INVESTING

| Print this Article |

Capture Higher Bond Yields Before a Rate Cut With Term Maturity ETFs

By Karen Veraa, CFA

A combination of rising short-term yields and geopolitical uncertainty has triggered a flight to cash. Money market fund assets rose sharply in 2023, hitting a record $6 trillion as of January 31, 2024.1

The appeal of money market fund yields above 5% is certainly understandable—but many investors don’t realize cash has historically underperformed short-term bonds when the Fed pivots from a tightening cycle to easing.2 And while the timing remains uncertain, the central bank has clearly signaled its intention to cut rates in 2024.3

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year,” Fed Chair Jerome Powell said.4

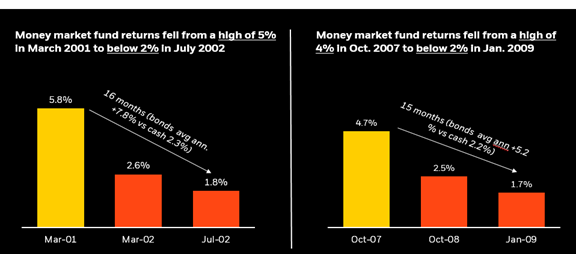

Cash yields can fall rapidly when the Fed pivots to rate cuts

Source: Morningstar as of 12/31/23. U.S. bonds Bloomberg U.S. Aggregate Bond Total Return Index from 03/01/2001 to 7/31/2002 and from 10/01/2007 to 01/31/2009. Money market fund returns represented by Morningstar’s Prime Money Market Fund category from 03/01/2001 to 7/31/2002 and from 10/01/2007 to 01/31/2009. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Against this backdrop, advisors may consider recommending clients step out of cash and into term maturity bond ETFs to seek to capture higher yields for longer periods of time while limiting exposure to any single cash product.

What Are Term Maturity ETFs?

Term maturity bond ETFs are designed to mature like a bond, trade like a stock, and diversify like a fund. BlackRock launched the first term maturity ETFs, known as iBonds®, in 2010 in the municipal sector. Over the past 14 years, term maturity ETFs have expanded to include funds that hold US Treasuries, TIPS, investment-grade credit, and high-yield bonds that range in maturity from 2024 to 2033.

These funds hold bonds that mature in the calendar year in the fund’s name. For example, iShares® iBonds® Dec 2026 Term Corporate ETF (Ticker: IBDR) holds investment-grade corporate bonds that mature throughout 2026. Investors in the fund can expect to receive monthly distributions and receive the final net assets in mid-December 2026 after the last bond in the ETF matures.

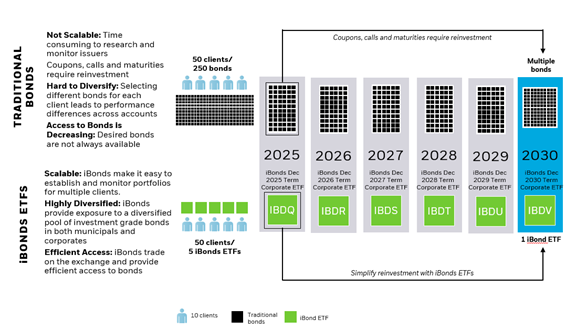

ETFs that hold bonds to maturity can simplify bond investing. Term maturity ETFs enable advisors to build bond ladders without the time-consuming and potentially costly effort to research and purchase the individual bonds. Here are five ways advisors can use these ETFs to help clients solve today’s investing challenges and help themselves from a practice management standpoint.

The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective.

5 Ways Advisors Can Use Term Maturity ETFs

Build bond ladders – Bond laddering involves buying equal-weighted amounts of bonds for each calendar year. With an ETF ladder, advisors can purchase one ETF for each calendar year, such as 2025 to 2029 for a 1- to 5-year ladder. Over time, the ETF ladder will allow for proceeds to mature each year in addition to a potential monthly income stream. In doing so, investors can have the potential for exposure to hundreds of bonds while earning monthly income. Then upon maturity they receive proceeds similar to investing in an individual bond.

Laddering tools on the fund provider’s website allows advisors to build bond ladders, view current market yields and durations, and monitor current holdings.

Capture yields before interest rates fall – Holding bonds to maturity is one way to lock in yields. But once the Fed starts to cut overnight rates, these yields will begin to decline—and so will the yields clients can earn. Adding a longer maturity ETF is one way to seek higher yields in client portfolios for a specific amount of time.

Diversify existing bond portfolios – For individual bond pickers, most portfolios tend to have only a handful of issuers. With high minimum bond sizes and lack of resources to devote to monitoring, keeping individual holdings to less than 20 bonds can make these accounts scalable. However, the consequence of holding fewer bonds is concentration risk. Layer in a few term maturity ETFs and bond portfolios can be easily diversified by increasing the number of bonds and issuers. For state-specific municipal bond portfolios, municipal ETFs can add more national exposure and reduce home state bias while still benefiting from federal and possibly state tax benefits.

Add exposure to high yield bonds or TIPS – Some advisors may feel comfortable picking US Treasury or corporate bonds. But when it comes to high yield corporates or Treasury Inflation Protection Securities (TIPS), they may leave this bond selection to the pros. With high yield and TIPS term maturity ETFs, adding these asset classes to portfolios is easier than ever.

Address IRA Required Minimum Distributions (RMDs) – Individual Retirement Accounts (IRAs) require the account holder to withdraw a required minimum distribution once they turn 72 years old.5 The RMDs are calculated using tables by the IRS based on the retirees’ ages and account sizes. Term maturity ETFs can be used to ladder out the first 10 years of RMDs. Since most term maturity ETFs mature in December, the RMD amount is available for withdrawal before year end.

Conclusion

With almost $45 billion6 invested in term maturity bond ETFs, investors are using these funds to manage interest rate risk, lock in yields, and add diversification to portfolios. The higher rate environment won’t stick around forever. These ETFs offer an easy, scalable way to navigate the bond market.

1 Bloomberg, Investment Company Institute as of 1/31/2024.

2 Bloomberg 1/1/90 through 6/30/23. Core bonds defined as Bloomberg U.S. Aggregate Bond Index, short-term defined as Bloomberg U.S. Aggregate 1-3 Year Index, and cash defined as Bloomberg U.S. Treasury Bill 1-3M. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

3 FOMC summary of economic projects as of Dec. 13, 2023.

4 FOMC transcript of Powell press conference, Jan. 31, 2024 Transcript of Chair Powell's Press Conference January 31, 2024 (federalreserve.gov)

5 Internal Revenue Service guidelines as of 1/31/2024

6 Source: BlackRock and Bloomberg as of 1/31/24 using total assets under management in US registered term maturity bond ETFs.

Karen Veraa, CFA, managing director, is the head of iShares US Fixed Income Strategy within BlackRock's Indexed Fixed Income Group. She works with financial advisors to help navigate the bond markets and assists with new bond ETF launches.

image credit: istock.com/metamorworks