| Monday, November 18, 2013 | Archives | Advertise | Online Buyer's Guide |

Wholesale Prices Decline in October, But Retail Demand Remains Strong

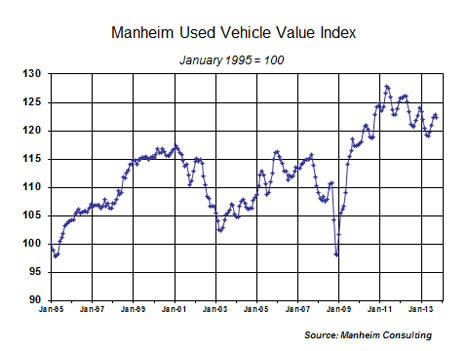

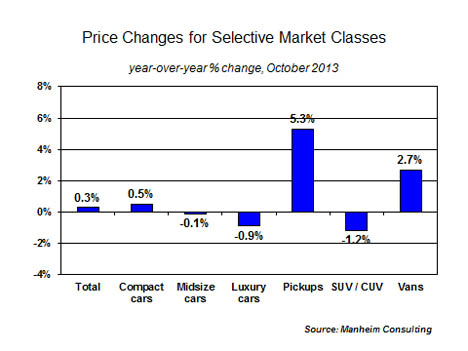

Since its all-time high in May 2011, the Manheim Index has shown a pattern of each subsequent cyclical high being lower than the previous one, and each low lower than the earlier one. Technical analysts term such a pattern "a confirmation of trend." But NAFA members and others in the business don’t need technical analysis to support the notion that the secular trend for wholesale prices is down – the fundamentals are shouting it!  Most notably, there is the coming increase in wholesale supplies. That increase will be driven primarily by off-lease volumes, but higher supplies will also come from other commercial sources. And, in the short term, wholesale prices on a year-over-year basis will now begin to bump up against the inflated levels created by Hurricane Sandy in October 2012. With respect to retail demand, we believe that the market will remain favorable for dealers, but that the impressive improvements achieved over the past two years will be hard to repeat. Used vehicle sales: overall growth continues and some segments sizzle. In October, total used unit retail sales rose 3.6 percent, resulting in a 3.5 percent year-to-date increase, according to CNW. Within that total, manufacturer certified pre-owned (CPO) sales rose 20.6 percent in October. Year-to-date CPO sales are 15.3 percent ahead of last year’s pace. Likewise, in the third quarter, the seven publicly traded dealerships groups posted their 17th consecutive quarterly increase in used unit retail volumes on a same-store basis. With off-lease volumes set to accelerate next year, franchised dealers should see higher volume again next year. The key is what level of profit those sales will generate. To that end, it is promising that gross margins held steady in the third quarter after declining steadily over the past several years. Luxury vehicles have a good October. Although luxury cars have been one of the weakest segments over the past year, past six months, and past three months, they outperformed the overall market in October. Meanwhile, prices for used pickups continued very strong, regardless of mileage category.  New vehicle sales stabilize. Recently, a true monthly read of new vehicle sales has been hampered by the pull-ahead of Labor Day sales into August, the payback for that in September, and then an October influenced by the government shutdown. Nevertheless, the annualized new vehicle selling rate (on a three-month moving average basis) has begun to plateau in the 15.5 to 15.7 million range. The consensus forecast of slightly more than 16 million sales in 2014 is reasonable; but, even if achieved, that would represent a much smaller percentage gain than what we posted in each of the past four years. The upward sales momentum has slowed. But pricing power has not slowed – and that’s even more important. Average transaction prices continue to rise as the result of lower net incentives, higher sticker prices, and the consumer’s desire for more heavily contented vehicles.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |