| Monday, June 17, 2013 | Archives | Advertise | Online Buyer's Guide |

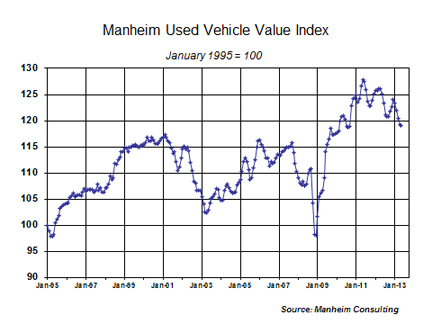

More Of The Same: Wholesale Prices Continued To Ease In May

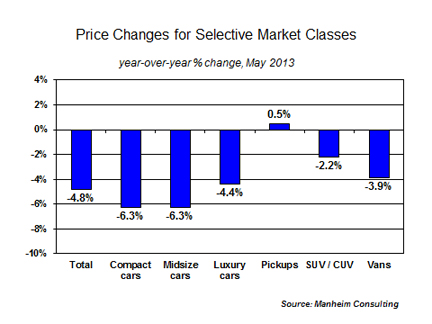

In fact, wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) slipped just 0.1 percent in May, bringing the Manheim Used Vehicle Value Index to a level of 119.1, which is 4.8 percent lower than a year ago.  This is reflective of the ongoing re-alignment of new and used vehicle price ratios back to more normal levels. Thus, the pricing impact of higher wholesale supplies in the second half of this year might be less than what many analysts previously anticipated. The dominant force in future wholesale pricing will more likely be retail volumes and dealer profitability. With used vehicle financing readily available at attractive terms, retail markets will likely remain strong. Used vehicle sales up overall, but down for dealers. Total used vehicle sales rose 2 percent in April, according to CNW. However, dealer sales fell by 4.7 percent in May. On the bright side, net profits and inventory turn rates continue at the normal levels. May results differ for various price points, seller segments, and market classes. An analysis of mileage changes by wholesale price tiers shows that vehicles in the $11,000 to $13,000 price range were the weakest segment of the auction market in May, relative to a year ago. This was bad news for the resale performance of commercial fleet managers, especially if their portfolio consisted mainly of only a couple of models of midsize cars. Those commercial fleet managers with a large number of small crossovers or full-size pickups fared better.  Sales pace is steady for new vehicles. In May, new cars and light-duty trucks sold at a seasonally adjusted annual rate (SAAR) of 15.3 million. This was reported as a welcome improvement from April’s temporary slip below the 15 million rate. The reality, however, is that the SAAR, on a three-month moving average basis, has been in a tight range ever since the beginning of last year. We find the three-month moving average more useful given that the monthly seasonal adjustment factor for new vehicle sales is subject to errors due to shifting seasonal forces, the diminished relevance of sale-day adjustments, and the lack of accounting for the distribution of weekends or holidays during the month. Incentive activity and inventory levels, the forces within the new vehicle that most impact wholesale values, remain supportive to used vehicle residuals. However, in some segments of the new vehicle market (mostly notably midsize cars), strong product offerings, attractive finance and lease deals, and a drive for market share have lowered wholesale prices for competing late-model used units.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |