|

|

| Archive | Subscribe | www.agc.org | January 2013 |

A Fleet Management Strategy Will Help the Bottom Line

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

Better Fuel Efficiency, Lower Interest Rates & Higher Resale Market Drive Need for Long-Term Fleet Management Strategy

By Kevin J. Kelley, Enterprise Fleet Management

Any business with a fleet of vehicles knows there are six major cost elements: depreciation, interest, fuel, maintenance, risk management and taxes. Not surprisingly, the ever-increasing cost of fuel is beginning to rival some of those cost elements, including depreciation, and less fuel-efficient older vehicles are the least cost-effective.

The good news is that there has never been a better time to begin to manage fuel expenses. Not only are 2013 model year vehicles designed for maximum fuel efficiency, but record low interest rates and an unusually high resale market for used vehicles present an exceptional opportunity for businesses with medium-size fleets to take advantage of the opportunity to lower expenses.

But, without a long-term fleet management strategy, getting the most value could still be a challenge. A long-term strategy can help project financial targets for three, four and five-years down the road on everything from acquiring and disposing of vehicles to managing maintenance, risk management, warranties, and mileage, as well as the potential wear and tear a business will inflict on each of its vehicles.

A good place to start is to work with a professional fleet management company that has access to a wide range of makes and models of cars, light- and medium-duty trucks and service vehicles and has the ability and experience to identify the right vehicles and available options to meet the individual needs of a particular business. In addition, they may have the ability to forecast and analyze long-term cost structures to help the business hit specific financial targets.

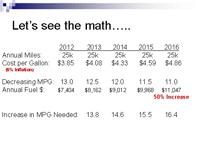

Because a fleet of vehicles can represent a major cost, requiring a considerable amount of money up front and demanding a continuing amount of money, time and resources to manage, businesses that have a long-term strategy will do well. Fuel is a good example. Combined with inflation, reduced fuel efficiency could lead to as much as a 50 percent increase in annual fuel costs within the next three to four years. This means that for a business just to maintain its current fuel budget it could ultimately be necessary to get the equivalent of 16 mpg from a vehicle that currently gets 13 mpg.

Today’s fuel reality is a growing concern for businesses that own and operate fleets of vehicles. Not only can owning and operating a fleet of vehicles efficiently and cost-effectively translate to better customer service, it can lead to a more profitable bottom line and more satisfied employees. The combination of new increasing regulations on vehicle manufacturers to improve fuel economy and steadily escalating fuel prices makes it imperative for businesses to begin now to better manage fuel costs for their fleet of vehicles.

Kevin J. Kelley is assistant vice president, business development & manufacturer relations for Enterprise Fleet Management, a full-service fleet management business for companies with medium-size fleets. Enterprise supplies most makes and models of cars, light- and medium-duty trucks and service vehicles across North America. For more information about Enterprise Fleet Management’s environmental stewardship and long-term commitment to the sustainability of the fleet management business, visit http://drivingfutures.com/fleetmanagement/. For more information about Enterprise Fleet Management, visit www.efleets.com or call toll free 1-877-23-FLEET.

2300 Wilson Blvd, Suite 300

Arlington, VA, USA

Ph: 703-548-3118 Fax: 703-837-5402