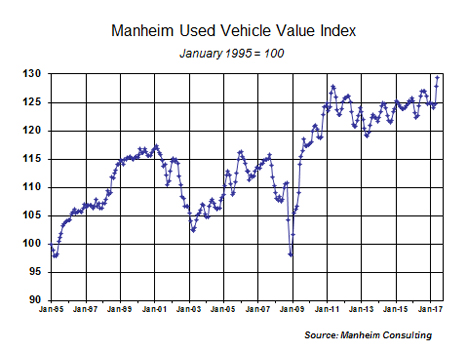

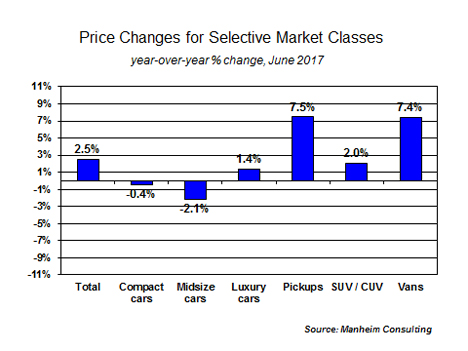

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.1 percent month-over-month in June. This brought the Manheim Used Vehicle Value reading to 129.3, which was a record high for the second consecutive month and represented a 2.5 percent increase from a year ago.

On a year-over-year basis, the mid-sized car category saw the largest decline (down 2.1 percent) in June, while pickups and vans saw gains greater than the overall market.

Like May, the June index result challenges concerns that increasing wholesale supplies from near-peak off-lease volumes and rising rental volumes would lead to rapidly declining used car values. Instead, strong retail demand for recent model year used vehicles is encouraging dealers to buy more vehicles from auction heading into the summer. The increased demand is more than offsetting the higher supply.SUV/CUVs accounted for 32 percent of rental risk sales in June of this year versus 30 percent last June. The share of compact cars fell from 25 percent to 23 percent. Average mileage for rental risk units in June (at 40,600 miles) was 2 percent below a year ago.

Combined rental, commercial, and government purchases of new vehicles were down 13 percent, due primarily to a sharp decline of new sales into rental (down 22 percent). Retail sales were down 0.7 percent in June.

Used CPO sales softened in June. CPO sales fell slightly in June (-0.8 percent) after increasing substantially in May. Year-to-date CPO sales are up 1.3 percent. CPO sales of light trucks jumped 7 percent as increasing SUV/CUV/pickup inventory coming off-lease is lining up well with consumer demand. The passenger car share of CPO sales came in at 49 percent for June, as SUV/CUV/pickups began to dominate just as they have since 2013 in the new vehicle market.

NAFA Fleet Management Association

http://www.nafa.org/