| Monday, May 20, 2013 | Archives | Advertise | Online Buyer's Guide |

Easing In Wholesale Prices Continues As Expected

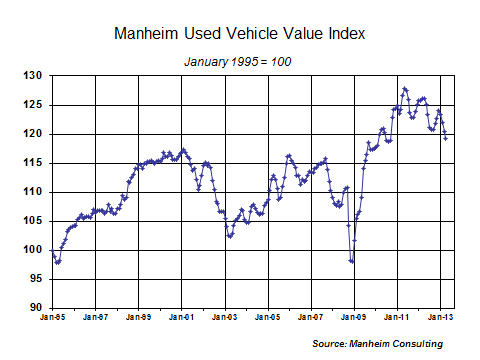

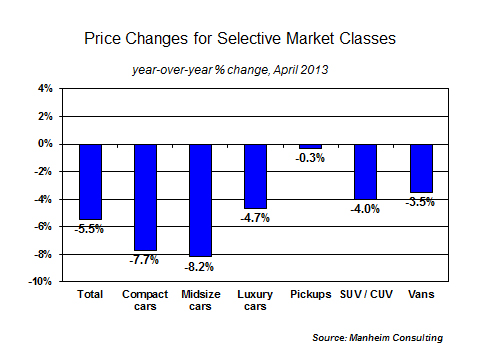

Although April marked the fourth consecutive monthly decline in wholesale used vehicle values (and produced a cumulative decline of 3.9 percent since December), the recent movement has been neither alarming nor disruptive to the market. Indeed, the easing was long anticipated and, in fact, probably mitigates some of the decline that many were expecting in the back half of the year. Moderating strength in the retail market, however, suggests the possibility of further pressure on wholesale values. Market class shifts remain predictable: Midsize and compact cars have been the most price-competitive segments of the wholesale market both in recent months and over the course of the past year. That’s not surprising given the offerings, pricing, and financing options available on midsize and compact cars in the new vehicle market. Prices for pickup trucks continued to be strong due to increased demand (as a result of the improvement in the housing industry) and limited supplies in the wholesale market, especially for units with less than 100,000 miles.  New vehicle sales pace eases: In April, for the first time since October of last year, the seasonally adjusted annual selling rate for new cars and light-duty trucks slipped below 15 million. Although it is still generally expected that full-year sales will be closer to 15.5 million than 15.0 million, the recent decline in consumer confidence, already low savings rates, and the overhang of possible negative regulatory and policy changes suggest that manufacturers and dealers may have to become more aggressive in pushing the market in order to reach their sales targets. Used vehicle sales stable in April: Total used vehicle sales rose less than 1 percent in April, according to CNW. And, used vehicle retail sales by dealers (excluding private-party transactions) fell by 1 percent. Nevertheless, sales for the first four months were up 5 percent in total, and up 7 percent for dealer sales. That’s a noteworthy achievement in the face of otherwise tepid consumer spending. Clearly, the ample flow of retail credit is boosting the used vehicle market. Results for the seven publicly traded dealership groups show that used unit retail sales rose 6.5 percent on a same-store basis in the first quarter of this year. That marked the fifteenth consecutive quarterly increase. Unfortunately, gross margins continued to decline. On a sales-weighted basis, it was the thirteenth consecutive quarter that used vehicle retail gross margins were lower than their year-ago levels. Given that F&I income is likely going to come under pressure, these narrow margins will prevent dealers from becoming aggressive bidders at auction, something every wholesale consignor should monitor.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |