Tom Webb's Remarketing Strategy: Fleet Sales Stay Strong Despite Slight Dip In Overall Used Vehicle Market

NAFA members have been receiving high value in return for vehicles they bring to market this year, and that trend continued in September. End-of-service fleet units were scarce, and average pricing for these units remained well above year-ago levels, despite the vehicles having higher mileage. As is typical this time of year, the pickups and cargo vans being sold by commercial fleets had a significant increase in average mileage.

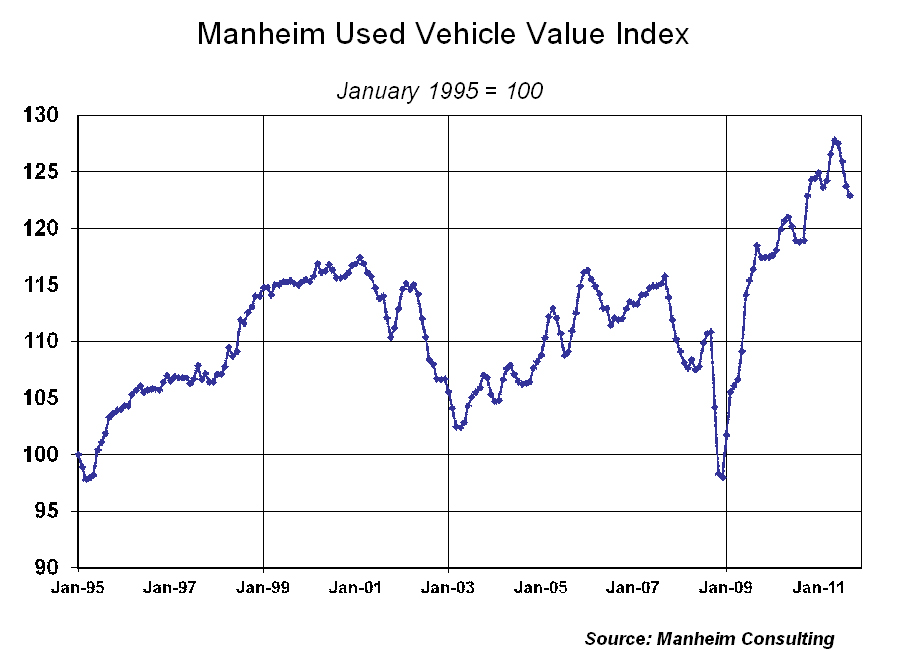

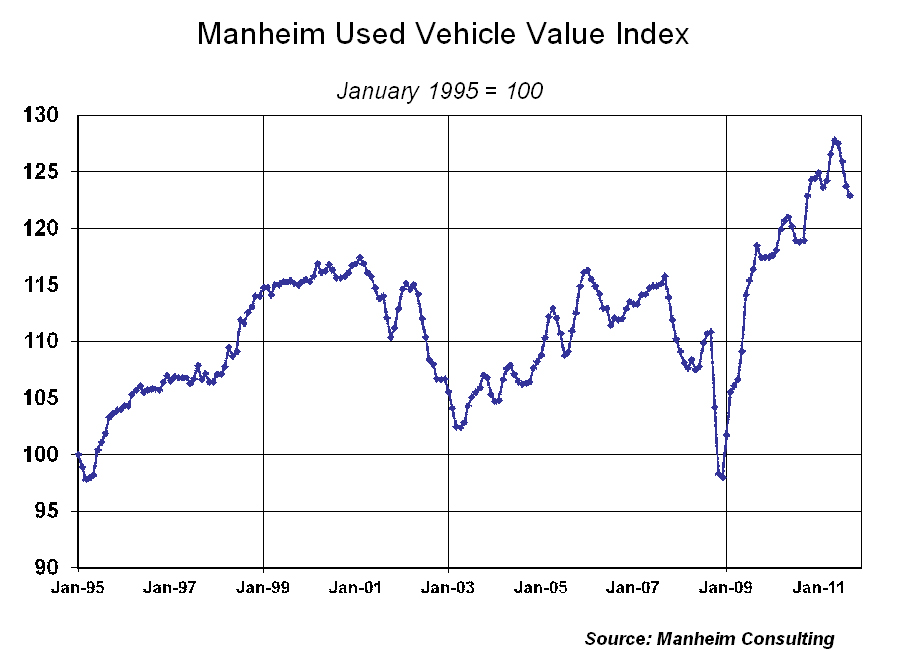

Manheim Index Declines in September

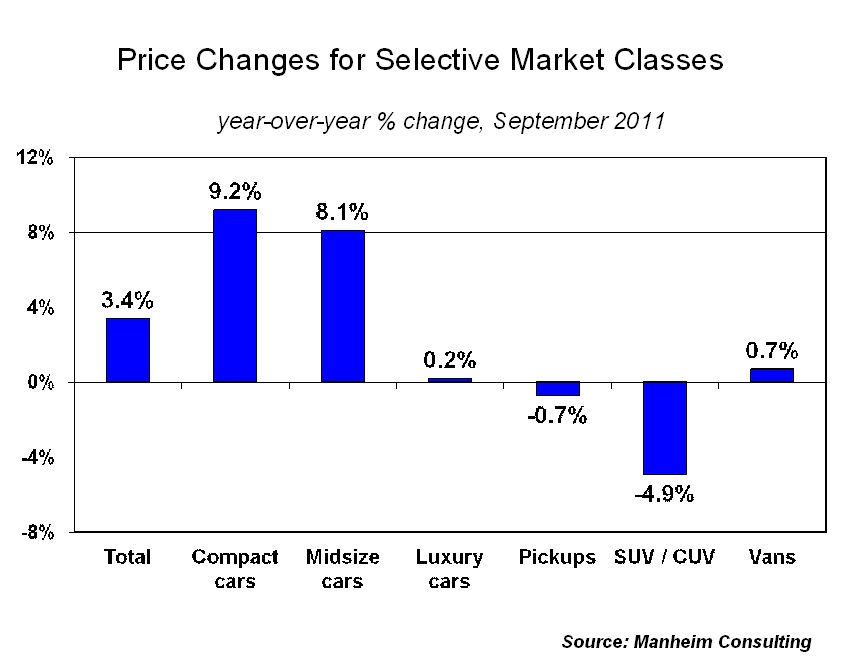

Looking at the broader used vehicle market, wholesale prices (on a mix-, mileage-, and seasonally adjusted basis) declined for the fourth consecutive month in September. The Manheim Used Vehicle Value Index now stands at 122.9, which represents a 3.4 percent increase from a year ago.

Although the decline in wholesale prices during the third quarter (-2.5 percent) was the sharpest since the fourth quarter of 2008, overall wholesale values today continue to be elevated by any reasonable historical measure. Mark that up to stronger retail demand (despite the dismal economic backdrop) and low wholesale supplies.

New vehicle sales beget used vehicle sales. New vehicles sold at a seasonally adjusted annual rate of more than thirteen million in September, an increase of ten percent from a year ago. The faster pace of retail deliveries naturally meant more trade-ins for franchised dealers. Given the solid and healthy state of the retail used vehicle market, those higher trade-ins quickly translated into higher retail used unit volumes. According to CNW Marketing Research, used vehicle retail sales at franchised dealerships rose 11.5 percent in September. Total used vehicle retail sales (including independent and private party transactions) rose 4.6 percent during the month, and were up 4.0 percent for the first nine months of the year. We expect the new vehicle sales pace will remain well above the thirteen million sales rate throughout the fourth quarter, which, in turn, will help dealers in their acquisition of used inventory.

Credit availability helps retail markets withstand economic headwinds. Although a thirteen million new vehicle sales rate is barely above replacement demand, achieving that level in an environment high unemployment, declining consumer confidence, eroding household wealth, and heightened economic uncertainty is an accomplishment. Likewise, having retail used units sales set to grow for the second consecutive year is an achievement given the financial state of most middle-income households. Give credit to the better availability of retail financing. With auto securitization volumes rising once again in the third quarter – and with credit spreads back to pre-recession levels, credit availability should remain positive.

Higher incentives spur pickup sales, but residuals increase also. A significant portion of September’s sales gain was the result of attractive incentives being used to pare down the inventory level of new pickup trucks. Despite the incentive activity, wholesale valuations for used pickups outperformed the overall market in September. Attribute that to the lack of supply of late-model units. With fewer two- and three-year old pickups being offered in the wholesale market, the normal transmission mechanism by which incentives depress residuals was disrupted.

Off-rental: higher volume and strong pricing. Off-rental volumes had their first significant year-over-over increase in September and pricing remained high as the average sale price barely slipped below $14,000. Expectations are that off-rental volumes in the fourth quarter will be above the year ago level and that pricing will remain firm.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.