Marginal Production Increase Possible for German Paper Industry in 2015

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

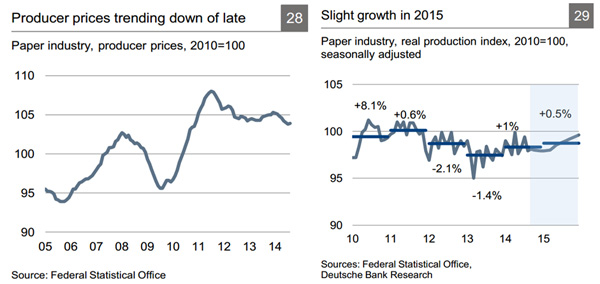

According to a recent report released by Deutsche Bank Research, Frankfurt, Germany, German paper industry production was trending slightly upwards at last reading, even though the sector registered lots of ups and downs at the monthly level. On average, final production numbers are expected to pick up by about 1% in real terms in 2014, with papermaking, which currently generates nearly 46% of total sector revenues, set to perform somewhat better than paper processing (54% of revenues).

Within the paper processing segment, household goods and hygiene articles are benefiting from the robust consumer climate and reporting above-average growth for 2014. The production of corrugated paperboard and paper, the biggest segment in paper processing by far, has been hit during the past few months by the noticeable weakening of industrial activity. Output here could fall slightly in 2014. Corrugated paperboard is the most important material for transport packaging in industry.

Paper industry orders have (still) not shown any visible downtrend over the past few months. However, the industry's business expectations have recently fallen into negative territory. This is likely attributable not only to the higher geopolitical risks but also to the darkened prospects for many user industries. Producer prices in the sector have also been trending more to the downside for several months—a sign of lacking business stimuli. In this respect, Deutsche Bank now forecasts domestic production to trend sideways at best during the next two quarters.

From Q2 2015, production could start to pick up again, the report notes. In sum, however, the full year 2015 will probably only see production increase by about 0.5%, it adds. Household related segments could again score somewhat better than industry-related segments, considering the satisfactory development of private consumption.

Corrugated paperboard production is likely to begin 2015 with a statistical underhang, which will weigh on the full-year result despite Deutsche Bank’s assumption of a recovery during the year.