FINANCIAL PLANNING

The case for advice-only financial planning

By Jon Luskin

Many NAPFA members manage client money and provide long-term comprehensive financial planning. Investment minimums and fees based on AUM are common. Yet, the AUM model isn’t attractive to everyone who would benefit from financial planning and investment advice. In a decade of studying investing, I have met many financially literate folks—do-it-yourself (DIY) investors—who seek advice-only planning.

“Advice-only financial planning is when clients don’t have the obligation, expectation, or even the option to have their investments managed,” says Cody Garrett, an advice-only financial planner.1 DIYers want control over the implementation of their financial plan. Under the right circumstances, I believe this is the proper choice.

Since August 2021, I have developed 200-plus advice-only relationships helping DIYers achieve their goals. Based on many conversations, I’ve found that financially literate people generally seek advice-only financial planning because at least one of the following applies to them. They:

- Enjoy managing investments themselves

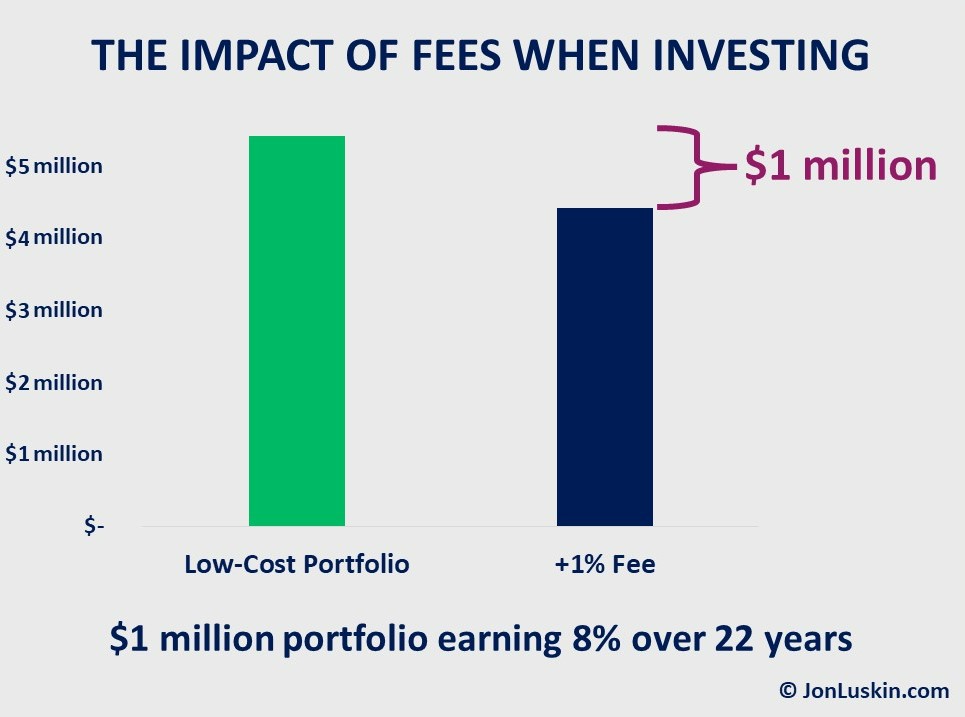

- Understand the impact of costs and therefore don’t wish to pay for asset management

- Don’t trust any asset manager enough to hand over their life savings

- Have had bad experiences with asset managers

The advice-only financial planning model lets DIY investors cost-effectively engage financial professionals, paying for the knowledge of a professional but not that professional’s ability to place trade orders. With this approach, clients save a small fortune over their lifetimes—given the compounding impact of fees on portfolio investment returns. Advice-only planning also frees planners from the mundane and unrewarding tasks of portfolio implementation and maintenance.

Working with DIY investors

The profile of a DIY investor seeking advice-only financial planning varies. Some first-time investors wish to learn how to invest windfall income (selling a business, receiving an inheritance, etc.). Seasoned DIYers typically want support applying their low-cost approach. There are also future DIYers—those firing asset managers—seeking help transitioning to self-management.

