Strong Year-to-Date New-Vehicle Retail Sales Pace Continuing In March

New-vehicle retail sales are on track to end the first quarter of 2012 particularly strong, with performance in March continuing the trend from the past several months, according to a monthly sales forecast developed by J.D. Power and Associates' Power Information Network (PIN) and LMC Automotive.

New-vehicle retail sales are on track to end the first quarter of 2012 particularly strong, with performance in March continuing the trend from the past several months, according to a monthly sales forecast developed by J.D. Power and Associates' Power Information Network (PIN) and LMC Automotive.

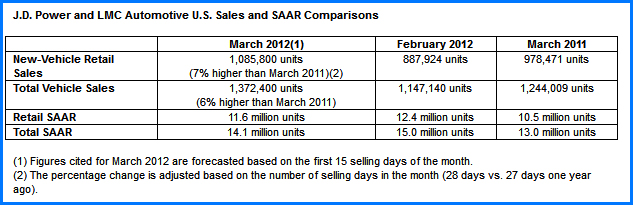

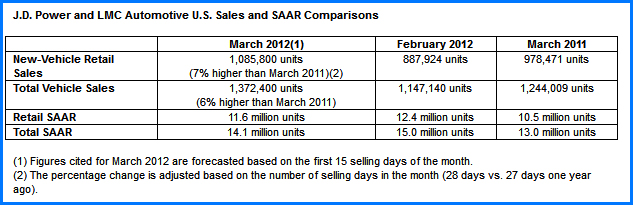

Retail Light-Vehicle Sales - March new-vehicle retail sales are projected to come in at 1,085,800 units—the highest monthly volume in more than two and one-half years—which represents a seasonally adjusted annualized rate (SAAR) of 11.6 million units. Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles.

"Each month of strong sales brings with it increased optimism that the pace of growth represents a true recovery for the sector," said John Humphrey, Senior Vice President of Global Automotive Operations at J.D. Power and Associates. "Barring any future shock related to geopolitical issues in the Gulf region and further upward pressure on the price of oil, we believe sales will continue on a solid pace for the balance of the year."

Through the first eighteen days of March, sub-compact and compact cars accounted for approximately twenty three percent of retail sales in the United States, the highest level since the CARS program was implemented in 2009, according to PIN. As a result, sub-compact and compact cars are quickly moving off dealer lots. Combined, sub-compact and compact cars were on dealer lots an average of forty-two days before being sold, compared with forty eight days industry average and turn rates substantially lower than in 2011—seventeen fewer days for sub-compact cars and forty six fewer days for compact cars. Conversely, full-size pickup trucks are sitting on dealer lots an average of sixty eight days, eleven days longer than they were a year ago.

Total Light-Vehicle Sales - Total light-vehicle sales in March are expected to come in at 1,372,400 units, which is a six percent increase from March 2011. In addition to the strong retail performance, fleet mix has been higher than normal for the first two months of the quarter, with January and February averaging twenty four percent. March is expected to finish slightly lower at twenty one percent of total sales.

Sales Outlook - The 2012 outlook for vehicle sales remains positive, as the first quarter selling rate is expected to come in at 11.6 million units for retail and 14.4 million units for total light vehicles. This sales tempo is ahead of the forecast for the full year of 11.4 million units for retail light-vehicles and 14.1 million units for total light vehicles.

"The first quarter selling rate has outperformed the annual forecast for sales for the first time since 2008, when the automotive market started to decline," said Jeff Schuster, senior vice president of forecasting at LMC Automotive. "The vigorous start to 2012 suggests that there is further upside potential if the current pace continues through the summer months."

Continuing the current trend, small-car sales (sub-compact and compact segments) are expected to remain strong throughout 2012, with combined segment share at nearly twenty percent of total light vehicles.

"Small car mix is benefiting from higher gas prices and new models entering the segment, with forty one small car models in the market in 2012, compared with just thirty back in 2007," said Schuster. "Overall share of small cars in 2012 is expected to climb to its highest level ever, at nearly twenty percent of total light-vehicle sales."

North American Production - North American light-vehicle production through February is up nearly twenty-three percent, compared with the same period in 2011. BMW leads the European manufacturers in year-to-date production volume increases, up forty-two percent due to higher production of the X3. The Japanese OEM production volume continues in recovery mode, with volume up twenty-six percent YTD February from YTD February 2011. The Detroit Three had approximately a twenty percent year-over-year increase in production volume. Production levels are expected remain at a higher level in the first quarter of 2012, with volume forecasted at 3.8 million units, up almost fifteen percent from the first quarter of 2011. Looking ahead to second quarter production, an increase of eighteen percent from last year is expected, with nearly 3.7 million units to be built (last year's second quarter was affected by the Japan earthquake supply disruptions).

Vehicle inventory declined to a fifty seven-day supply at the beginning of March, compared with a sixty six-day supply at the beginning of February. Car inventory is at below-normal levels with a forty eight-day supply in March, down from sixty days in February, while truck inventory levels fell to a sixty six-day supply (previously at seventy two days).

Given the robust level of demand to date in 2012, overall inventory levels are back in check (under sixty days). LMC Automotive is increasing its North American production outlook for 2012 to 14.2 million units (up from 14.0 million units) to keep pace with the higher level of demand.

New-vehicle retail sales are on track to end the first quarter of 2012 particularly strong, with performance in March continuing the trend from the past several months, according to a monthly sales forecast developed by J.D. Power and Associates' Power Information Network (PIN) and LMC Automotive.

New-vehicle retail sales are on track to end the first quarter of 2012 particularly strong, with performance in March continuing the trend from the past several months, according to a monthly sales forecast developed by J.D. Power and Associates' Power Information Network (PIN) and LMC Automotive.