By Jonathan Smoke

By Jonathan SmokeCox Automotive

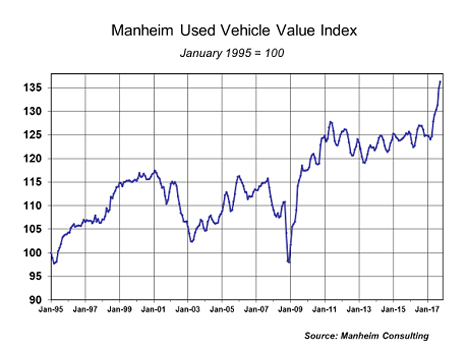

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.02 percent month-over-month in October. This brought the Manheim Used Vehicle Value Index to 136.3, which was a record high for the sixth consecutive month and an 8.1 percent increase from a year ago.

On a year-over-year basis, all major market segments again saw gains, including midsize cars. SUVs/CUVs, pickups, and vans outperformed the overall market.

Though wholesale market values continue to show strength as a result of growing retail demand, most of this price strength can be attributed to the recovery following Hurricane Harvey and Hurricane Irma. Replacement demand combined with a reduction in available supply has caused wholesale inventories to tighten. The impact to the wholesale market was widespread, resulting in abnormal wholesale price gains for another month.

Rental risk pricing improves in October. The average price for rental risk units sold at auction in October was up four percent year-over-year. Rental risk prices were down three percent compared to September. Average mileage for rental risk units in October (at 42,500 miles) was one percent above a year ago.

New vehicle sales impress again in October. October new sales volume fell one percent year-over-year with one less selling day compared to October 2016; but relative to earlier in 2017, the performance was impressive. Back-to-back seasonally adjusted annual rate (SAAR) readings of more than 18 million beat expectations and are fueling a strong finish to 2017. Cars continue to see sharp declines as sales in October fell nine percent compared to last year, with all major car segments having sales declines. Light trucks outperformed cars in October and were up four percent year-over-year. New vehicle sales year-to-date are down two percent compared to last year.

Combined rental, commercial, and government purchases of new vehicles were up one percent, led by gains in commercial (plus-four percent) and government (plus-nine percent) fleet channels. Overall fleet sales are down nine percent for the year versus 2016.

New vehicle inventories remained below 4 million units, but inventories did tick up from September.

Used sales gained in October. According to Cox Automotive estimates, used car sales improved by three percent year-over-year in October. The October used SAAR decreased to 39.7 million units from September’s 41 million. The retail growth in used sales is coming from vehicles less than four years old, which have grown 14 percent year-over-year, year-to-date. Vehicles less than four years old represent the largest age segment of vehicles in the used car market.

Economy continues to chug along. The first estimate of real GDP growth in the third quarter came in at 3.0 percent, beating expectations of 2.6 percent growth. Two consecutive quarters of three percent or greater growth is a positive improvement, as we have not seen two such strong quarters in a row since mid-2014. After declining in September, consumer sentiment rebounded in October, with the final reading from the University of Michigan coming in at 100.7, its highest level since the start of 2004. Households are feeling more upbeat about the outlook for the U.S. economy, which is a solid leading indicator of consumer spending and the rest of the economy in the fourth quarter.

Jonathan Smoke is Chief Economist for Cox Automotive. Follow Jonathan on Twitter at @SmokeonCars for the latest industry research and insights.

By Jonathan Smoke

By Jonathan Smoke