PRACTICE PROFILE

A Relationship Business

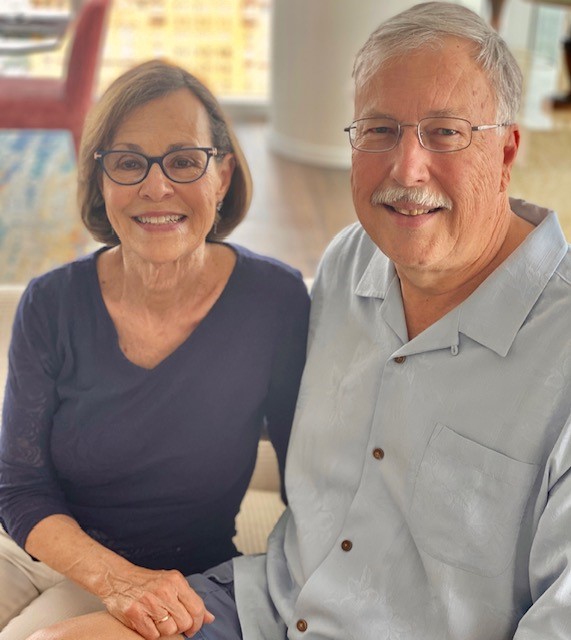

Russ and Vicki Schultz of Schultz Financial Group

By Kevin Adler

Speaking by phone during a drive from their home in Reno, NV, to the San Francisco area this spring, Vicki and Russ Schultz were on a typical trip that combined pleasure with business. They lined up meetings with two clients of Schultz Financial Group and two investment managers during the weeklong excursion.

Vicki, joined by two other wealth managers, did the same thing on their way to NAPFA’s spring conference in San Diego in May. “We stopped off to see seven clients and a CPA in Orange County [California] and then continued to San Diego,” says Vicki, who focuses her time on high-net-worth client relationships and mentoring younger wealth managers. “Seeing clients in person after three years was special.”

“We care about our clients, and we spend a lot of time with them. You learn that it’s not just about the money. Family issues, health issues, careers, and more play into the success of their financial plan,” she adds.

“It’s all about personal relationships,” says Russ, who is the CEO and chief investment officer.

Those personal relationships span about 100 client families today, for which Schultz Financial manages about $233 million. About 40% of its clients are in California, where Schultz Financial started; 40% in Nevada, where it moved in 1993; and the rest elsewhere.

Starting Out

Russ started the firm in 1982 in Newport Beach, CA, having grown disillusioned with work at a regional brokerage firm. He decided to work like an attorney or CPA, charging an hourly fee. “I had no idea that anyone else was doing it,” he says.

Fortunately for him, he met other Fee-Only pioneers just as NAPFA was getting started. Soon, he and Vicki were playing key roles in the group’s early growth (see “NAPFA: Collaboration of Independent Thinkers” below).

Vicki took a more circuitous path. She was an elementary school teacher for a few years, then, while her children were young, handled payroll part time for a friend’s business and did a lot of volunteering. “When the kids went to school, I decided to get an MBA,” she says. “It took me four years, two classes at a time at night and summers.”

With her MBA completed in 1983, she looked for financial services work but was not attracted to the cold calling demanded by insurance companies and brokerages. Almost ready to accept a job with a bank, Vicki saw a small ad in the newspaper: “Firm is looking for a financial analyst, call Russ.”

Pleased that she didn’t have to work up another resume and cover letter, Vicki picked up the phone. She was the first hire Russ and his partner made. “This was great—somebody who wanted me to analyze, do financial plans, and not sell. I just jumped in,” Vicki says.

The World of the 8.5% Commission

The early 1980s was a time of change in consumer financial services. Old habits were being challenged, but new models had not yet gained a foothold. Education of clients was the first step. “Clients thought load funds were better than no-loads,” Russ says.

Commissions to buy a mutual fund at the time through a broker were 8.5%, and the Schultzes would explain to a prospective client that the $10,000 check they wrote left them only $9,150 invested. “It’s amazing how different the reaction is when they see the dollars instead of the percentage,” Russ says.

