Not One, Not Two, Not Three...

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

By Jonathan Smoke

By Jonathan SmokeCox Automotive

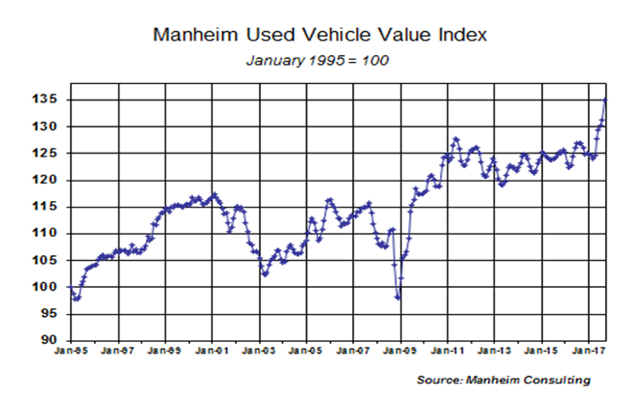

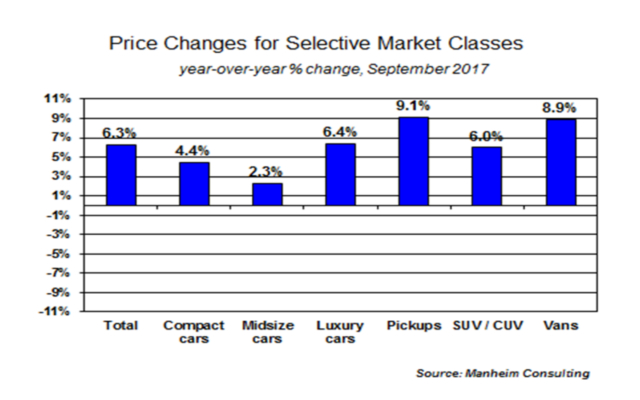

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 2.77 percent month-over-month in September. This brought the Manheim Used Vehicle Value Index to 134.9, which was a record high for the fifth consecutive month and a 6.3 percent increase from a year ago.

On a year-over-year basis, all major market segments saw gains, including midsize cars. Luxury cars, pickups, and vans outperformed the overall market.

Though wholesale market values continue to show strength as a result of growing retail demand, most of this price strength can be attributed to the recovery following Hurricane Harvey and Hurricane Irma. Replacement demand combined with a reduction in available supply is causing wholesale inventories to tighten. The impact to the wholesale market is widespread, providing additional support for likely continued wholesale price gains for at least another month or two.

Rental risk pricing improves in September. The average price for rental risk units sold at auction in September was up four percent year-over-year. Rental risk prices were up two percent compared to August. Average mileage for rental risk units in September (at 42,200 miles) was six percent above a year ago.

New vehicle sales improved dramatically in September. Replacement demand was clear in the new vehicle market as well. September new sales volume jumped six percent year-over-year with one more selling day compared to September 2016. With a Seasonally Adjusted Annual Rate (SAAR) of 18.5, this was the highest September SAAR reading in three decades and highest monthly SAAR level since July 2005. Cars continue to fall out of favor with consumers as sales in September fell three percent compared to last year, with all major car segments having sales declines. Light trucks outperformed cars in September and were up 12 percent year-over-year. Both the Ford F-Series and Chevy Silverado were up 21 percent year-over-year. New vehicle sales year-to-date are down two percent compared to last year.

Combined rental, commercial, and government purchases of new vehicles were up seven percent, led by gains in commercial (up 26 percent), rental (up two percent), and government (up four percent) fleet channels. Overall fleet sales are down 10 percent for the year versus 2016.

New vehicle inventories remained below 4 million units and are at the lowest level of the year.

Used sales gained in September. According to Cox Automotive estimates, used car sales improved by eight percent year-over-year in September. The September used SAAR increased to 40.4 million units from August’s 38.1. The retail growth in used sales is coming from vehicles less than four years old, which have grown five percent year-to-date versus the same time period last year. Vehicles less than four years old represent the largest age segment of vehicles in the used car market.

Economy continues to chug along. The final reading on Gross Domestic Product (GDP) growth in the second quarter came in at 3.1 percent, which maeked the quickest growth since the first quarter of 2015. The economy was gaining momentum this summer, and that growth would have continued in the third quarter had we not had the disruption of the severe hurricanes in August and September. The hurricanes disrupted auto sales, home sales, and retail sales in August. Consumer spending had grown a robust 0.3 percent in July from June, but increased only 0.1 percent in August. Adjusted for inflation, purchases declined 0.1 percent, which was the first decrease since January. Spending is expected to rebound in subsequent months to more than make up for the August disappointments. We are clearly already seeing that in auto sales.

Jonathan Smoke is Chief Economist for Cox Automotive. Follow Jonathan on Twitter at @SmokeonCars for the latest industry research and insights.