Wholesale Prices Rise For Third Straight Month

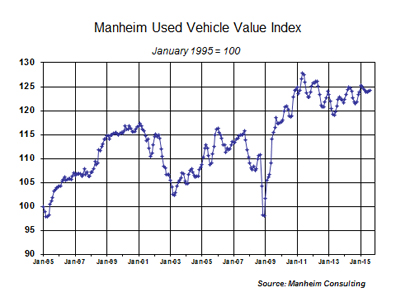

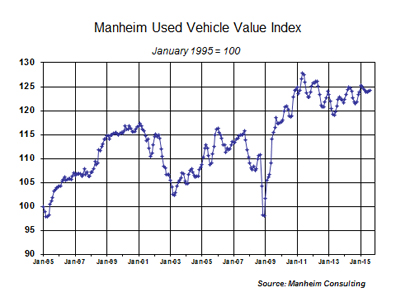

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased for the third consecutive month in August. This brought the Manheim Used Vehicle Value Index to a reading of 124.3, representing an increase of 2.1 percent from a year ago.

The stability of wholesale pricing, in the face of rising volumes, stands in stark – and welcome – contrast to the volatility in financial markets. It should not, however, come as a surprise. The reverberations of international events will not be felt in the used vehicle market unless and until actual fissures develop in our domestic economy. Such a reversal of fortune is a definite possibility, but it would likely require an additional buffering by those outside forces as well as policy mistakes on our part.

The volume / price relationship. Higher wholesale volumes naturally drive prices lower, all other things equal. And, naturally, all other things are never equal. As evidence, note that a simple regression of adjusted prices as a function of wholesale volume returns no statistically significant results. Adding in additional explanatory variables to capture labor market and credit conditions gives the volume variable a statistically significant negative coefficient; but it is not particularly strong, and the residual errors in the equations remain large.

It’s the availability, not the cost, of credit. One of the problems in developing statistical models of future pricing is the difficulty of quantifying the availability of credit, as opposed to its cost. And clearly, availability is the more important of the two.

In past cycles, credit spreads could sometimes be used as a rough proxy for availability; but our protracted period of near-zero interest rates has left the yield curve devoid of any historical perspective. Note, for example, that the percentage point spread between the 10-year and two-year Treasury note (monthly average) has been at least 125 basis points since January 2008. The spread reached half-century highs during the recovery and even now stands around 150 basis points. Even when the Fed begins it rate hikes, the spread will remain elevated – it may even widen. Chances of an inverted yield curve providing a heads up to the next recession? Slim.

It’s the time of the season for prices to fall. Statistically speaking, the largest seasonal decline in mix- and mileage-adjusted prices occurs between September and November. Over the past decade, the seasonal impact has averaged an additional percentage point of depreciation in each of the three months.

This year, along with the international issues (which will likely remain turbulent), our budget and debt ceiling "debates" will add uncertainty to the market.

Rental risk pricing recovers from July. A straight average of auction prices for rental risk units bumped up from July’s low, but remained below 2013 and 2014 levels. The average mileage on rental risk units fell to its lowest level since October of last year. Auction volumes were down in August after being up significantly in the first seven months of the year. In August, new vehicle sales into rental declined 3 percent, but were still up 5 percent year-to-date.

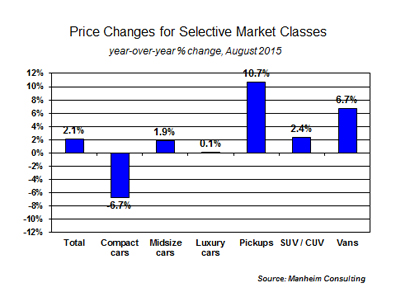

Market segment and consignor segments. Pickups, SUVs, CUVs, and vans continued to have higher prices year-over-year. Midsize and luxury cars were also up, but the comparison was against weak year-ago pricing. Compact car prices are down 6.7 percent over the past year.

A straight average of auction pricing was up year-over-year for both commercially consigned and dealer-consigned units. The average mileage on dealer-consigned units continued to track slightly below its year-ago level.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.