2015 Marks Sixth Consecutive Year Of Fleet Vehicle Purchase Increases

New vehicle purchases by commercial fleets grew by more than two percent in 2015 to 629,000 units. It was the sixth consecutive yearly increase and pushed total purchases 81 percent higher than during the 2009 recession. New vehicle purchases by government agencies, however, declined slightly in 2015 and were little changed from their 2009 level. This brought total commercial and government fleet purchases to 871,000 in 2015, up considerably from the 588,000 purchased in 2009, but shy of the million-plus units bought in 2006 and 2007.

In 2016, commercial fleet purchases should continue to grow as a result of higher employment levels; but the increases won’t be nearly as large as earlier in the cycle when businesses had both pent-up demand and the desire to "short-cycle" some of their fleets to take advantage of exceptionally high wholesale prices. Over the longer term, we see new vehicle sales into fleet staying below the one million mark as the result of employment shifts between industries, a changed occupational distribution within industries, a continued tight rein on both private and public fleet budgets, and a concerted effort to improve the utilization of the existing fleet. As such, future fleet sales will be driven more by the replacement cycle created by the 6.5 million vehicles currently operated by commercial entities and government agencies.

Fleet Operating Costs Improve in 2014

In 2015, fleet managers once again enjoyed stable or declining operating costs as a result of low energy prices, stable maintenance and repair expenses, and lower-than-expected depreciation costs. These savings were partially offset by safety recalls that increased rental outlays for supplemental units. Keeping operating expenses in check is important for the future health and growth of the fleet industry since budget outlays to the fleet department remain constrained. Lower operating expenses better enable fleet managers to grow units in operation and provide higher service levels to fleet drivers.

Today’s higher-quality vehicles and, in some cases, extended power train warranties have kept fleet expenses in check by reducing maintenance and repair costs on a per-mile basis. When repairs do occur, however, they are significantly more expensive than in the past as the diagnosis is often more complex and the parts and labor costs higher. Similarly, the prevalence of synthetics has made oil changes more expensive, but it has lengthened service intervals. Additionally, fleet operators, like retail consumers, have benefited from manufacturer programs that cover first-year oil changes and tire rotation. But it remains important that fleet managers and fleet management companies ensure that all required fluid changes and scheduled services are actually performed and documented. Otherwise, warranty claims will be denied.

After years of significant increases, tire prices were stable in 2014 and 2015, primarily as a result of low oil prices, and thus, it is likely that tire prices will remain stable in 2016. The shift toward more expensive, larger-diameter tires appears to be a trend that has now played out; but there is increased use of special-sized tires for which there is not a lot price competition between manufacturers in the replacement market.

One area of fleet operating expense that is bound to rise in coming years is funding costs. The Federal Reserve finally hiked the targeted federal funds by a quarter-point in December of 2015, and it is expected that there will be several more hikes over the course of 2016. Even with the increases, however, interest rates will still be low from a historical perspective.

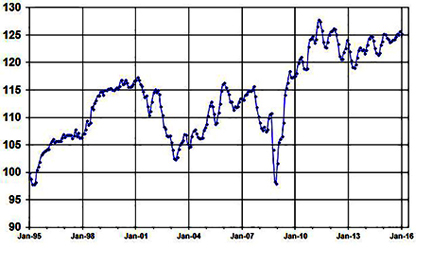

Manheim Used Vehicle Value Index: Wholesale Prices Fall in January

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) fell in January. It was only the second decline in the past eight months, and it brought the January reading to 125.2 – virtually unchanged from a year ago.

Although it has been long anticipated that wholesale values would ease in 2016 as a result of higher supply, we suspect the first downward movement of the year was more the result of past margin compression than growing wholesale volumes. Retail used vehicle gross margins were not strong in the fourth quarter of last year, so it is only logical that dealers will moderate their bidding until such time as the risk-reward ratio comes back into better alignment.

Excerpts from this month’s column were taken from the Manheim Used Car Market report, now available for download at www.manheim.com/services/consulting.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.

Tom Webb is Chief Economist for Cox Automotive. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com.