Wholesale Prices Reach Highest Levels Since July 2011

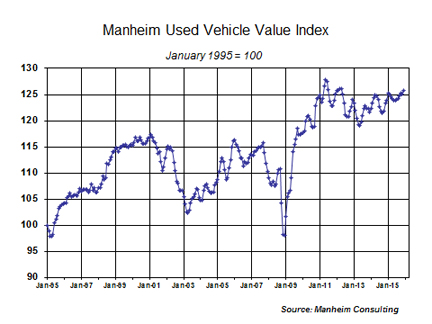

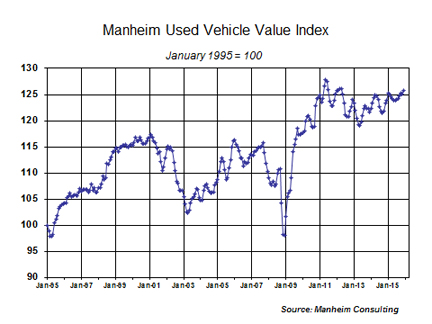

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased in December. It was the sixth increase in the past seven months, and it brought the December reading to 125.7 – its highest level since July 2011 and only 1.6 percent below the peak reached in May of that year. The Index is up 1.5 percent from last December.

On an annual average basis, the Manheim Index rose 1.2 percent in 2015, after a 1.5 percent increase in 2014. In 2012 and 2013, the Index declined by 1.0 percent and 1.8 percent, respectively. Four consecutive years with annual price movements of less than two percent represents the longest stretch of wholesale price stability in the Index’s 20-year history. A lot of macro-economic and industry factors contributed to that stability; but also we can give credit to better and more efficient remarketing practices that have enabled commercial consignors to anticipate, respond to, and thus minimize impending swings in wholesale pricing.

Moderating the pressure on wholesale prices will become more important in the years ahead because wholesale supplies will be growing quickly. Look for remarketers to take a more holistic approach that effectively utilizes all available tools and channels, and which more closely aligns the competing objectives of the firm.

Outside the control of remarketers, however, will be the overall health of the retail used vehicle market. Right now, it appears that the favorable environment has longer to run.

Rental risk pricing remains steady. In December, auction prices for rental risk units (adjusted for broad changes in mix and mileage) were up 0.9 percent from November, but down 1.3 percent from a year ago. The adjusted price series has remained in a very narrow range for the past four years.

Average mileage in December (at 44,375 miles) was down from November and was also below its year-ago level. December’s auction volume for rental risk units was down from last December’s very high level, but full-year 2015 auction volumes were up. The conversion rate in recent months has returned to normal levels after being high in the summer months.

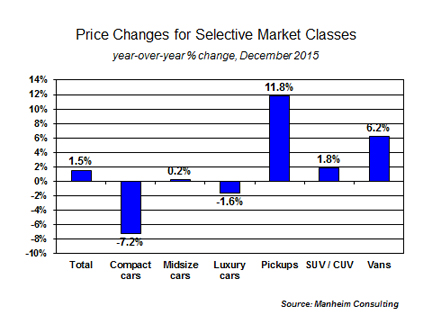

Market class and consignor segment trends. Wholesale pricing for used pickup trucks eased in December, but that was after exceptional strength in recent years due to higher pricing in the new truck market, greater demand created by construction activity, low gas and diesel prices, and a wholesale supply that has grown slower than some other vehicle segments. On a mileage-adjusted basis, pickup prices have risen nearly 23 percent over the past three years.

Compact cars in December, as well as in recent years, underperformed the overall market due to fierce price competition on the new vehicle side and shifting consumer preferences. That segment was down over 7.2 percent in just the past year, and 9.4 percent over the past three years.

Pricing for vans, especially cargo units, remained very strong in recent months as it has for several years. Luxury cars showed some strength in the month of December, but are down for the year, and will likely face higher wholesale volumes in early-2016.

A straight average of all auction sales showed prices rising throughout the fourth quarter. Average mileage for all auction sales declined in 2015 as a result of a higher share of sales accounted for by commercial consignment.

New and used vehicle sales increase for six consecutive years. New car and light-duty truck sales reached a record 17.5 million in 2015, despite a softer-than-expected 17.2 million SAAR in December. Inventory levels remain in line with market conditions.

Used vehicle sales in 2015 also increased for the sixth consecutive year. The percentage increases have been much smaller than for new vehicles, but that is to be expected for a market that is much more stable over the economic cycle and which declined less than half as much as new vehicle sales during the recession. Preliminary CPO sales numbers put the full-year total at 2.5 million, which represented a fifth consecutive year of record sales.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.