Encouraging Signs In Labor And Credit Markets Mean Good Things For Dealers, Fleets

By Tom Webb

Remember "The Good, The Bad and The Ugly?"

If a sequel were set in the auto industry of 2010, it might be "The Good, The Bad and The Obvious." It doesn't have quite the same ring to it, but the message is an important one for fleet managers.

Let's first dispatch with The Obvious and The Bad.

The Obvious: The primary use of a vehicle is for transportation to and from work.

The Bad: There are fewer people employed in the U.S. today than there were in December 1999.

And now for The Good.

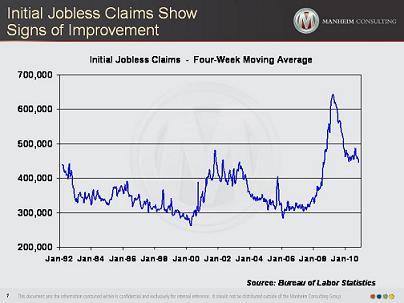

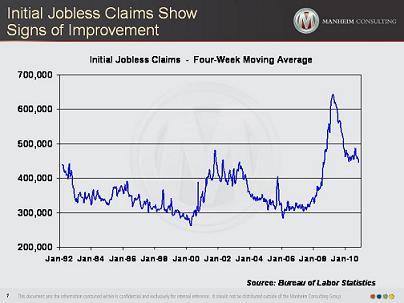

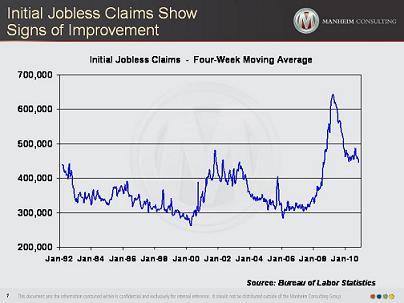

In October, total non-farm payrolls grew by 151,000. Private-sector jobs grew by 159,000 – the second largest monthly increase since early 2007. And, then, on November 10, initial jobless claims were reported to have fallen to 435,000 and the four-week moving average hit its lowest level since the collapse of Lehman Brothers.

As part of an economist panel at the National Auto Auction Association convention in September, I stated that I expected to see significant employment gains in the coming months. I quickly added, however, that I had no quantitative evidence to support that projection. It was primarily a gut feeling. Thankfully, we now have a little concrete evidence to support my hunch, as initial jobless claims represent one of the more important indicators of turning points in the employment cycle.

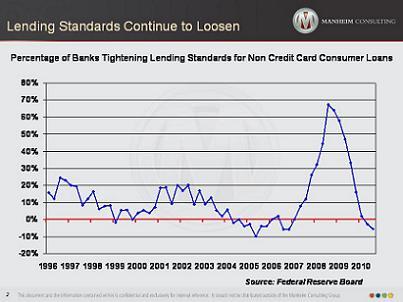

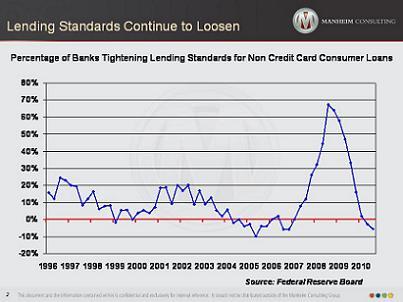

The skies have also brightened with respect to credit availability – at both retail and wholesale. With the opening up of the securitization market for auto loans, lenders are once again able to provide retail financing at rates that are attractive to customers, but still provide profit opportunities for dealers and, of course, the lenders themselves. The Federal Reserve Board's Survey of Senior Loan Officers shows that in 2010, more banks have been loosening credit standards as opposed to tightening. Contrast that to the second half of 2008 when the net share of banks tightening reached a record 66 percent.

Likewise, wholesale lenders, like Manheim Automotive Financial Services, are opening new, or expanding existing, lines of credit for dealers.

Why is all of this important to fleet managers? It's simple – end-of-service fleet vehicles are bought by car dealers, not car collectors. What they are willing to pay is dictated by the vibrancy of the retail used vehicle market, which, in turn, is driven by labor market and credit conditions. Today, retail sales are improving, dealers are making profits, and the increased availability of non-prime auto credit has made end-of-service fleet vehicles especially attractive to dealers. In addition, the coming rebuilding of company payrolls should reverse the slide in corporate fleet sizes.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.