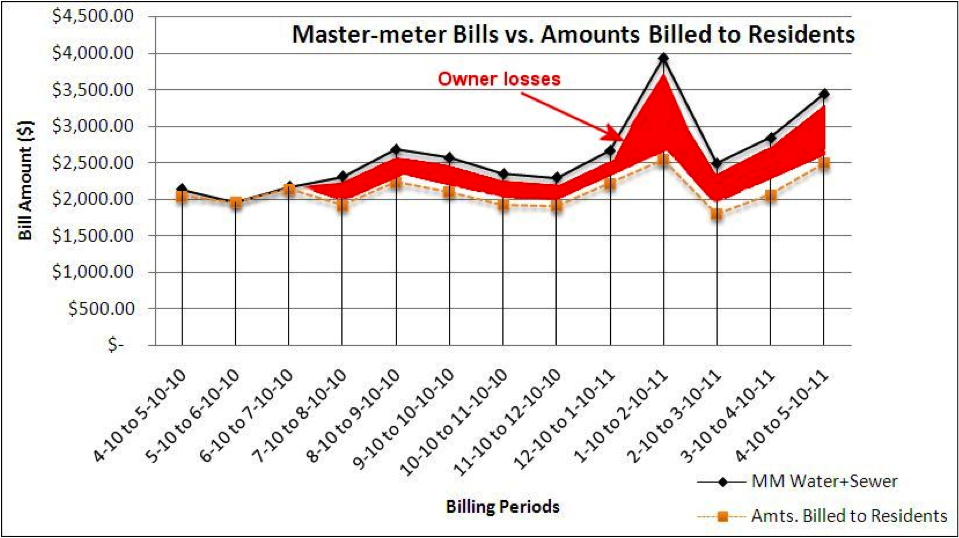

"How much money do you estimate was lost?" We put this question to a multifamily owner whose complexes total nearly 500 units. His answer was shocking. "Nearly $200,000 over several years." Our next question was obvious..."How?"

"Each year, the amount of money we paid for our master-meter water and sewer bills increased, but the amount we recovered from our resident utility billing program slowly decreased. We relied on a billing provider to manage the process for us but the losses happened gradually enough that we didn't catch the errors."

When the owner investigated more closely, he discovered that his local water utility had increased the water/sewer rates several times, but that resident bill calculations had not been updated with those rate changes.

While this is an extreme example of what can happen when resident utility bills are calculated inaccurately, it also exposes two common problems: under- and over-billing.

Under-Billing Costs Owners. Under-billing usually occurs in submetered complexes when the master-meter rates increase but those rate changes are not carried over to resident bills. It can also happen when common area deductions (CADs) are higher than necessary, or when legally billable fees--e.g., emergency medical services, stormwater charges, etc.--are not charged back to residents.

Over-Billing Puts Owners in Jeopardy. Over-billing is most likely to happen when owners fail to subtract CADs or other unbillable expenses from the master-meter bill amount, and charge residents more than they should. It also occurs when owners receive a lower commercial utility rate, and then bill tenants at a higher residential rate.

Over-billing puts the owner in the undesirable position of "profiting from the sale of utilities." It gives discontented residents justification for filing complaints with the public utility commission (PUC) or sharing their grievances with the local media as this example highlights:

"Angry tenants voice complaints at CH Village. Residents upset by utility bills and safety issues" - http://chestnuthilllocal.com/issues/2009.04.16/news1.html

Outsourcing Resident Utility Billing

To simplify resident utility billing, owners often use a third party billing company. Be aware, however, that these service providers make mistakes. It's recommended, therefore, that owners periodically conduct their own internal "audit" to ensure that bills are being tallied properly. Here's a simple auditing process:

1. Know state regulations regarding multifamily utility billing. You can find the appropriate rules for multifamily utility billing residents at your state's PUC office or through a National Apartment Association (NAA) Affiliate. These rules define how to calculate resident bills.

2. Collect relevant billing data. Build a spreadsheet that has three columns: Billing Period, Master-meter Charges (for your complex), Amounts Billed to Residents (less any resident service fees or other non-billable charges).

