| Monday, December 19, 2011 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

Remarketing Strategy: Fleet Pricing Bounces Back As Overall Wholesale Market Strength Continues

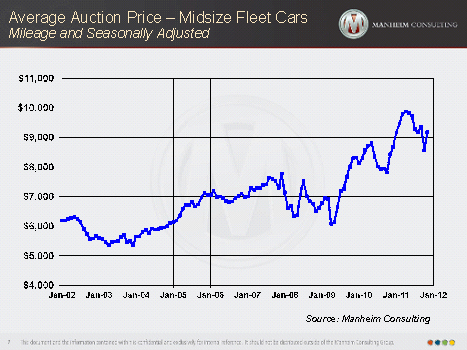

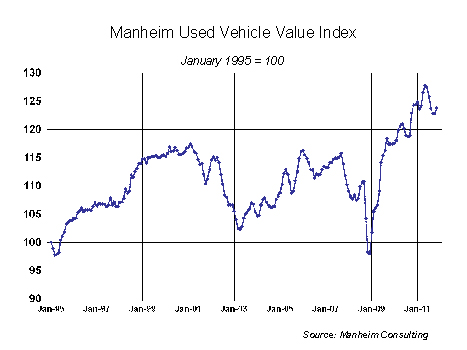

Manheim Index Rises in November After five consecutive monthly declines from its all-time high in May, the Manheim Used Vehicle value Index rose 0.8 percent in November to a level of 123.8. Wholesale used vehicle prices, on a mix-, mileage-, and seasonally adjusted basis, are down 0.4 percent on a year-over-year basis. Prolonged pricing strength in the wholesale market has been the result of sustained improvements in retail vehicle markets (both new and used) and reduced wholesale supplies. With signs of improvement in the broader economic picture, retail vehicle markets will likely produce an even bigger appetite for available auction inventory.  November new vehicle sales post best sales rate in years. New cars and light-duty trucks sold at a seasonally adjusted annual rate of 13.6 million in November. This was the fastest sales pace since June 2008 (excluding the inflated cash-for-clunkers tally in August 2009). And, contrary to the expectation of some analysts, sales gains were achieved without aggressive incentives or channel-stuffing inventory into the dealer network. New vehicle incentives in November were up only modestly from October (the normal seasonal pattern) and down 8.6 percent from a year ago. In fact, Edmunds reported that it was the lowest level of November incentive spending since 2002. Used vehicle retail sales grow again, profits strengthen. Retail used unit sales rose only a modest 3.4 percent in November according to CNW Market Research, but several segments of the market (such as CPO vehicles) continue to track at a record pace. Statistics and comments from lenders also point to further growth in subprime used vehicle loan origination. Additionally, as a result of the strength in new vehicle pricing, used vehicle retail gross margins were under less pressure in November. Off-rental units continued to command strong prices at auction. As was the case in October, rental risk volumes rose significantly in November without any deteriorating impact on pricing, which held steady. Average miles on auction-sold vehicles also remained steady with previous months. Price movements by market class. Over the periods of the past three months and of the past six months, pickups and minivans have been the strongest segments. Compact cars are up the most year-over-year, but have weakened in the back half of this year. On a mileage- and seasonally adjusted basis, however, compact car prices showed an uptick in November. Data sources that look only at straight averages might not pick up on this fact since, in November, the average mileage of a compact car sold at auction reached a record high.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |