Tom Webb: First Quarter Results Are Strong For Retail, Wholesale Markets

If I had to choose just one word to describe the state of the retail and wholesale automotive markets in the first quarter, there’s no doubt that the word would be "strong."

At the retail level, new and used vehicle demand was heavy. Meanwhile, wholesale volumes showed welcome increases in several segments, and wholesale prices remained at lofty levels.

New and Used Vehicle Sales Go on a Joy Ride - New cars and light-duty trucks sold at a seasonally adjusted annual rate of 15.1 million in February. And, as in recent months, sales gains were not built upon incentives. In fact, incentive spending continued to track down on a year-over-year basis. With sales exceeding manufacturer expectations, plant utilization high, and even some backlogs in the supplier industry, there is no reason to expect a near-term return to high incentives. Early March numbers indicate that the new vehicle sales pace well remain well above fourteen million, resulting in a first quarter annualized rate of around 14.5 million.

Of special interest to NAFA members, fleet deliveries were up substantially in February, as sales to commercial fleets rose twenty eight percent and purchases by rental car companies increased twenty one percent; but that still left retail sales up a healthy eleven percent for the month. New vehicle sales into rental in February included a wide mix of makes and models. And, off-rental volumes and average mileage suggest that the purchases reflected needed replacements. As such, we do not believe that today’s higher sales into rental will have a depressing effect on future residuals.

Used vehicle retail sales rose during February, with an increase of more than ten percent and with the pace accelerating at month-end. Early numbers suggest that used vehicle retail sales also rose in March.

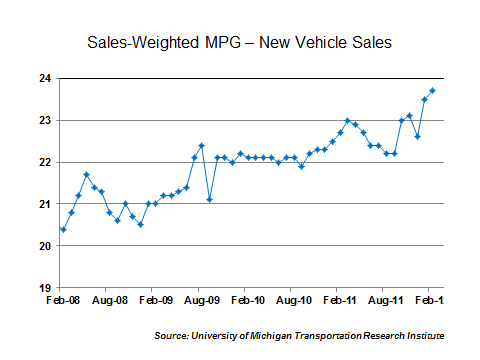

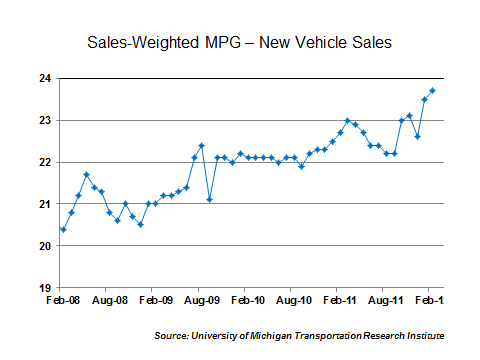

Higher gas prices affect model selection, but not decision to buy – for now. Rising gas prices have become an increasing concern as 10 states have now passed the $4-a-gallon level, and half a dozen more are only pennies away. The average sales-weighted fuel economy of new vehicles purchased in February increased to 23.7 mpg, up from 22.7 mpg a year ago and only 20.4 mpg in February 2008. Pricing strength in the wholesale market also reflected the continued shift in consumer preferences. Compact and midsize cars remained far and away the strongest segments of market over the past three months and over the past year.

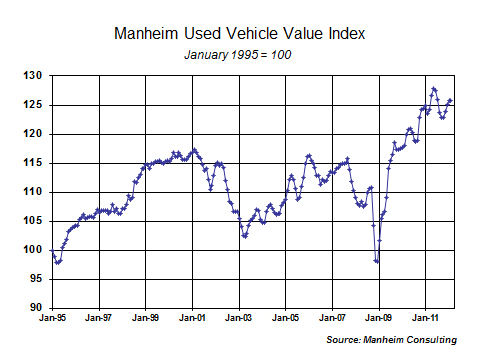

Manheim Index Moves Up Marginally in February - The Manheim Used Vehicle Value Index moved up marginally to 125.8 in February. The index of mix, mileage, and seasonally adjusted wholesale prices is now up 1.8 percent year-over-year and off only 1.6 percent from the all-time high reached in May 2011.

All of the increase in wholesale prices in February came in the second half of the month. New and used vehicle sales numbers showed that the retail market also accelerated as the month progressed.

Off-rental: High Prices, High Volume, and High Mileage - The more than twenty five percent increase in new vehicle sales into rental in the first two months of 2012 meant that the number coming out of service also rose. The higher volume did not prevent prices from reaching near-record levels, despite near-record average mileage at time of sale.

End-of-service Fleet Units: also Higher Prices and Higher Volume - Mileage and seasonally adjusted prices for midsize cars coming out of fleet service reached a record high in February. This was also true for many other segments of commercial fleet units, except cargo vans, which showed a lot of variance depending vehicle specifications and condition.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.