INVESTING

| Print this Article |

Is Private Credit’s Moment Just Getting Started? How to Navigate the Risks Ahead

By Jonathan Schonberg

Given our shared enthusiasm for alternatives and all things NAPFA, it’s only fitting I first met our CEO, Mike Ponticello, at a NAPFA conference back in 2007. As our alternatives-based kinship grew over the ensuing years, we created many great memories as regulars on the NAPFA circuit. Back then, the term “liquid alternative” had yet to be coined, Morningstar had no proper category for such funds, and many RIAs we spoke with felt alternatives were best left to large institutions. Given the lack of viable, non-commissionable product choices for the Fee-Only channel, who could blame them?

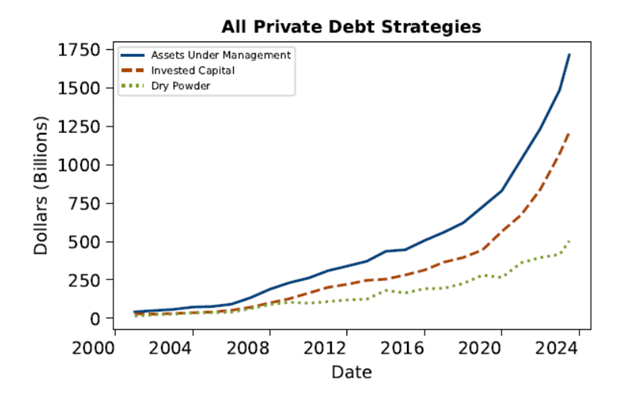

Since 2007, alternatives have earned broad RIA acceptance and enjoyed staggering AUM growth. Private credit surged from $375 billion in 2008 to $1.6 trillion in 2023 and is predicted to double again in the next four to five years (Brookings Institute). Even a skeptic would be hard-pressed to argue this huge influx of dollars and players in the space has been anything but a positive for RIAs, their clients, and small mid-market businesses and their workers.

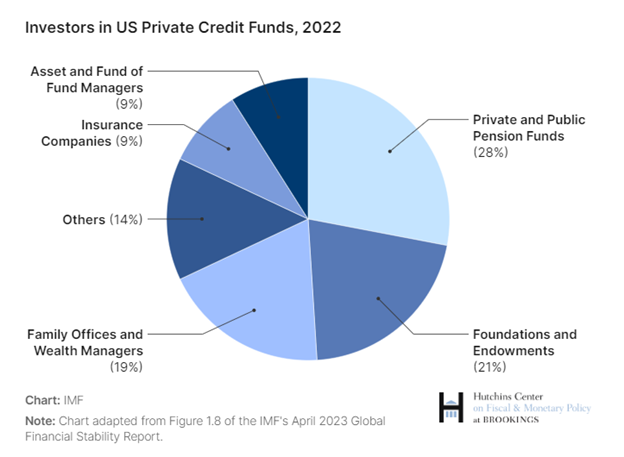

In 2007, it was rare for RIAs to fully embrace Swensen’s Yale Model of investing but as we can see in the figure below, at least collectively this channel is now behaving much like an institution.

Open Questions

But how should a Fee-Only advisor think about private credit going forward? How does one use private credit wisely and obtain the maximum benefit for clients while properly identifying, assessing, and minimizing the risks? What are the current risks and what others may be lurking around the corner? And what prudent RIA wouldn’t look at the near-vertical line below (US Federal Reserve 2/24) and not worry about recency bias, confirmation bias, herding issues, and other behavioral finance risks lurking beneath the surface.

In a Wall Street Journal article from 4/28/23 called “Getting the Sharp End of the Investing Stick,” Jason Zweig jumped into a firestorm by asking how the fact sheet for Cliffwater’s $1.5 billion private credit portfolio could possibly display a Sharpe ratio of more than 10 and a beta of zero. In case you are rusty on your modern portfolio theory statistics, a Sharpe ratio over one is considered good and a ratio over three would be considered nothing short of stellar. Zweig writes that he called the Nobel Laureate himself to get to the bottom of things. Here’s a quote from the article.

“Maybe that’s Sammy Sharpe’s ratio,” he said.

