Wholesale Prices Decline Again In July

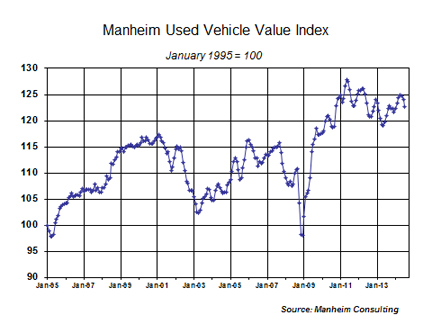

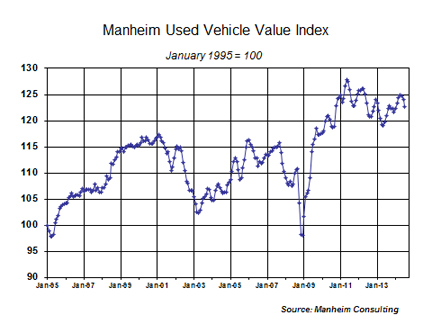

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined one percent in July. That resulted in a Manheim Used Vehicle Value Index reading of 122.7 for the month, an increase of 1.5 percent from a year ago.

This was the third consecutive monthly decline in wholesale pricing. And, given that the magnitude of the decline has increased each month, it has prompted talk of a free fall in pricing. That talk is premature. Wholesale prices have been on a secular downward trend since the all-time peak was reached in May 2011; but the movements have been modest, and there have been several up-cycles within the larger trend.

Recent price movements reflect an adjustment that many thought would occur earlier in the year. That it came now, just prior to a period of historical seasonal weakness in pricing and impending wholesale supply increases, only intensified the fear of a collapse. But such a collapse cannot come from industry forces alone. It would also require a significant altering in the current trajectory of labor market and credit conditions. That’s possible, but not likely.

Rental risk units: Prices remain in a narrow range, and mileage rises. Auction prices for rental risk units (adjusted for mileage and mix shifts) moved up marginally during the month, but were flat versus a year ago. Unadjusted for mix and mileage shifts, rental risk prices were down for both the month and year-over-year. Average mileage on rental risk units sold at auction continued to increase and reached nearly 41,000 miles, up eleven percent from a year ago.

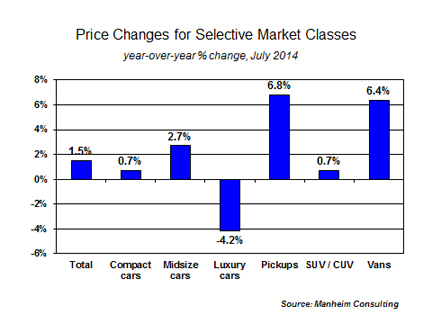

Luxury car pricing has been good for buyers; not so much for sellers. In July, the price decline in wholesale values for most luxury cars was twice that of the overall market. And there were segments within the luxury market (for example, entry level and premium units) that suffered even more. These segments have been under-performing the overall market throughout the past year. Blame it on the growing wholesale supply of very nice units being offered and the continued effort to push new sales. That’s great for consumers and dealers (who acquire vehicles at the right price and turn quickly), but it has been a little rough on commercial sellers of these units. Most of them, however, had been long expecting this adjustment in price.

Compact and midsize car pricing remains stuck. Compact and midsize cars have been the victims of their own product successes. It has resulted in a very competitive marketplace for both new and late-model used units. Given the plethora of high-quality offerings, it is tough for any one model to stand out. That has increased both cash and non-cash promotions.

Price movements in July were fairly consistent across the price tiers. Our analysis of average mileage by price tiers showed that the strongest pricing in July was in the $13,000 to $15,000 range, whereas the weakest price was just below that, in $10,000 to $12,000 range. But the differences were not large and were totally consistent with the shifts in auction volumes.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.