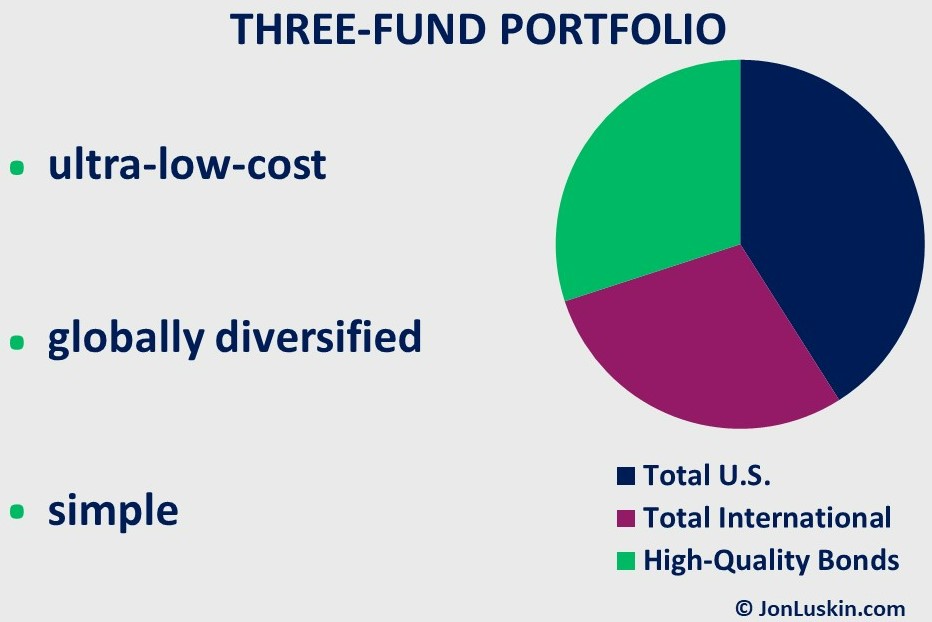

Advice-only planners provide simple model portfolios—typically a handful of low-cost index funds—that DIYers can manage themselves. For maximum simplicity, a single-fund solution (such as a balanced fund) also works. For those not interested in managing their money, advice-only planners can review low-cost options for professional portfolio management.

Most conversations around investing are straightforward. (Investing is simple when using a handful of low-cost index funds or a single balanced fund.) However, there are notable exceptions, like unwinding legacy positions with unrealized gains in taxable accounts.

Financial planning is complicated

DIYers understand that financial planning is more complicated than investing. Many families approach financial planners seeking not just a second opinion on their investment portfolios, but also answers to more difficult questions around retirement and taxes.

When working with DIY investors, advisors should expect to spend more time on financial planning topics than on investing. Advice-only planners need to cover areas that many DIYers miss, such as umbrella insurance coverage and estate planning. Those are critical elements of any financial plan that even the most perfect asset allocation cannot solve.

The economics of an advice-only financial planning firm

Fortunately for advice-only planners, “no AUM” doesn’t equate to “no income.” Advice-only planners can earn six figures in revenue—and keep most of it. Based on my experience, charging $200 per hour is more than feasible. Moreover, by shunning portfolio management and performance reporting software, office staff to field ad hoc portfolio distribution requests, and even office space, advice-only planners keep more of their revenue.

Advice-only financial planning models vary. Some advisors charge hourly for advice as needed; others charge a recurring retainer for ongoing advice (see “Making your fixed-fee model acceptable to your state regulator” in the Dec. 2020 NAPFA Advisor). For example, I charge a one-time, flat fee ($1,725) for the initial engagement, then hourly ($350 per hour) if a family needs further help. According to a survey by Michael Kitces, hourly rates range from $100 to $750 per hour, with one-time engagement fees from $250 to $12,000.2 While Kitces’s data isn’t specific to advice-only planners, among my peers, I’ve seen advice-only fees in the middle of that broad range.

