Water Walker Economic Update Recap

Print this Article | Send to Colleague

Inflation began the year as a “transitory” risk, one that would likely fade quickly with little effort on behalf of our central bank. Hindsight is always twenty-twenty, but early in the year inflation was mostly contained to goods, not services, as many supply chains were still under pressure from the pandemic. What became interesting to watch was how the economy for services, anything from travel and hospitality to professional services began to succumb to the broad march towards higher prices. Inflation’s staying power was apparent by mid-year, and as a result the Federal Reserve effectively changed its stance from away from “transitory” towards a mentality of, “we’ll do whatever it takes”. As a result, the Federal Funds Rate, which is the baseline rate at which banks borrow/lend to each other overnight, has risen from zero to roughly four percent in a matter of twelve months. The Consumer Price Index (CPI), the most utilized measure for US inflation, sits at 7.1% year-over-year, down from a high of 9.1% in June, but well below the central bank’s target of 2.0%. Meanwhile, the unemployment rate sits at a near-historic low of only 3.6% as of September, the lowest level since the late 1960s, providing a strong backdrop heading into the new year. In effect, there is plenty of room for the Fed to continue in raising interest rates, although there are some indications that inflation is moderating slightly.

Inflation began the year as a “transitory” risk, one that would likely fade quickly with little effort on behalf of our central bank. Hindsight is always twenty-twenty, but early in the year inflation was mostly contained to goods, not services, as many supply chains were still under pressure from the pandemic. What became interesting to watch was how the economy for services, anything from travel and hospitality to professional services began to succumb to the broad march towards higher prices. Inflation’s staying power was apparent by mid-year, and as a result the Federal Reserve effectively changed its stance from away from “transitory” towards a mentality of, “we’ll do whatever it takes”. As a result, the Federal Funds Rate, which is the baseline rate at which banks borrow/lend to each other overnight, has risen from zero to roughly four percent in a matter of twelve months. The Consumer Price Index (CPI), the most utilized measure for US inflation, sits at 7.1% year-over-year, down from a high of 9.1% in June, but well below the central bank’s target of 2.0%. Meanwhile, the unemployment rate sits at a near-historic low of only 3.6% as of September, the lowest level since the late 1960s, providing a strong backdrop heading into the new year. In effect, there is plenty of room for the Fed to continue in raising interest rates, although there are some indications that inflation is moderating slightly.

INTEREST RATES AND UNEMPLOYMENT

2023: WHAT MAY LIE AHEAD

A recent survey conducted by Bloomberg shows that markets now predict the overnight lending rate will hit roughly 5% by the middle of 2023. Why does this matter? As this rate increases, the cost of borrowing for nearly everything from credit cards to mortgages will increase.. Borrowing influences consumption, which should slow down the economy in time, albeit with a significant lag. Higher interest rates will eventually stifle consumer demand, pushing down prices for nearly everything, but how far can the Fed take it before it triggers a recession or hurts the labor market? Maybe a more important question is: can we avoid a recession altogether?

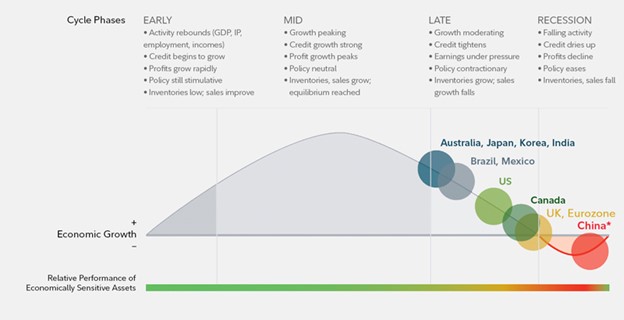

Earlier this year, after surveying a multitude of data, economists mostly shifted their view that the United States is now in the midst of a “late-cycle expansion”. This mature stage of the business cycle typically coincides with positive, but slowing growth, tighter credit conditions and lower earnings. More specifically, in this stage the economy is still growing but the labor market is tight (low unemployment), companies are reporting lower earnings and sales, inventories are high, interest rates are rising, and the yield curve is flattening. For those paying close attention to the financial markets this summer and into the winter, that definition seems fitting for where we currently are. Business cycles often have a variety of definitions, but in general they are a way to measure the expansion, and eventual contraction, of a nation’s economy. The chart below shows a graphical interpretation of this along with characteristics for each stage.

THE BUSINESS CYCLE: 2022-2023

As of this writing in mid-December, the same economists surveyed above believe the US will likely avoid a recession until at least mid-year, but after that it appears much less certain whether the economy can hold on to continued growth. On the bright side, expectations for the US consumer remain robust, as the unemployment rate is only expected to tick up modestly to ~4.2% by mid-year (currently 3.6%), before hitting 4.8% by the end of the year. As a reminder, the US consumer accounts for nearly 70% of Gross Domestic Product (GDP) and is the bellwether indicator for where we’re likely headed. Around this same mid-year, to end-of-year window, markets are expecting interest rates to hit their highs, with yields eventually declining by this time next year. So, in effect we have a somewhat positive expectation for most of 2023, with greater uncertainty later in the year.

Looking ahead to 2023, it will be critical to keep an eye on the factors that define this part of the business cycle. Will earnings expectations continue to decline, or will there be a rebound? Will the labor markets remain tight despite rising interest rates? How will ongoing inflationary pressures affect the consumer? These questions will need to be answered to determine how long we stay in a late-cycle expansion versus heading into any sort of contraction, or recessionary period. As of this writing, economists see a 60% chance that the US could enter a recession in the next twelve months. The Federal Reserve will do everything in its power to balance its mandates of maximum employment, and price stability, and it’s anyone’s guess exactly how this will play out.

For the next six months, pay close attention to broad corporate earnings and any signs of change in the labor market. These two items are likely to be the key factors that determine if we stay in an economic expansion or fall into recession.

LOOKING TO 2023: A FEW CONSIDERATIONS

It appears the consensus is for cautious optimism as we head into a new calendar year. Rates are expected to increase, but to what level and for how long? We previously discussed the ~5.0% expectation for overnight rates, but how long will that persist? Federal Reserve Chair Jerome Powell has indicated that rates will move higher, for longer, but the latter statement is where the markets have trouble. Will rates stay high for six months? A year? Nobody can be certain. Thankfully, overnight bank deposits and money market funds are paying above zero for the first time in years, but we should always have an eye towards what could be coming next. We do not know how long current rates will persist, but we seemingly have some time to take advantage of the current state of affairs.

One key idea for next year: For those who have flexibility, it may be worth considering “locking in” some of these higher rates for the longer-term. For example: the overnight federal funds rate is expected to end the year around 4.2%, while longer-term US treasury notes maturing in six- and twelve-months yield approximately 4.5% each. In practice, let’s look at a twelve-month US treasury as a practical example: an investor could purchase this security, knowing that they’ll not only receive their principal back at maturity, but will earn exactly 4.5% in interest for one year, regardless of what happens to interest rates during that time. As you can see, if an investor likes these elevated, current yields, but would like to create some certainty as to how long they’ll be available, one could “lock in” rates near 4.5% today, knowing that they can benefit from these higher yields for six or twelve months, or potentially even longer.

Lastly, from all of us at Deep Blue Investment Advisors, we would like to thank you for your ongoing trust in 2022 and wish you happiness, health and success in the new year.

Benjamin Streed, CFA, is Director, Fixed Income & Portfolio Management, at Deep Blue Investment Advisors. He can be reached at 813-440-5088 or benjamin@deepblue-inv.com.