Remarketing: Broader Wholesale Market Experiences Modest Gains As Fleet Sales Achieve Record Highs

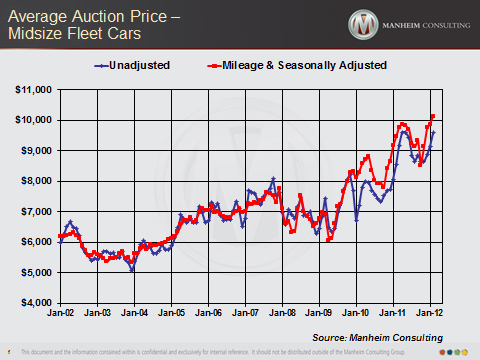

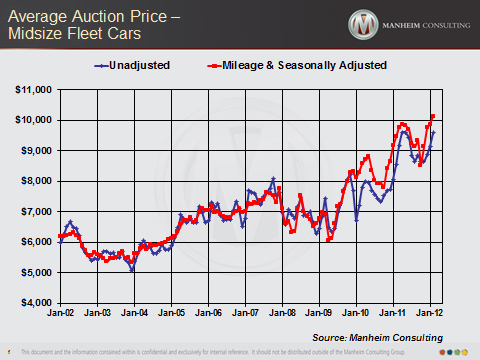

February was a very good month for fleet managers. Mileage- and seasonally adjusted prices for midsize cars coming out of fleet service reached a record high. This was also true for many other segments of commercial fleet units, except cargo vans, which varied widely based on vehicle specifications and condition.

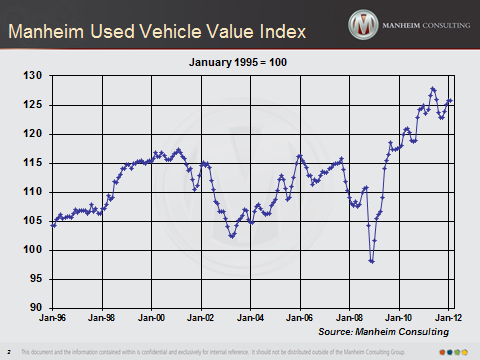

Manheim Index Up Marginally in February

The Manheim Used Vehicle Value Index moved up marginally to 125.8 in February. The index of mix-, mileage-, and seasonally adjusted wholesale prices is now up 1.8 percent year-over-year and off only 1.6 percent from the all-time high reached in May 2011.

All of the increase in wholesale prices in February came in the second half of the month. New and used vehicle sales numbers indicate that the retail market also accelerated as the month progressed.

New and used vehicle sales go on a joy ride. New cars and light-duty trucks sold at a seasonally adjusted annual rate of 15.1 million in February. This far exceeded the estimates made by all of the daily tracking firms right up until the final release date. And, as in recent months, sales gains were not built upon incentives. In fact, incentive spending continued to track down on a year-over-year basis. With sales exceeding manufacturer expectations, plant utilization high, and even some backlogs in the supplier industry, there no reason to expect a near-term return to high incentives.

Fleet deliveries were high in February, as sales to commercial fleets rose twenty eight percent and purchases by rental car companies increased twenty one percent, but that still left retail sales up a healthy eleven percent for the month. New vehicle sales into rental in February were split among a wide mix of makes and models. Off-rental volumes and average mileage suggest that the purchases reflected needed replacements. As such, we do not believe that today’s higher sales into rental will have a depressing effect on future residuals.

Used vehicle retail sales also rose during February, with an increase of more than ten percent and with the pace accelerating at month-end. Preliminary numbers and conversations with dealers suggest that front-end gross margins showed normal seasonal improvement and that already-high back-end incomes continued to rise.

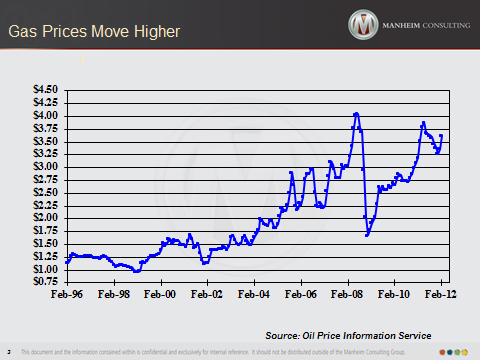

Higher gas prices affect model selection, but not decision to buy – for now. Rising gas prices were of increasing concern in February – at least as far as the media goes. Higher gas prices did not dampen consumer confidence, which jumped during the month, or stall new vehicle sales. Nor was the level of used vehicle transactions, where one would more likely see the first impact, affected. There was some acceleration in the ongoing shifts between market classes and engine selections within a model, though.

The average sales-weighted fuel economy of new vehicles purchased in February increased to 23.7 mpg, up from 22.7 mpg a year ago and only 20.4 mpg in February 2008. Pricing strength in the wholesale market also reflected the continued shift in consumer preferences. Compact and midsize cars remained far and away the strongest segments of market, both over the past three months and over the past year.

Off-rental: high prices, high volume, and high mileage. The more than twenty five percent increase in new vehicle sales into rental in the first two months of 2012 meant that the number coming out of service also rose. The higher volume did not prevent prices from reaching near-record levels, despite near-record average mileage at time of sale.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.