| Monday, March 18, 2013 | Archives | Advertise | Online Buyer's Guide |

Manheim Index Declines In February As Wholesale Volumes Rise

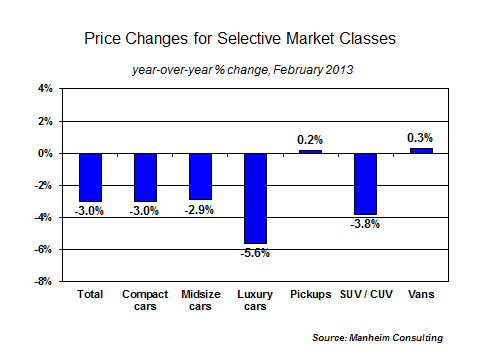

The weakening in adjusted wholesale prices this year was not unexpected. It is the result of a payback for the year-end uptick in prices caused by Hurricane Sandy as well as the longer-term shift caused by the wholesale market’s adjustment to growing future supplies after a period of exceptional shortage. New vehicle sales begin to level off. New vehicles sold at a seasonally adjusted annual rate of 15.4 million in February, which was in line with expectations. Given that the consensus full-year forecast is 15.5 million, and that sales have been running at a 15.4 million rate for the past three months, the pace of new vehicle sales, which had been on a straight line up from the trough of 9.5 million in mid-2009, will now plateau. Used vehicle sales continue rising. Entering 2013, there was more concern about the near-term pace of used vehicle sales than for new vehicle sales. After all, it is lower- and middle-income used vehicle buyers who are most impacted by the loss of the payroll tax holiday, delayed (and smaller) tax refunds, and higher gas prices. Despite those drags, used vehicle retail sales were strong in both January and February and produced a 12 percent year-to-date increase in retail deliveries for dealers. The pricing impact of growing wholesale supplies. The coming increase in wholesale supplies in 2013 and beyond is well-known, but to assess the impact on pricing it is important to quantify that increase relative to retail demand. The total number of units supplied by commercial sellers (whether sold at auction or not) will likely rise to more than 5.8 million units in 2013 from 5.1 million in 2012. By 2015, the total will likely reach more than 6.8 million units. Clearly these are sizable increases – but they are off a very low base. Relative to the number of used vehicles retailed by dealers, however, total commercial wholesale supplies will be only 20 percent in 2013 and 22 percent in 2015. That’s up from 18 percent in 2012, but well within the historical average range over the past decade.  Prices of off-rental units remain strong. In February, unadjusted prices for off-rental risk units sold at auction approached the highs reached last spring. Average mileage (37,000) was down 6 percent from a year ago. Volume was up from last year.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

|

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |