| Monday, August 19, 2013 | Archives | Advertise | Online Buyer's Guide |

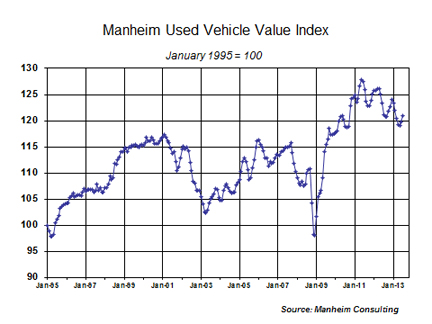

Wholesale Used Vehicle Prices Rise Even With Higher Supplies

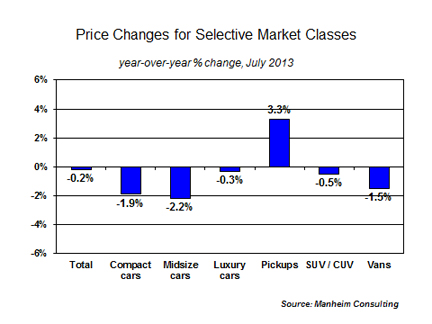

Attribute the gain to strong dealer demand, driven by profitable used vehicle retail opportunities and low new vehicle inventory levels for certain models. Given the ready availability of retail credit, we do not expect dealer demand for wholesale units to ease any time soon. However, it is still the general consensus that wholesale values will moderate in the latter part of the year. On a non-seasonally adjusted basis, prices fell between June and July. The Manheim Used Vehicle Value Index now stands at 120.9, a decline of only 0.2 percent from its year-ago level.  Mid-priced vehicles show some weakness. An analysis of mileage changes by wholesale price tiers shows that vehicles in the $11,000 to $13,000 price range remained the weakest segment of the auction market. This hurt the overall resale performance of some commercial fleet managers (since that is their primary price range), but many makes and models popular with commercial fleets continue to perform very well in the auction market. Auction prices for rental risk units remain strong. Unadjusted prices for rental risk units sold at auction increased in July, whereas the normal seasonal pattern usually brings a decline. Why the change? High prices were the result of a richer mix of vehicles being sold within market classes along with strong demand driven by the hot market for late-model used vehicles. Retail CPO sales, for example, kept up their record pace in July.  Pickup prices pull back modestly in July. Although pickups have easily been the strongest segment over the past year, they underperformed the market in July. Increased supplies (a normal result of the recent surge in new pickup sales) are starting to work their way into the wholesale market, but there is still a shortage of late-model, low-mileage units. Retail used vehicle profit opportunities remain abundant. Retail used unit sales by dealers fell in July, as they did for the second quarter as a whole, according to CNW. But that’s not the vibe one gets from talking to dealers in the lanes. Clearly, we have a case of the strong, not only surviving, but prospering. In the second quarter, same-store used retail unit volumes increased for the sixteenth consecutive quarter. And, the magnitude of the increase (+13.2 percent) was the largest since the second quarter of 2010 (a time when the comps were much easier). Their sales-weighted gross margin eased only slightly over the past year. Strong new vehicle sales keep inventories and incentives in check. With new vehicle sales in June and July running at an annual rate of 15.9 million and 15.8 million, respectively, dealers have found themselves short of some models. This should minimize the threat of overly aggressive incentives, even though fights for market share remain very real.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |