Tom Webb: No Signs Of Seasonal Decline In Wholesale Prices

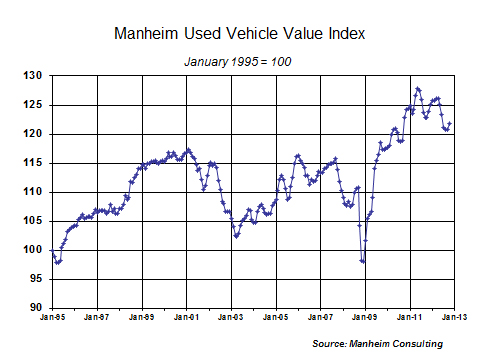

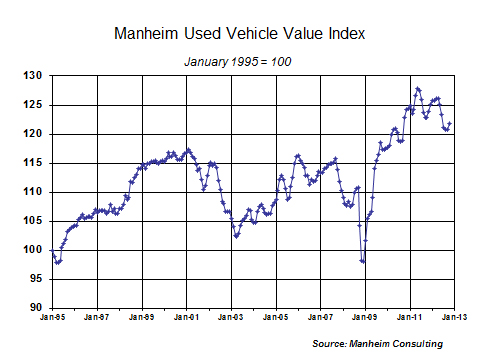

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) rose by one percent in the month of October. The October Manheim Used Vehicle Value Index stood at 121.9, which represented a 0.7 percent decline from a year ago.

Traditionally, the biggest seasonal swing in wholesale pricing occurs between September and October. As such, the rise in the seasonally adjusted Manheim Index is proof that, once again, manufacturers and dealers have had an effective, well-managed, model-year transition. Carry-over stocks were lean – and, thus, there was no need for deep discounting. As of November 1, new vehicle inventory levels have been below sixty days (on a 12-month rolling basis) for the longest period ever.

Used vehicle sales in October were reduced by Hurricane Sandy, but dealers still posted a strong seventeen percent gain for the month. Certified pre-owned (CPO) sales remain on pace for new record of more than 1.8 million unit sales in 2012. CPO sales should get a further boost in coming months as pull-ahead lease programs provide additional CPO inventory. On the lower end of the market, dealers are already working the coming tax season with down-payment deferral programs.

Most analysts believe that the impact of the hurricane will be to raise wholesale prices. We tend to agree, but believe the effect will be both modest and temporary,

Greatest pricing strength continues to reside in middle price tiers. As has been the case all year, vehicles in the $8,000 to $11,000 price range attracted the strongest bidding in October. In recent months, however, the relative market strength between the various price tiers has evened out quite a bit.

Prices for off-rental units remain strong. The average auction price for rental risk units sold at auction was unchanged between September and October, making it the second consecutive year where there was no seasonal decline. Likewise, volumes sold in October did not show a seasonal decline either. The average mileage on rental risk units sold at auction continued to decline modestly.

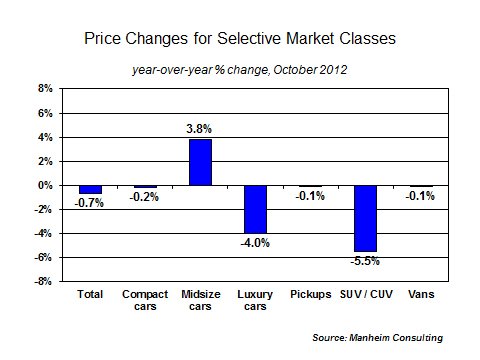

Midsize cars show the greatest pricing strength. In recent months, as well as over the past year, midsize cars have shown the strongest pricing. This bread-and-butter segment of the wholesale market has been supported by higher pricing in the new vehicle month (as a result of strong product and smooth model year transitions) and growing retail market appeal. Meanwhile, over the past year, the broad SUV segment has been the weakest market category. Within that overall segment, however, crossovers have outperformed the total market.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.