Fleet Vehicle Prices Remain Strong In Rising Wholesale Market

In last month's column, I had the pleasure of confirming what fleet managers were sensing in the auction lanes – wholesale prices for midsize end-of-service cars had reached an all-time high in March, surpassing the $10,000 mark.

April's figures weren't quite as good, but didn't miss the mark by much – on a mix, mileage, and seasonally-adjusted basis, prices for these vehicles were at their second-highest levels ever.

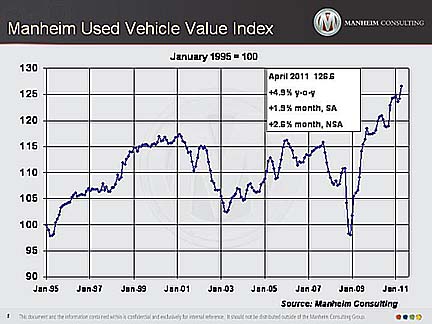

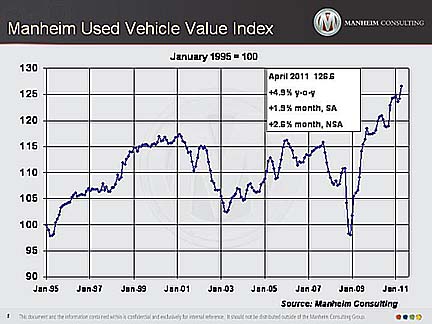

Anyone who has recently spent any time at auctions, in person or online, knows that prices aren't strong just for fleet vehicles. In fact, adjusted wholesale prices for all vehicles rose 1.9 percent in April over the previous month, taking the Manheim Used Vehicle Value Index to a record-high level of 126.6, the second time this year (January being the other) that the Index, launched in 1995, has set a record.

Why are fleet managers, and other consignors, earning such high prices in the lanes? The contributing factors, in both the new and used markets, are straightforward:

- Lower wholesale supplies (the NAAA reports that total auction sales were down 8.6 percent in the first quarter of 2011). High retail demand for used vehicles (total used vehicle sales were up 12 percent in April, and 9 percent year-to-date, according to CNW Marketing Research).

- Tight inventories in the new car market (standing at a forty-six-day supply at the beginning of April, with many models expected to dip to a thirty-day, or lower, supply soon).

- Steady demand, and higher net transaction prices, for new vehicles.

April's strong wholesale market reflected an accelerating shift toward the fuel-efficient market classes, with increased premiums paid for higher fuel-efficiency within model lineups. On a year-over-year basis, for example, almost all compact and midsize cars showed double-digit prices increases, while full-size SUVs, and pickups, have shown price declines. Over the past six months, the divergence has been even more startling; compact and midsized cars are up more than sixty percent (annualized), while large SUVs, and pickups, are up less than five percent.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at http://www.twitter.com/TomWebb_Manheimand read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at http://www.twitter.com/TomWebb_Manheimand read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at http://www.twitter.com/TomWebb_Manheimand read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at http://www.twitter.com/TomWebb_Manheimand read his blog at www.manheimconsulting.typepad.com.