to make themselves more attractive to carriers, for example by having rest areas and facilities for drivers, collaborating on strategic initiatives, and improving turnaround times to get drivers in and out of facilities as quickly as possible.

Even as the economy begins to soften and capacity opens up, most companies show no sign of reverting to past bad habits, according to the report. “Neither shippers nor suppliers seem satisfied with business as usual and the opportunity to leverage technology and collaborative practices is driving tangible efficiencies and shared gains,” said Michael Zimmerman, one of the report’s main authors.

This sense of optimism was echoed by the panel of industry experts that addressed the report’s finding at the National Press Club in Washington, DC, when the report was released in June. Jill Donaghue, vice president of supply chain for Bumble Bee Foods, was heartened by the change that has occurred in the industry. “After last year, shippers and carriers are truly coming together to collaborate,” she says. “No longer is it, ‘You’ve got to reduce your rates.’ Instead it’s, “How can we work together to be more efficient so that both of us make decent margins?’”

Donaghue says that even though Bumble Bee has been a “shipper of choice” for many years, it made an additional effort to be more collaborative. For example, based on carrier feedback, Bumble Bee has shifted how it contracts out its business. This year the company is working with a few core carriers and using quarterly pricing instead of year-round pricing. This change has reduced uncertainty for the carriers, she says.

Walmart also has had a “shipper of choice” program in place for over a decade, according to Ken Braunbach, vice president of U.S. transportation. But last year, the retail giant renewed its focus on efficiency at the dock. For example, in the past, if perishable products arrived at Walmart’s docks not meeting temperature specifications, the retailer would hold the truck at the dock until the problem was sorted out. Now, it is unloading the products from the truck and allowing the drivers to go on their way, improving driver and truck utilization.

On the carrier side, some companies also followed a more collaborative approach in spite of the lure of increased rates last year. For example, Derek Leathers, president and CEO of Werner Enterprises, said that Werner did not chase the favorable rate increases seen in the spot market and instead stuck with its shippers.

“In some cases, we did take rate increases,” he said. “But they were not in excess of what the market was seeing, and in many cases, they were significantly below that. We stuck by our shippers, and we are seeing them reciprocate this year.”

To learn more …

For 30 years, the annual “State of Logistics Report” has quantified the impact of logistics on the U.S. economy. The summary provided in this article represents just a small fraction of the statistics and analysis included in the report. CSCMP members can download a full copy of the report at no charge from CSCMP’s website.

Additionally, videos of the June 19, 2019, “State of Logistics Report” presentation and the panel discussion that followed the report’s release at the National Press Club in Washington, D.C., are available on Penske Logistics’ YouTube channel. The presentation will be repeated at CSCMP’s EDGE Conference.