Wholesale Prices Strong; Should Remain So In 2014

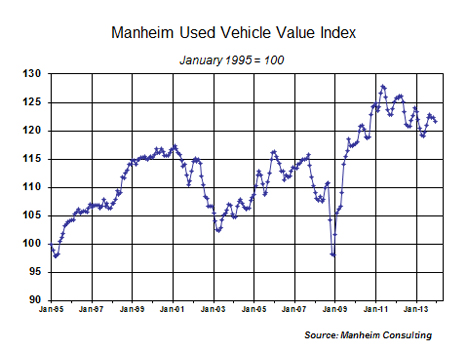

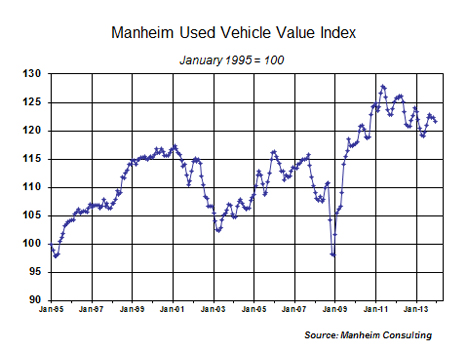

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 0.6 percent in December. The Manheim Used Vehicle Value Index reading was 121.7 in December, which represented 1.9 percent decline from a year ago.

The relative strength in wholesale pricing (down only 4.8 percent from an artificially boosted high in May 2011 and down only 1.8 percent on an annual average basis in 2013 despite higher wholesale supplies) remains very much a retail story. Retail used unit sales are strong, margins are narrow but stabilizing, and efficiencies have been greatly enhanced by both increased productivity and higher throughputs per store.

Underpinning all of this has been employment growth and readily available retail financing at attractive terms. We do not expect these fundamentals to materially change in 2014, although a few missteps may occur along the way. In the first quarter, for example, it is possible that wholesale supplies may rise faster than expected, and those vehicle segments dependent on tax-refund-fueled demand may once again be disappointed by unpredictable, uneven, and relatively low disbursements from the IRS.

Used vehicle sales have best December since 2005 - Total used unit retail sales rose more than four percent in December, bringing the full-year total to just under 42 million, according to CNW. December’s gain was led by an eleven percent increase in sales by franchised dealers, who continued to benefit from a higher volume and higher quality of trade-ins. This helped CPO sales post another record year.

Independent dealers posted a 4 percent increase in December unit sales after showing a five percent gain in November. Just as last year, Buy-Here, Pay-Here dealers made use of down-payment deferral programs to get a jump-start on the tax-refund selling season.

Rental risk prices eased in December, but remained strong - The average auction price (mix- and mileage-adjusted) of rental risk units sold in December was 2 percent lower than its year-ago level. With some sellers de-fleeting early and others holding off until the seasonal price rise at the beginning of the year, unit volumes sold in December were low. The average mileage on units sold in December was the highest since July 2012.

Our series, which compares rental risk prices to the government’s measure of prices paid by businesses for new vehicles (with a one-year lag), indicates that off-rental prices have been stable and strong for three years.

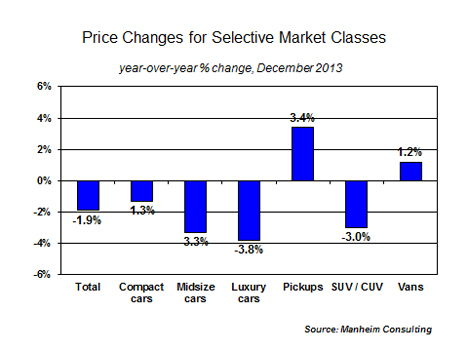

Market class and price tier shifts - Pricing for luxury cars continued to underperform the overall wholesale market in December. Pickups, vans, and sports cars were the strongest segments.

Our analysis of mileage by price tier indicates that in December, as well as the year as a whole, vehicles in the $8,000 to $9,000 price range had the strongest pricing. This was consistent with the reduction of supply in that price range.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.