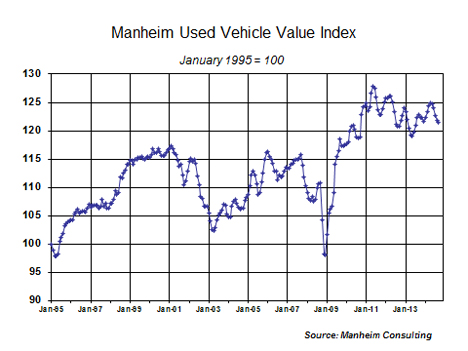

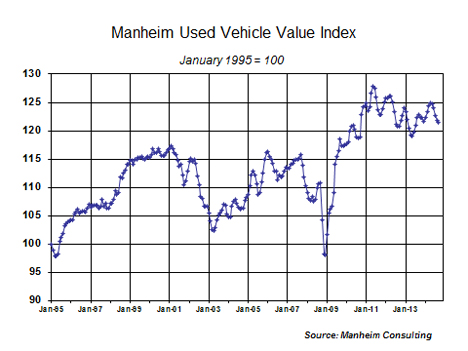

Wholesale Prices Decline For Fifth Straight Month

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 0.3 percent in September, the fifth consecutive monthly decline. This brought the September Manheim Used Vehicle Value Index reading to 121.4, down 1.1 percent from a year ago.

After exceptionally strong new vehicle sales in August, some franchised dealers entered September with higher-than-desired used vehicle inventory levels as a result of trade-ins and lease turn-ins. Dealers who priced these units right were able to quickly retail them and then purchase from the growing supply of commercially consigned units at auction in September. Independent dealers also stepped up their purchasing activity given a slight improvement in retail sales and lower wholesale pricing, which provided a better risk/reward proposition.

Rental risk prices fall again in September. Average auction prices for rental risk units continued to decline in September. After accounting for broad changes in mix and mileage, prices for rental risk units were down 4.5 percent from a year ago. Average mileage crept back up above 40,000, and volumes sold increased.

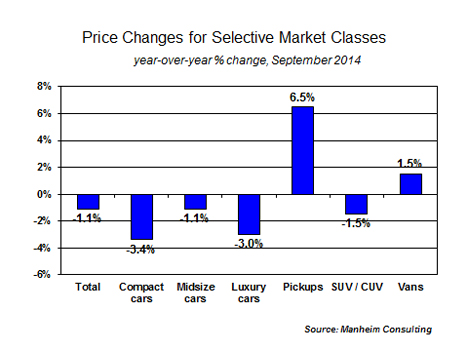

Market segment and price tier trends. Pickups and vans remain the strongest segments year-over-year; but in recent months, all of the market classes have been showing basically the same level of easing in prices on a seasonally adjusted basis. The multi-year decline in used luxury car pricing slowed considerably in September, which if it holds will be good news for lessors that have a large number of luxury units coming back over the next several months.

Although vehicles in the $9,000 to $10,000 price range continued to show the weakest relative price performance in September (and also the highest year-over-year increase in supply), this segment may be helped in coming months by falling gas prices, which provides a big benefit to households that make up the retail customer base for these vehicles.

New vehicle sales: Back to reality. After an exceptionally strong 17.4 million new vehicle sales pace in August (driven in part by technical and calendar factors), new vehicle sales, as expected, pulled back to a 16.3 million rate in September. For the first nine months of this year, the seasonally adjusted annual selling rate was 16.3 million; it was 16.6 million over the past six months and 16.7 million over the past three months. Although economic forces suggest that the retail consumer sector will improve in the months ahead, it is likely that the auto industry will plateau given that it got out ahead of, and then ran considerably faster than, the overall recovery.

Lease penetration rates have continued to rise in 2014, pushing new lease origination up by close to fifteen percent so far this year. Many of today's leases are returning satisfied lease customers from 2011. It is hoped that this virtuous lease return/new lease cycle continues, as it will help offset the slower turn cycle being created by the growing number of 72-month and 84-month retail loans.

Used vehicles: A better September. After a disappointing August when dealer used vehicle retail sales declined by more than nine percent, September saw an increase of nearly five percent, according to data from CNW. Some of the used vehicle sales shift reflects reverberations from the new vehicle side. Strong new vehicle sales in August stole some used vehicle buyers in that month, but the resulting trade-ins were then retailed in September. Franchised dealer used vehicle retail sales were up 6.6 percent in September after being down 5.6 percent in August. CPO sales were up twenty percent in September and ten percent year-to-date.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.