At first, the firm worked with almost any prospect, and clients’ questions were typical of a family with rising income and emerging needs such as children’s college education and saving for retirement. Many of them were entrepreneurs, surgeons, and others whose incomes would rise considerably during their careers. This led Russ to develop a message he shares with all clients that “your biggest asset in your early years is your human capital, your earning potential.”

At the same time, the Schultzes encouraged clients to think about what they would do when they reach their financial goals. This evolved into their Four Capitals approach: financial matters, physical well-being, intellectual engagement, and psychological space. To cite a couple of examples of how the elements work together, Vicki says that good health is necessary to enjoy one’s wealth, and the firm has found that hard-driving, Type A clients are most satisfied in retirement if they continue to use their expertise in meaningful ways.

When it comes to health advice, the Schultzes often bring in their daughter, who consults for them part time. Nicole Schultz Ninteau has a Ph.D. in biochemical and molecular nutrition.

Over the years, enough clients achieved major financial success that Schultz Financial has evolved into a high-net-worth advisory firm. For accredited investors and for those who have more than $5 million in investable assets and thus are eligible for private placements, real estate has been a big focus. The firm hires managers it believes can execute in a specific area, such as multifamily housing, office, industrial, retail, student housing, or medical. It also finds investments in private credit and venture capital debt, as well as in private equity.

“Russ’s due diligence process is very thorough,” says Vicki, who often accompanies him on office and site visits, as well as casual dinners with managers and spouses. “It takes quite a while before we take on a new manager.”

Post-Covid-19, Pre-Succession

While road trips to clients and investment managers are still the Schultzes’ forte, two factors have emerged in the last few years that have set changes in motion for the company.

The first is Covid-19. Vicki says that clients have adapted well to using Zoom and Teams as alternatives to some in-person meetings. “Connections are important, even if it’s on a screen,” she says.

With the team working from home during the pandemic, the firm accelerated its five-year plan to automate as many of its processes as possible, and it completed the task in two years. “Any administrative function done by human labor is now being done by software,” Russ says.

The other recent development is that the Schultzes have started to implement a succession plan that will enable current and future team members to buy into the firm. FP Transitions valued the firm and helped set up the internal succession structure. Chief Operating Officer and Chief Compliance Officer Jennifer Spector, MA, and Wealth Manager Alyssa Dalbey, CPWA®, CFP®, have started the process.

The succession plan is expected to maintain continuity for clients, which has been a hallmark of Schultz Financial Group for 40 years. Several times over the decades, assets have transitioned from firm clients to heirs, and the heirs have stayed with Schultz Financial.

Collaboration of Independent ThinkersRuss Schultz has the perfect phrase to describe what NAPFA was in the early years and remains to this day. “It was a collaboration of independent thinkers. That’s what made NAPFA,” Russ says. Those Fee-Only trailblazers shared every scrap of information they could come up with that would help their clients and create a new, fiduciary model of service. Russ and Vicki Schultz were in the middle of the action, serving on the national board and West Region board and chairing conferences. “We hosted West Region meetings in our living room!” Vicki Schultz laughs. “It was so important to have like-minded people you could talk to. We were all just trying to figure it out—there was no right way,” Vicki says. “You could call somebody and say I have this case, and this is what we think we will do. What would you do?” Support from fellow NAPFA members took many forms, Russ adds, from how to solve a client’s problem, to practice management, to encouragement that they were on the right track. “These people were our friends and colleagues. They made sure we didn’t stop what we were doing,” he says. |

Schultz Financial Group

Location: Reno, NV

Website: sfginc.com

Year founded: 1982

Number of staff: 6

Number of clients: 100

Total assets under management: $233 million

Typical clients: 50 to 70 years old and looking for retirement planning and investing expertise to get to their goals. “Our clients have aged along with us, and we have started working with the next generation, which is a great transition for our young wealth managers.”

Typical client needs: In addition to financial planning, older and wealthier clients seek advice on estate planning, gifting, and charitable planning.

Typical investments: Portfolios are balanced to meet each client’s financial picture, goals, and risk tolerance. The firm invests in actively managed mutual funds and private investments. If clients meet the requirements, they can invest in private real estate, private credit, and private equity.

Piece of advice to fellow NAPFA members: “Keep working to help consumers understand the need for objective advice and continue to work with regulatory bodies to help in that regard. It has been our goal for 40 years.”