Manheim's Thomas Webb: Wholesale Prices Jump In August

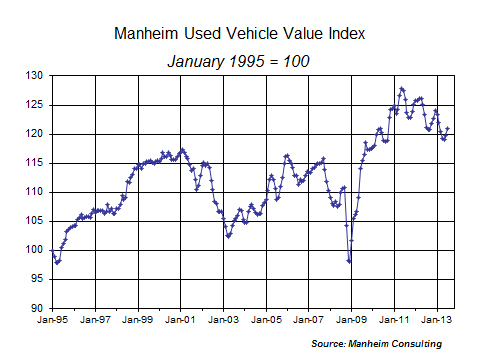

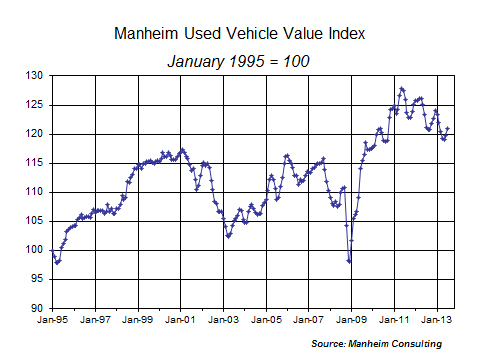

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) rose for the third consecutive month in August. The Manheim Used Vehicle Value Index now stands at 122.3, which represents an increase of 1.3 percent from its year-ago level.

The August increase in wholesale prices was the largest since the jump at the end of last year due to the impact of Hurricane Sandy. The drivers of today’s strong wholesale pricing are more positive – low inventories and higher transaction prices in the new vehicle market and strong profit opportunities in the retail used vehicle market.

Wholesale pricing for midsize cars improves. Of note to NAFA Members, mileage-adjusted prices for midsize cars are basically flat relative to a year ago; but in recent months, their seasonally adjusted prices have improved significantly – and, in fact, outperformed the overall market. In the first half of this year, wholesale pricing for midsize cars was being hurt by the competitive offerings and price discounting in the new vehicle market. In recent months, new vehicle pricing in this segment has been rising since that is where several inventory shortages reside. As a result, seasonally adjusted wholesale prices for late-model midsize cars have risen.

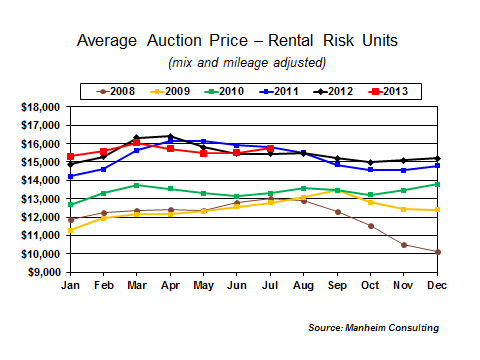

Pricing for rental risk units remains steady. Average auction prices for rental risk vehicles (adjusted for mileage and broad changes in mix) were little changed in August relative to July. On a year-over-year basis, prices were up 1.4 percent. Again, pricing strength in the new vehicle market helped these late-model used units. The average mileage of rental risk units sold at auction in August was down relative to the past few years.

New vehicle sales pace tops 16 million in August. New vehicle inventory (both the actual number and days’ supply) has always been a key determinant of late-model used vehicle prices. August was no exception. Dealers started the month with low inventories for several key models, and with August’s sales pace exceeding expectations, the days’ supply fell even further. That led to higher new vehicle transaction prices and strong wholesale used vehicle values.

August’s sales rate was likely influenced by a seasonal adjustment factor that failed to fully capture the impact of the early Labor Day, but there is no denying the new vehicle market is very robust. And, importantly, manufacturers are content enough with today’s sales rate not to artificially push it even higher.

Used vehicle retail market also improves in August. Total used vehicle retail unit volumes rose 5.6 percent in August, with dealer sales up 4.7 percent, according to CNW. This put year-to-date sales up 3 percent for both the total and dealer sales. Channel checks suggest that the ever-present squeeze on both front-end and back-end gross margins is being more than offset by higher volumes, faster turns, and increased productivity.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.