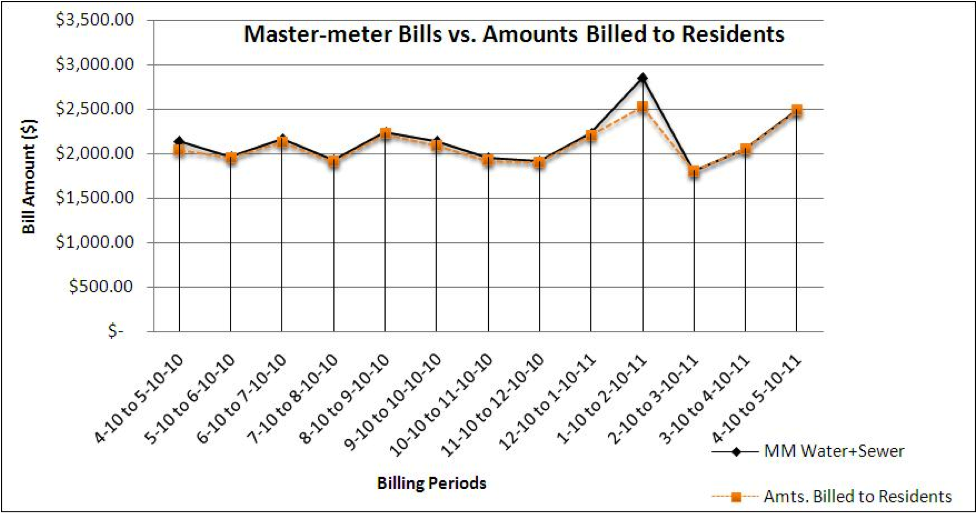

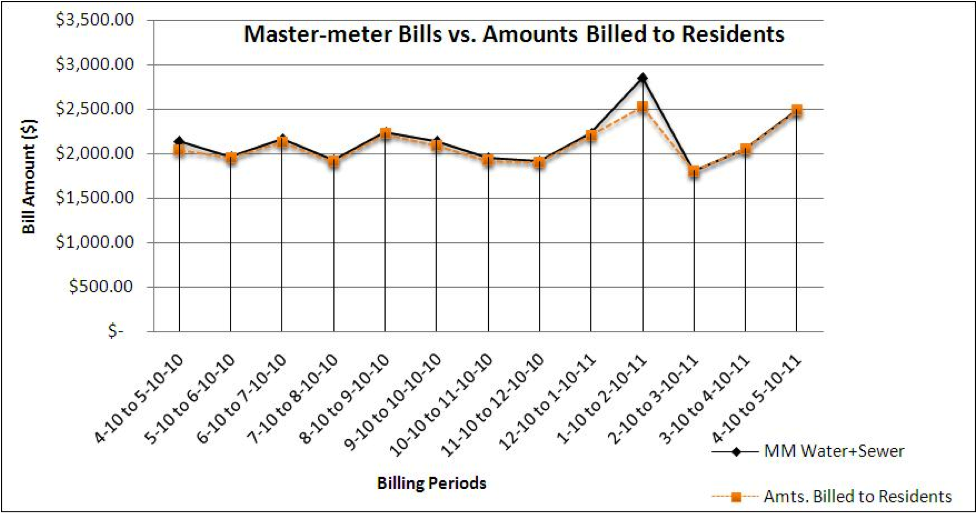

3. Graph Master-meter Charges and Amounts Billed to Residents. On the x-axis of your graph, display the Billing Period. On the y-axis, display Bill Amounts ($). Add data points for the Master-meter Charges and plot the line. Next, add data points for the Amounts Billed to Residents and plot the line.

Figure 1.

If the graphs are tightly coupled, like Figure 1, your billing is most likely accurate. If the graphs diverge over time, like Figure 2., you're probably under-billing.

Figure 2.

Summary

Billing errors, and the financial and tenant problems they can create, are entirely preventable. Periodically auditing your utility billing program will ensure accounting accuracy and give you peace of mind.

- End -

AmCoBi offers affordable, quality-focused utility billing and submetering services to the multifamily industry. Our services help multi-residential owners and property managers improve profitability, reduce utility expenses, and save money.