Written by CSCMP Member Jim Dawson

The impact of the COVID19 pandemic on global supply chains will play out throughout the world well into the foreseeable future. In the U.S. the stark reality of relying on China as an integral manufacturer of many products that Americans gave little thought to prior to COVID-19, has resulted in a groundswell cry to reevaluate this relationship moving forward. From the C-suite of large multinational corporations to closely held business owners the question of whether to move some manufacturing operations back to the United States is currently underway. While it is impossible to move a foreign manufacturing facility overnight, some operations can be peeled back to the U.S. in short order. This will likely result in the opportunity to export these products from the U.S., thus revisiting the vitality of the Interest Charge Domestic International Sales Corporation (IC-DISC) may be in order, especially for closely held businesses.

Qualifying as an IC-DISC

An IC-DISC is effectively a shell company that creates permanent tax savings for its individual owners by virtue of the Internal Revenue Code and related Treasury Regulations. The IC-DISC is deemed to act as a sales commission agent for a U.S. manufacturer or distributor that exports U.S. made products. The IC-DISC does not have employees or offices and does not physically perform any services or participate in export sales even though it is entitled to a commission.

The IC-DISC is a legal entity organized as a C corporation. The corporation makes an election to be treated as an IC-DISC on Form 4876-A. However, for the C corporation to be treated as an IC-DISC, certain requirements must be met. These requirements include, the corporation cannot be a corporation ineligible to make an IC-DISC election, cannot be a member of any controlled group, be capitalized with $2,500 and can only have one class of stock with a stated value of $2,500 on each day of the tax year.

To qualify as an IC-DISC, the C corporation must pass two tests, the qualified export receipts test and the qualified export assets test. The qualified export receipts test requires that 95% of the gross receipts of the IC-DISC constitute qualified export receipts. Qualified exports receipts include gross receipts from the sales or services related to export sales or rents, engineering or architectural services for projects outside the U.S. and commissions thereon. The qualified export assets test requires that 95% of the assets of the IC-DISC be qualified export assets. Qualified export assets include accounts receivable, temporary investments, export property and loans to producers.

It is extremely important that the exporter can substantiate its exports satisfy the definition of export property. Qualified Export Property is defined as property that is

Calculation of the Commission

The size of the federal tax benefit to be derived by utilizing an IC-DISC is based on the calculation of the IC-DISC commission amount. The amount of the commission is calculated utilizing one of three pricing methods:

Maximizing the Benefit

In general, the IC-DISC federal tax benefit is derived as follows:

