| Monday, December 16, 2013 | Archives | Advertise | Online Buyer's Guide |

Outperforming Auto Sales Continue To Surprise

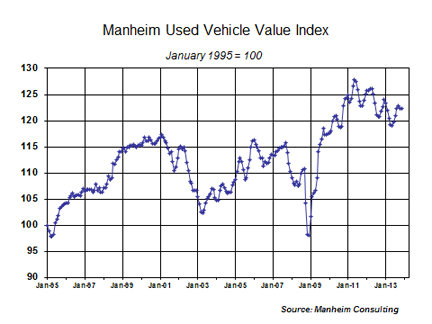

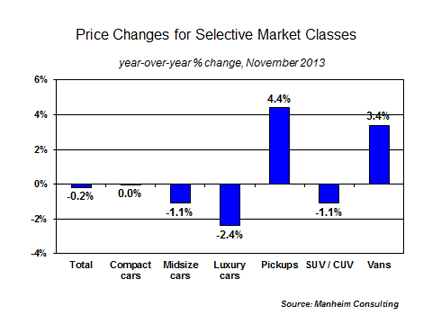

That’s an environment that guarantees falling wholesale values, right? Well, not this time. And the reason was simple: dealers have been quickly selling their wholesale acquisitions – and at a nice profit, despite those narrow gross margins. Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) actually inched up in November. This pushed the Manheim Used Vehicle Value Index reading to 122.4 in November, which represented a 0.2 percent decline from a year ago.  Market class and price tier shifts. The strong segments of the market continued to be pickups, vans, and sports cars. Our analysis of mileage by price tier indicates that vehicles in the $8,000 to $9,000 price range were the strongest, while vehicles in the $11,000 to $13,000 price range were the weakest segment during the first eleven months of 2013. In each case, this corresponded to their growing, or declining, share of auction volume. Luxury cars, after slightly outperforming the market in October, slipped back to the bottom of the pack in November. Wholesale pricing for midsize cars has also underperformed the overall market in recent months, which is not surprising given the level of inventory and incentives in that segment in the new vehicle market.  New vehicles: higher sales at higher prices. New car and light-duty trucks sold at a seasonally adjusted annual rate of 16.4 million in November. It was the fastest (non cash-for-clunker) sales pace since February 2007, and it came in spite of overall consumer spending that was lackluster at the start of the holiday selling season. New vehicle sales were particularly strong in the days following Thanksgiving. Give credit to clever marketing by both manufacturers and dealers, increased incentive spending, and product offerings that continue to connect well with consumers. Despite the increase in incentives, average new vehicle transaction prices continued to rise in November, up $946 from October and up $328 from a year ago, according to Kelley Blue Book. This will moderate future declines in the Manheim Index since it represents a dollar amount, not a residual percentage. Used vehicle sales strengthen. As good as new vehicle sales were in November, used vehicle sales were even better – at least for franchised dealers who posted a 10 percent increase in unit sales, according to CNW. Total used unit sales, including independent dealers and private party transactions, rose a more modest, but still strong, 4.5 percent. Preliminary numbers for manufacturer certified pre-owned sales in November showed that they continued on their record-setting path.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |