Wholesale Prices Rise Again In February

Print this Article | Send to Colleague

Print this Article | Send to Colleague

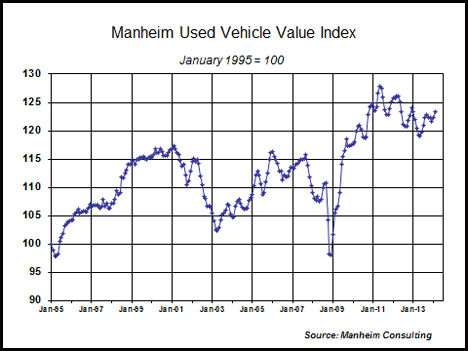

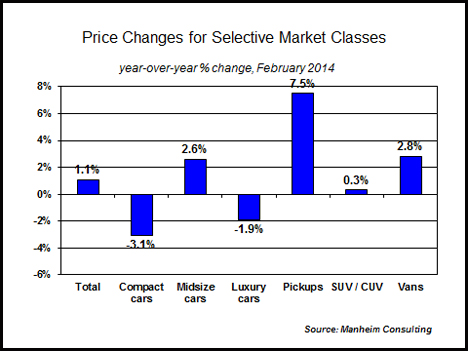

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) rose 0.8 percent in February. The Manheim Used Vehicle Value Index reading was 123.3 in February, which represented a 1.1 percent increase from a year ago.

A surge in individual income tax refund disbursements in late-January and early-February played a role in propping up wholesale values last month. In addition, readily available retail financing (at attractive terms) made the used vehicle retail market more profitable than the underlying unit sale numbers would suggest.

With new vehicle sales, incentives, fleet deliveries, and wholesale supplies now expected to grow after a weather-induced hiatus, some pressure on residual values should be expected. The easing, however, will be moderated by what promises to be a continued healthy used vehicle retail market.

Market class and price tier trends. Compact car pricing in the wholesale market remained very much a dogfight due to ample supplies and competitive pricing in the new vehicle marketplace. Pickups remained in high demand in the wholesale market, and there was less-than-adequate supply.

In February, lower-priced units sold very well at auction (due, no doubt, to that influx of tax refunds). There was some weakness in units’ wholesaling for more than $20,000 – but, as always, that was very much make- and model-specific.

Rental Risk Unit Pricing Mixed In February. When measured as a straight average, rental risk prices were down from a year ago, but up relative to January. After basic adjustment for mix and mileage, off-rental prices were up both year-over-year and sequentially.

Average mileage on off-rental units sold at auction reached an all-time high of more than 42,300 miles in February. That reflects in part, a delayed de-fleeting, and slow fleet deliveries on new units into the rental fleet.

New Vehicle Sales Disappoint, Again. New car and light-duty trucks sold at a seasonally adjusted annual rate of 15.3 million in February, which brought the three-month moving average to that same level, and -- as we cautioned last month – below the 12-month rolling total. That’s usually not a good sign.

But, again, weather and delayed fleet deliveries were a significant factor. This will increase the pressure on manufacturers to push sales in the months ahead. Incentives were already picking up in late February; but they were mostly selective and were still down relative to average transaction prices, which continue to rise.

Used Vehicles: Better Than The Unit Numbers Suggest. Total used unit retail sales declined 1.3 percent in February, with dealer sales down 2.3 percent, according to CNW. That left dealer retail unit sales down 0.6 percent for the year. Despite slightly lower unit volumes industry-wide, our dealer contacts still report that profits are on the rise, as throughput per store is higher and margins are stabilizing.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Back to NAFA Connection