2011 Brings A Fresh Start To Industry, Consignors

By Tom Webb

The end of 2010 brings the promise of a stronger 2011 for the economy. But when it comes to the wholesale pricing of end-of-service fleet units the question becomes "can it really get any better?" Many fleet managers would be more than happy with a repeat of 2010's pricing. So, as we begin the countdown to New Year's Day, I thought it would be helpful to share a brief picture of where we are in the recovery and a bit of encouraging news for the Members of NAFA.

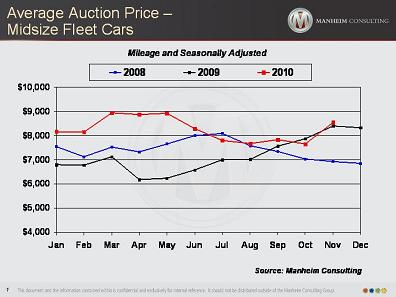

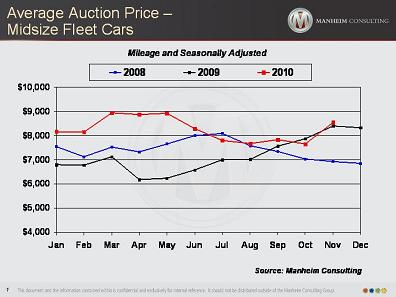

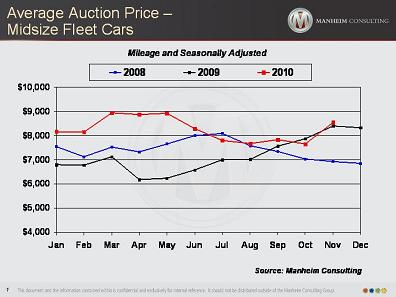

As employment numbers rise, and I anticipate that they will, consignors will benefit from continued growth in sales and prices. In fact, despite worse-than-expected news on the job front in November, auction prices for end-of-service fleet units rose for almost all market classes. The all-important, mid-size car segment showed particular strength as a mileage- and seasonally adjusted index of pricing for end-of-service mid-size fleet cars jumped sharply in November.

The Recovery: Where are we now?

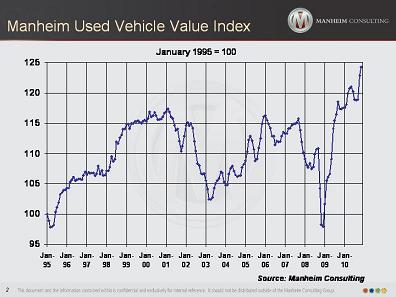

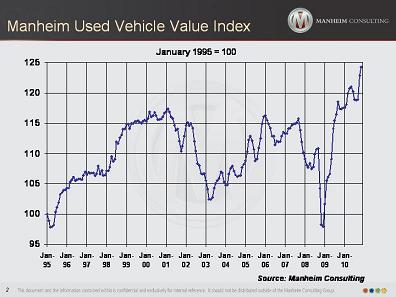

In November, wholesale used vehicle prices (on a mix-, mileage- and seasonally adjusted basis) increased for the third consecutive month and reached an all-time high. In fact, the November Manheim Used Vehicle Value Index reading was 124.3, an increase of 5.9 percent from a year ago. Consumer confidence levels are also rising.

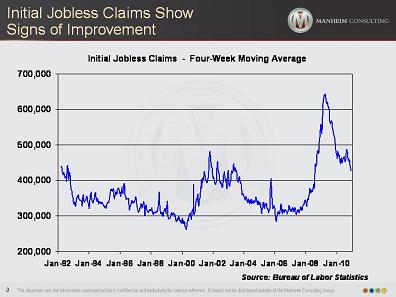

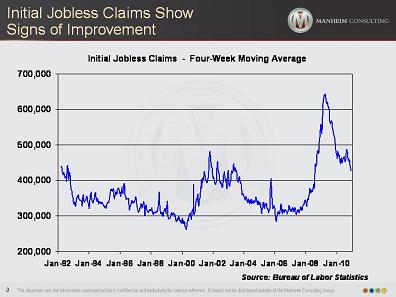

The positive indicators regarding consumer confidence and used vehicle values were tempered by the sobering news that the unemployment rate rose to 9.8 percent in November. But concentrate on the doughnut, not the hole. Payrolls will grow in 2011 – and at a rate faster than in 2010. But, given the magnitude of job losses during the downturn, I still project an "upward slanted W" recovery. In other words, I expect the U.S. will enter another recession before we make it back to the previous peak in employment.

As for the pricing of end-of-service fleet units, appreciate that subprime lending is accelerating. With recent vintage loans performing exceptionally well, the cost of funds for subprime lenders will remain low. And, thus, they will want to further grow their portfolios.

Give a person a job and access to credit, and they will certainly want to buy the vehicles coming out of fleet service.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.