TAXES

Optimizing your self-employed business clients’ Social Security benefits while minimizing their tax liability

By Martha Shedden

As fee-only financial professionals, you are perfectly positioned to offer your self-employed business owner clients in their 50s a Social Security analysis that can help them identify the optimal strategy to balance their remaining years of earnings, payroll taxes paid, and Social Security benefits received.

Many in this group already have the 35 years of earnings used in the Social Security benefit calculation, but they plan to continue working into their 60s. And if their business has been very successful, they have probably been paying themselves a high wage. They may not realize that this can result in high payroll taxes for the remaining years with very little, if any, increase in their Social Security benefit. It doesn’t have to be this way—and you can show your clients a solution.

Why this type of planning can be helpful

Self-employed business owners have a unique opportunity to control their income, their payroll taxes as the employer and an employee, and their future Social Security benefits. This type of evaluation is possible for all business structures, but is particularly helpful for those set up as S corporations. The S-corp structure provides owners with more control over their income and taxes because owners can be company employees and have access to company disbursements.

Owner-employees must pay themselves a reasonable salary for their work, which is subject to income taxes and Social Security and Medicare payroll taxes. These owners can also receive distributions from corporate profits, which are subject to income taxes but not to Social Security and Medicare payroll taxes. Given that the 2023 tax rate is 15.3% for up to $160,200 of net self-employment income (and then drops significantly as the 12.4% Social Security tax doesn’t go beyond that threshold), adjusting a salary can create major savings.

Your 55-year-old client’s business may be able to pay them a $300,000 annual salary, but how much should they take in salary for the next five to 10 years? How much would those payroll taxes add up to? What is “reasonable compensation” for their role and level of responsibility in the company? With the guidance of a tax professional, can they afford to collect a lower “reasonable” salary?

For many small business owners with control over their income, it can be eye-opening to complete a Social Security analysis that includes this type of tax calculation. The analysis should include the evaluation of multiple future earning scenarios for individuals and couples, if applicable, and demonstrate future lifetime estimates of Social Security benefits for each scenario.

The results will show future payroll taxes paid versus lifetime Social Security benefits received for each scenario and the net lifetime financial impact.

One couple’s case

Let’s look at Sally and Steve Smith, who are both dentists and are both currently 62 years old. Together, they are the sole owners of a dentistry practice that is an S corporation. Sally and Steve each take a $140,000 annual salary. Although they plan to work through 2027, the year they turn full retirement age at 67, they do not plan to start collecting Social Security until age 70. They are interested in an analysis of other Social Security-based income and tax strategies, as well as the possibility of retiring sooner.

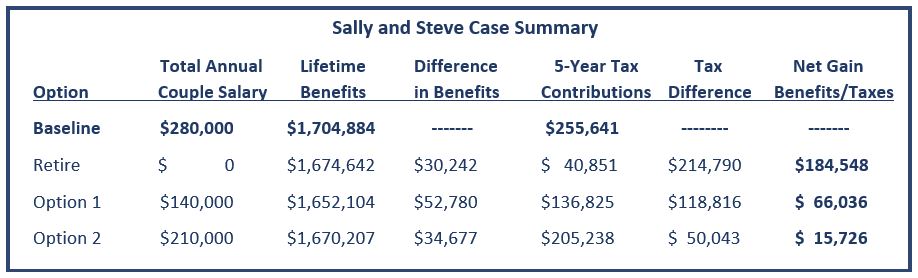

The baseline is for the Smiths to continue collecting $140,000 salaries for five more years. The three alternative options include retiring at the end of the year or taking salaries that are 50% or 75% of the current amounts.

Does it make sense for the Smiths to pay themselves only $70,000 or $120,000 in salary instead of $140,000 for the next five years? The key to this analysis is determining what “reasonable compensation” makes sense.

Running through the three scenarios (see “Sally and Steve Case Summary” below), the analysis shows that if they reduced their combined annual income by 50% to $140,000, it would reduce their combined Social Security benefits by $52,780 over their lifetimes (assuming they begin collecting at age 70 and live to be age 90), but it would save them $118,816 in Social Security and Medicare tax contributions over the next five years. This is a net gain of $66,036.

You can develop this analysis yourself, if you have the right expertise and software. Or you can consult with a tax professional and a Social Security expert. Either way, offering this kind of Social Security expertise can help your current clients and lead to new referrals.

Martha Shedden, CRPC, RSSA, is president and co-founder of the National Association of Registered Security Analysts, which educates and trains financial professionals on Social Security rules and strategies to help their clients. NARSSA offers Self-Employed Tax and Retirement Analysis.

image credit: istock.com/seb_ra