Wholesale Pricing Eases As Expected

Print this Article | Send to Colleague

Print this Article | Send to Colleague

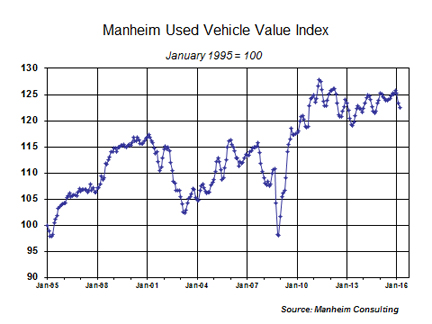

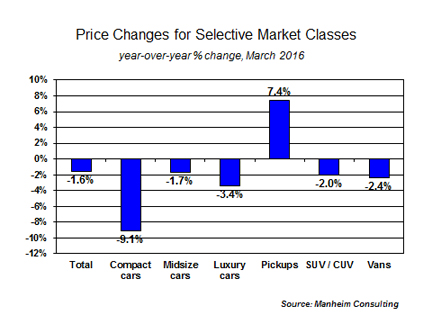

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined in March for the third consecutive month. That brought the Manheim Used Vehicle Value Index to a reading of 122.5 for March, a decline of 1.6 percent from a year ago.

Although wholesale prices have fallen every month in 2016, this should not be looked at with alarm. After all, it has long been anticipated that pricing would ease this year. Additionally, evolving industry patterns and practices may be muting what used to be a very strong spring bounce in pricing. Remember, wholesale prices did increase somewhat this year before the seasonal adjustment, and the large seasonal adjustment factor is based on past history, which may be less relevant in today’s market. Nevertheless, fundamentals do suggest that the current trend will prove longer-lasting than the several short cycles that we have already experienced since the May 2011 peak in the Manheim Index.

Rental risk: Volumes rise, prices fall. As expected, auction sales of rental risk units rose in March as higher new unit sales into rental (and a low conversion rate on February auction sales) forced the situation. The average auction price (adjusted for broad shifts in mix and mileage) rose 1 percent from February, but was down 7.3 percent from a year ago. Average mileage was the lowest since September 2014.

New vehicle sales: Will the industry accept or defy the plateau? March’s new vehicle selling pace (16.5 million, and well below expectations) is hard to analyze given another two-day "selling day" adjustment (a quaint notion, at best) and shifting fleet activity. For the quarter, the SAAR was 17.1 million. The question is whether manufacturers will be content with a full-year sales tally similar to last year or they will push for a more aggressive target. We’re optimistic they will remain disciplined given that it is they who, through their captive finance arms, hold the residual risk on some 10 million off-lease units outstanding.

Used vehicles: Supply creates demand. Consider it a twist on Say’s law — units forced back into the wholesale market must then be retailed. Preliminary numbers suggest that dealers had another strong used vehicle sales month in March. (Both franchised and independent dealers had double-digit gains in used vehicle sales for the first two months of 2016, according to NADA.)

CPO sales were up 9.6 percent in March, which meant that, even despite a decline in January, first-quarter sales were up 5.1 percent.

Price trends by market class, consignor type, and price tier. Wholesale prices for compact cars just can’t seem to find a bottom, despite the multiyear adjustment. Blame competitive pricing on the new vehicle side and the consumer preference shift to small crossovers, which are now more available in the wholesale marketplace. Wholesale pricing for luxury cars was also weak in March, after stabilizing at year end.

Vehicles in the $7,000 to $10,000 price range continued to face the greatest competitive pricing pressure in the first quarter. Vehicles valued above $15,000 did noticeably better. The percentage growth in auction volume was slanted toward units above $25,000.

In part because of a higher share of sales accounted for by commercial consignment, a straight average of auction prices in March reached an all-time high, and average mileage was the lowest in five years.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Back to NAFA Connection