“Who’s Sammy Sharpe?” I asked.

“I don’t know!” Prof. Sharpe cackled. “But that can’t be my ratio.”

If some private credit marketing statistics look too good to be true, RIAs might also want to be cognizant of the structural tailwinds the space has benefited from during 2008–2022 due to persistently falling interest rates. As rates trudged lower year after year, this allowed businesses to improve their situations by repeatedly refinancing at better terms. Private credit investors’ take-home pay reflected as much; however, this tectonic lift should not be counted on going forward.

Prudent RIAs should also be wary that the complexion of private credit might be changing due to its own success. If you look under the hood, are the popular funds and products being forced to own the same things? A Bloomberg article entitled “Flawed Valuations Threaten $1.7 Trillion Private Credit Boom" from 2/28/24 points out that indeed, three of four private credit funds own the same loans.

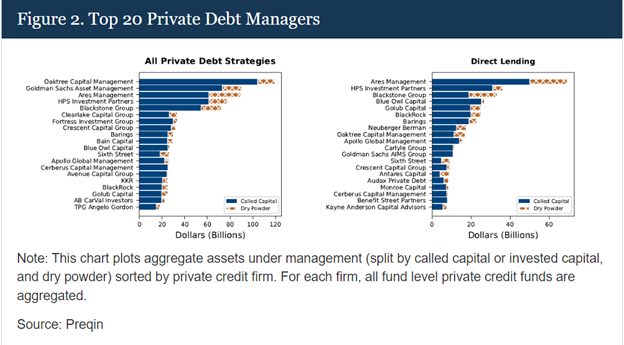

A Federal Reserve report from 2/24 displays the following figure and states, “The sector is heavily concentrated in a few large fund managers.” The note goes on to say, “Staff estimate that top 10 U.S. private debt fund managers hold about 40–45 percent of all dry powder in the U.S., across all private debt strategies.” This “disproportionately high demand” for a few fund managers should at the least be a yellow flag for Fee-Only practitioners thinking about concentration, liquidity, and capacity risks, among other things.

Fee-Only advisors should be cognizant of the industry concentration illustrated in the chart above and ask if there will be enough deal flow and underwriting capacity to keep up with demand. In your due diligence, you will also want to understand to what degree entrants in the space are asset gathers, asset managers, or some combination and how this would impact your engagement.

Solution

In our view, RIAs can and should participate in private credit but they should do so by engaging in distinct areas having clear, definable risks. These risks must be articulated and outlined clearly by the sponsor, and if the sheer size or opaqueness of the product prevents that from happening, then perhaps the RIA should think twice. In other words, regarding risk, you have to be able to name it to tame it.

Some private credit shops achieve differentiation with a very specific point of view such as lending with an eye to companies in overlooked zip codes. These lenders may even provide worker solutions to their borrowers’ low and moderate-income employees. These “impact” style private credit managers should have noticeably different risks than those seen in large, plain-vanilla credit managers.

Other niche credit managers may focus solely on lending to small businesses whose debtors are blue chip companies such as Samsung, Amazon, or P&G. While technically loaning to small businesses, the credit ratings of these funds can get a significant boost from the larger, associated debtors. With this technique, credit managers provide plenty of daylight between themselves and the monolithic, often syndicated managers and their conflated portfolios.

To summarize, when evaluating private credit, RIAs should:

- Seek to have a healthy skepticism

- Be aware of the cohorts you will be investing alongside

- Search for niches where you can take repeatable “micro-risks” in well-defined sandboxes you can identify and understand

Finally, don’t forget about the compliance complexities that may crop up as you adopt private credit or other alternatives. It’s always worth checking to make sure your ADV is up to speed and reflects your usage of these instruments. Stay tuned for future articles from American Elm Advisors on this topic.

Best of luck and we hope to see you out there at a NAPFA conference soon!

Jonathan Schonberg is director of Business Development for American Elm Advisors and American Elm Distribution Partners. He works with RIAs and alternative managers and may be reached at 203-275-6179. American Elm provides compliance services, managing broker-dealer solutions, and alternatives.

image credit: istock.com/Irina Shatilova