Remarketing Strategy: Tight Supply Keeps Wholesale Fleet Prices Strong

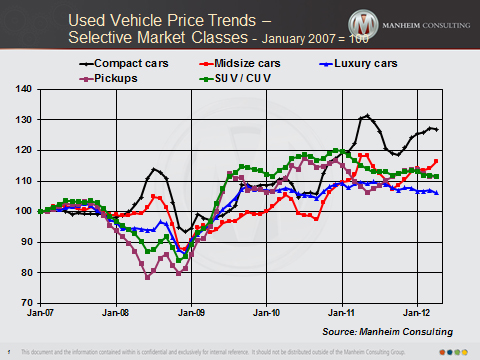

When anything less than another all-time record qualifies as a "decline," you know a high bar has been set. Such was the case for wholesale prices for midsize fleet cars last month.

Average auction prices for midsize fleet cars fell in May, but that was after reaching a record high in April. Average prices for these vehicles still remained well above $10,000, as they have all year.

Reduced Supply Leads to Higher Bids

A major reason for the strength in end-of-service fleet prices is that the loss of supply at auction in recent months has been for vehicles that normally sell in the $8,000 to $10,000 price range. As dealers hold onto more trade-ins that fall into this price range (and, at the same time, more dealers actively seek these types of vehicles at auctions) the impact on pricing has been predictable. Dealers are also more willing to bid on these units since they know that the subprime financing needed for their subsequent retail sale is now much more available.

Prices for fullsize pickups coming out of fleet have been high all year. This, in spite of the fact that the subsequent retail demand for these units has been dampened by the weakness in construction trades.

Although new vehicle sales into commercial fleet are up nearly eighteen percent for the first five months of this year, the trough in this number came in 2009. As such, end-of-service fleet volumes at auction will remain constrained for some time.

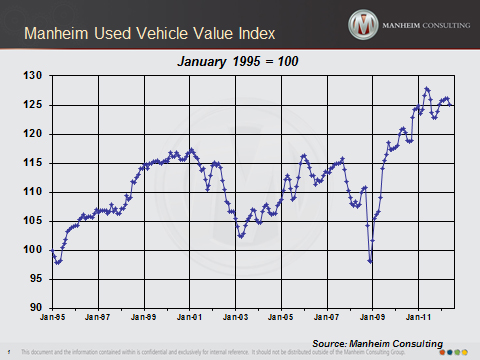

Manheim Index Declines

Overall, wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) fell 0.8 percent in May. The Manheim Used Vehicle Value Index now stands at 125.1 versus 126.1 in April. The year-over-year decline increased to -2.7 percent as the comparison was made against the Index’s all-time high reading.

New Vehicle Sales Disappoint

New cars and light-duty trucks sold at a seasonally adjusted annual rate of 13.8 million in May versus an average of 14.5 million in the first four months. May’s tally was significantly below expectations and suggests that Memorial Day sales were not as robust as initially reported.

The news wasn’t all bad, however. New inventories remained in check, and average transaction prices rose. That should help support future used vehicle values. An increase in incentive activity remains troubling, especially the reported resurgence of stair-step incentive programs. In the past, these have often been very destructive to used vehicle residuals.

Used Vehicle Retail Sales Increase in May

Whereas new vehicle sales failed to meet preliminary estimates for May, used vehicle sales exceeded them with a gain of 4.4 percent, per CNW. The year-to-date gain was 6.2 percent. Certified pre-owned sales, after slipping in April, returned to their record pace with a gain of more than eight percent in May, according to Autodata.

May Off-rental Prices Decline Sequentially, but Remain High

In May, the average price for rental risk units sold at auction fell by more than three percent from the previous month, but it was still the highest May price ever. Auction volumes for rental risk vehicles continued to run well above year-ago levels. Meanwhile, average mileage was the same as in April, but down eight percent from May 2011.

Thomas Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Thomas Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Thomas Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Thomas Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.