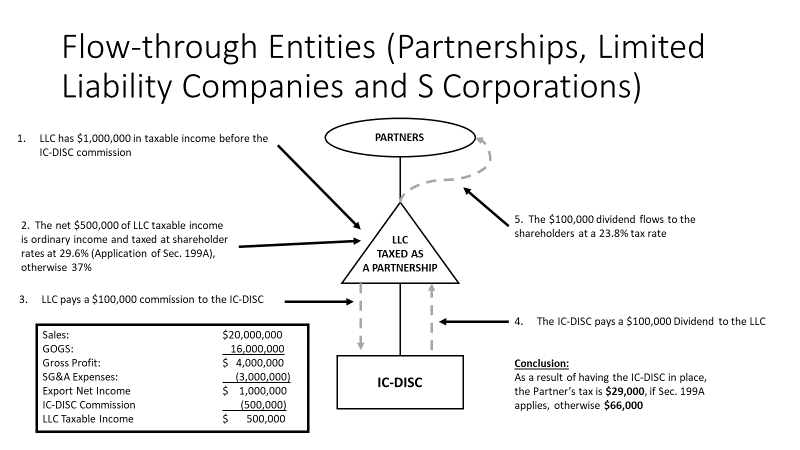

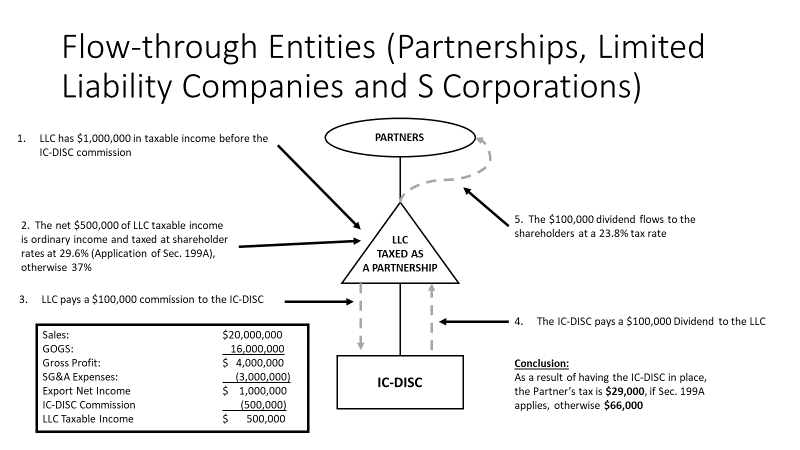

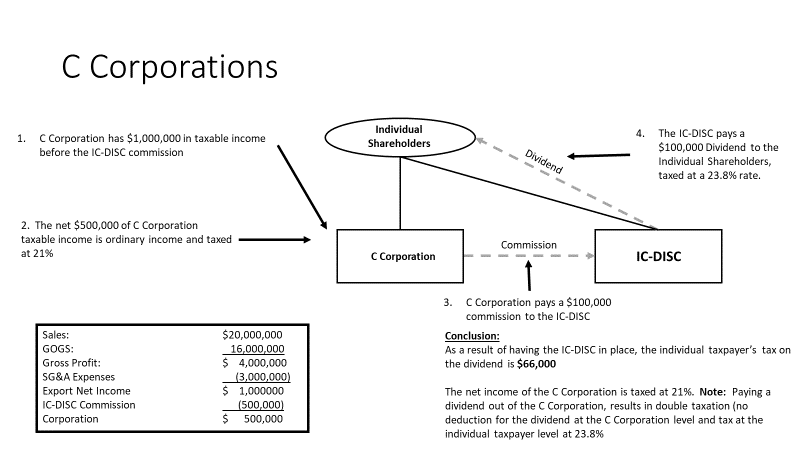

The maximization of the tax benefits of an IC-DISC depend largely on the structuring of the legal entities involved in the export sales transactions and the receipt of IC-DISC dividends by the individual shareholders. Two structures most commonly utilized include:

In the structure above, the commission paid by the related exporter to the IC-DISC is deductible as an expense. This deduction yields a federal tax benefit to the individual owners of the exporter at their applicable ordinary income tax rates. As a result of the Tax Cuts and Jobs Act (TCJA), effective for 2018, the highest individual tax rate is 37% or, as may be applicable, 29.6% for those qualifying for the new Section 199A Qualified Business Income Deduction. The 23.8% individual tax rate on qualifying dividends remains unchanged. Thus, the rate differential can be either 13.2% (37.0% - 23.8%) or 5.8 (29.6%-23.8%).

As noted earlier, the preferential rate on IC-DISC dividends is limited to individuals. C corporations are taxed at regular rates on IC-DISC dividends, thus a C corporation owned IC-DISC offers no permanent tax rate arbitrage opportunity.

This result can be dramatically altered by structuring the IC-DISC ownership either by having the IC-DISC owned by an LLC owned by the same individual shareholders of the C corporation or directly by the same individual shareholders of the C corporation. By structuring the ownership of the IC-DISC as previously noted, the rate differential of either 13.2% (37.0% - 23.8%) or 5.8% (29.6%-23.8%) can be secured.

Benefits Beyond Tax Rate Arbitrage

In employing an IC-DISC in a closely held business’ overall tax planning, consideration should be given to other business planning objectives.

Increased Liquidity for U.S. individual Taxpayers or the Business

Shareholders looking to rebalance their investment risk profiles can use the cash received from the IC-DISC to gain liquidity. For the related manufacturer or distributor, the IC-DISC provides a means to combat lending and debt covenant restrictions that many times restrict diversification and risk management. Rather than be restricted by items such as amount of salary that can be paid, dividend restrictions and debt covenants shareholders gain flexibility to take action that best serve the business.

Ability to Leverage the Cost of Capital

The reinvestment of IC-DISC earnings back into the exporting company by means of a note and interest in the form of a producer loan results in addition tax rate savings and diminishes the cost of capital to the group. Care should be exercised when utilizing producer loans as there are restrictions on both their size and use.

Create Management Incentives

Management Incentives can be created for export company management and other personnel by being named shareholders of the IC-DISC, thus allowing them to benefit from any additional cash flow created by increasing the manufacturer or distributors sales.

Succession and Estate Planning Facilitation

The cash distributed from the IC-DISC to individual taxpayers, can be used by those taxpayers participating in a buy-out of current or previous shareholders. IC-DISC shares may also be used as a method to freezing stock values.

Revisiting Existing C Corporation IC-DISC Structures

Closely held businesses are encouraged to review their current IC-DISC structures and assess the ongoing tax benefits due. While some closely held businesses may find that the benefits of using an IC-DISC are far outweighed by the compliance and maintenance costs, others will discover the IC-DISC still provides them with a benefit for engaging in export activities.