Remarketing Strategy: Used Vehicle Sales See Slowing Inevitible

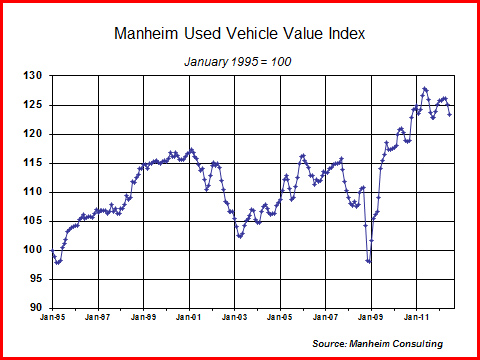

NAFA members paying attention to activity in the wholesale market have no doubt experienced a slight decline in prices over the last three months. In fact, wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) fell 1.4 percent in June, bringing the Manheim Used Vehicle Value Index to a level of 123.4, which represented a 3.2 percent decline from a year ago.

And June’s drop in wholesale prices was much faster than May’s (-0.8 percent) and April’s modest decline of only -0.1 percent.

So, you may be wondering, are we now in a freefall? The answer is "no." The decline has been an orderly retreat – and one that is not yet over. Though there is an outside chance that the eventual outcome may not be completely pleasant (due to the tenuous economic recovery underway) my belief is that it should be a retreat that still leaves both buyers and sellers in a comfortable position, retail markets unperturbed, and profit opportunities intact.

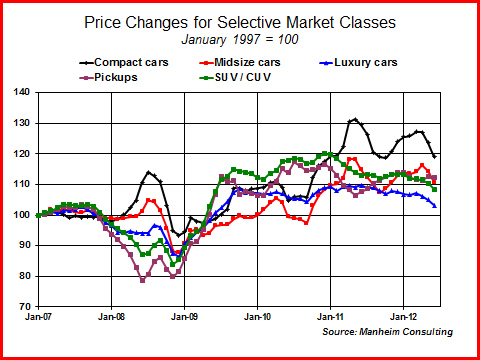

Shifting price trends by market class. Of the major market classes (on a mileage- and seasonally adjusted basis), compact cars have been the weakest segment over the past three months, the past six months, and past year. But, as shown in the accompanying graph, their longer-term rise has been exceptional.

Pickup trucks were the only market segment up over the past three months. They have also outperformed all other segments over the past six months and past year.

Prices for off-rental units decline. The average price for rental risk units sold at auction declined in both May and June. In straight average dollar terms, the two-month drop was slightly more than $1,000 per vehicle, but that still left auction prices higher than a year ago. However, if one makes some basic adjustments for the broad changes in mix and mileage of units sold, rental risk prices this year are down from last year, and off some 4.4 percent from the peak reached in April 2011.

New vehicle sales show continued strength. The new vehicle sales pace, which had slipped to 13.8 million in May, moved back up to 14.1 million last month.

There is no doubt that new vehicle sales have outperformed, and will continue to outperform, the overall economy. Consider this tidbit: Only one time in the past fifty-six years have new vehicle sales grown in a year in which real GDP growth was less than two percent. 2011 was that year. 2012 is shaping up to be the second such year.

Used vehicle retail sales ease in June against a tough comparison. While total used vehicle retail sales in June declined 2.5 percent from their year ago level (per CNW), sales for the first half of the year still showed a healthy 4.1 percent gain.

The comparison against a year ago was distorted by last year’s production disruption that left dealers short of new vehicle inventory and pushed substitute used vehicle sales higher. The total new-to-used sales ratio was a high 4.3 to 1 in June of last year, and a more normal 3.4 to 1 this year.

Certified Pre-Owned sales continue to run at a record pace and medium- and low-priced units are moving off dealer lots quickly thanks to readily available credit.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.