INSURANCE

Choosing the right income annuity for your client

By Rob Barnes

New products and distribution options are emerging for annuities as insurance companies continue to develop products to serve a growing market of RIA advisors. An analysis shows that fee-only advisors’ assumptions can be wrong. Don't assume a commission-free product is better than one with a commission, and don't assume an immediate annuity will provide better income than a deferred annuity with an income rider. Do check the financial strength of potential providers.

Crunching the numbers: DIA versus income rider

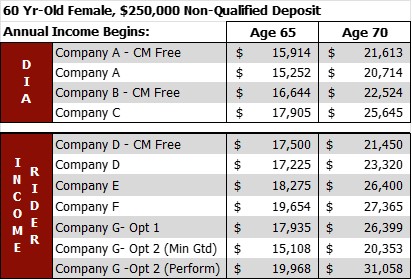

In the exhibit below, we assume a 60-year-old female purchases a $250,000 non-qualified annuity and takes income at age 65 or 70. The exhibit compares income generated from deferred income annuities (DIAs) and deferred annuities with an income rider, using commission-free (labeled “CM Free”) and commissionable products. Companies A and D have expanded into RIA distribution channels offering both options; the other companies offer only one option.

Deferred income annuity

A DIA takes a lump sum today and guarantees an income starting in the future. A pure “life only” election is used in our example; if the annuitant dies during the income stage, income stops. Any contingency to protect against an early death would lower the income paid.

Company A, offering both commission-free and commissionable options, pays approximately 4% more to the client with the commission-free product. However, Company C’s commissionable product generates more income than the products from Company A or Company B.

Be aware a commission-free product may not pay commission to an agent but it might pay a commission to the distribution partner. Insurance companies must pay to distribute their products one way or another. Historically, they either had their own agent support systems or distributed through a brokerage general agency (BGA). Today, more companies sell directly to the consumer or distribute through the RIA channel. Some companies ask their BGA partners to distribute the RIA product without an agent commission but with a commission to the BGA.

Insurance companies usually pay agents a one-time commission to set up lifetime income via a DIA or a single-premium immediate annuity (SPIA). If they don’t receive a commission, they’ll need to charge you or your client in some way for their time in setting up the DIA or SPIA. This might mean you need to charge or add a fee to help your client purchase a DIA or SPIA in the future.

Deferred annuity with guaranteed income rider

A deferred annuity offering a guaranteed minimum income rider is another way to guarantee future income for a client. This approach offers more flexibility than a DIA because it doesn’t require an income start date at purchase. The other benefit of an income rider versus a DIA is that a remaining balance will go to heirs if the annuitant dies early after turning on the income rider.

In the table above, Company D, offering both commission-free and commissionable products, had a surprising anomaly: The commission-free product pays slightly more at 65 but significantly less at 70. Company F guarantees the most income at both ages but has considerably lower ratings, potentially excluding them as an outlier. Company G offers an indexed option that allows for a higher lifetime income with positive performance.

This example shows that:

- Guaranteed income riders available today compete well with an immediate annuity.

- If your client seeks to protect their assets and provide a guaranteed income now or in the future, it is important to compare income rider products with SPIA/DIA products.

- Most products offering an income rider are based on unisex pricing. In theory, you would expect them to be more competitive for women than men, but you need to crunch the numbers because anomalies and sweet spots exist.

- You should be aware that high payouts may come from financially weaker companies that may pose a risk to the promised payout.

Best practices

There are many variables to consider when shopping and comparing annuities. Like life insurance, annuities are all math with assumptions for interest, expenses, and mortality. Whether a commission is paid or not does not, by itself, make one product superior to another. I assume many advisors will want to charge some type of fee to clients who buy an annuity, especially if it is a deferred annuity, which may need monitoring over time.

Any search should start with investigating how strong the company is and giving closer scrutiny to companies selling annuities exclusively, which means that they are more vulnerable to problems with annuity pricing. If guaranteed income is the client’s priority, it is important to compare income rider options to SPIA/DIA products. You should also look at the broader marketplace to compare commissionable and commission-free options.

It is important to note this analysis did not cover every product available today. As more products and distributors enter the commission-free marketplace more analysis should be done. In the meantime, any thorough search should include both commissionable and commission-free options.

Robert M. Barnes, CLU, ChFC, is president of Integrated Insurance Consulting, a NAPFA Resource Partner. Partnering with advisors for 25+ years, he is an expert in business and estate planning uses of insurance. Contact him at (708) 307-2577 or rob@intinsconsulting.com.

image credit: istock.com/imaginima