For those not charging an ongoing subscription fee, the need to find clients persists. Fortunately, many cost-conscious DIYers prefer not to commit to ongoing fees. That means planners charging one-time fees will always have business.

The need to move beyond fee-only

Years ago, when I first learned the differences between commission-based and fee-only financial planning models, I knew I’d never want to do commission sales. I also looked at how I wanted to spend my time. For me, the sales process was less attractive than solving challenging financial problems.

Yet, I quickly discovered that even the fee-only model had its challenges when billing on AUM. One problem I noticed was that fee-only firms were using portfolios that were more complex than necessary. As advice-only advisor Rick Ferri says, “Complexity is job security.”3

Having written my master’s thesis on institutional asset management, I know that cost—not complexity—is critical to investing success.4 Yet some firms haven’t gotten the memo (or don’t care). The result can be arbitrary stock picks at one firm or using exotic, high-fee alternative assets as a marketing tool at another—instead of educating prospective clients about the importance of managing investing costs.

Of course, that’s not the case with every firm billing on AUM. But problematic portfolio design does happen, given the conflict of interest when firms try to justify AUM fees, striving to deliver investment outperformance rather than financial planning value.

An incentive for compromised portfolio design isn’t the only problem with the fee-only model. Another issue I’ve seen is a lack of incentive to pursue strategies that compromise firm revenue when billing on AUM. The conflicts of interest show up when advising on pension annuitization (versus taking an IRA rollover for more AUM dollars), investing in anything not AUM billable (Series I savings bonds, rental real estate, etc.), and more.

Of course, there will always be a need for professional asset management for those who aren’t DIY investors. Fortunately, unbundling investment management from financial planning can make sense, helping to avoid the problems discussed above. Alternatively, flat-fee billing (as opposed to AUM) is another promising approach as a fair, transparent way to bill.5

New planners should consider the advice-only model

As an advice-only advisor, I enjoy being the technical resource for the families I serve. Working with motivated, financially literate DIY clients is emotionally and intellectually rewarding because those clients are heavily invested in their financial success. It feels better to work with someone who’s excited and interested in financial planning.

Advice-only isn’t the best model for planners who thrive on implementing a financial plan. Instead, it’s ideal for those who enjoy teaching financial planning to inquisitive learners. If you like financial planning subject matter, know that’s what advice-only planners spend more time on: talking about financial planning, rather than executing it on behalf of someone else.

Knowing what I know now, I’d have taken this path from day one, and I encourage financial planners starting out to consider the advice-only route. The number of people who decide to manage their investments themselves will continue to grow, and so will the need for advice-only financial planners.

Jon Luskin is a fee-only, advice-only CERTIFIED FINANCIAL PLANNER™ professional in San Diego, CA. He specializes in providing hourly advice for do-it-yourself investors. Jon enjoys being a “financial planning nerd,” helping families be responsible for their own implementation.

1. Michael Kitces, “Using The Advice-Only Financial Planning Model To Build A Sustainable Advisory Firm.” Nerd’s Eye View (blog). December 20, 2021.

2. Michael Kitces, “How Financial Planners Actually Do Financial Planning (2020).” Nerd’s Eye View. 2020. March 14, 2022.

3. Rick Ferri, “Your Investment Adviser’s Dirty Secret,” COLIN COUNTY Living Well Magazine, March/April 2020.

4. Jon Luskin, “Testing Swensen: Measuring the Value Added by Alternative Assets within the Investment Pools of Non-profit Organizations,” JonLuskin.com (blog), 2013.

5. Michael Kitces, “The Salience of Financial Planning Fees – It’s Not Just About How Much You Charge, But How You Charge.” Nerd’s Eye View (blog). June 7, 2012.

image credit: istock.com/fizkes