Paper Products: Internet Threat Conquered?

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

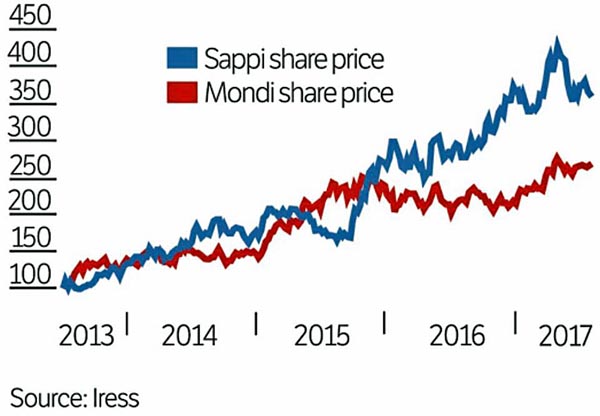

According to an article this past week by Business Live (New Zealand), Sappi has steadily clawed its way back to growth since early 2014 after being found wanting in the aftermath of the global financial crisis. Coupled with multiple crises across the global advertising and publishing industries caused by the Internet, the company found itself holding expensive, first-class assets in declining world markets for fine coated paper.

The path downhill was a steep one, with the stock plunging from around R120/share in mid-2008 to somewhere close to R15 in early 2009. Since then the share battled to reach R40 until a growth spurt brought on by a strategic change in direction began in early 2014. The stock was pushed to above R100 in early 2017 and has now settled at around R90.

South Africa’s rival global packaging, paper, and pulp producer, Mondi, rode a charmed upward trajectory despite the collapse in world financial markets. From early 2009 its share price rose steadily and almost without respite, from about R25/share to around R350 now.

Mondi’s average return on capital employed has been nothing short of stellar. This started years before it was spun off from Anglo American and listed in mid-2007, though it has come off a little of late.

Presiding over this northward climb has been former CEO David Hathorn (photo right). Mondi had started investing heavily in world-class plant and facilities as a part of Anglo American, mainly in Central Europe, giving it a marked advantage in terms of production costs and pricing in global markets.

Presiding over this northward climb has been former CEO David Hathorn (photo right). Mondi had started investing heavily in world-class plant and facilities as a part of Anglo American, mainly in Central Europe, giving it a marked advantage in terms of production costs and pricing in global markets.Mondi had also set its sights firmly on packaging products, eschewing traditional office paper markets as the Internet took its toll on printing. The company remains a provider of A4 and many other uncoated fine paper types, but has acquired a vast range of speciality and other packaging assets in 100 production sites across more than 30 countries. Key group operations are in Central Europe, Russia, North America, and South Africa.

When world stock markets were bucking and ripping, Sappi started converting some of its paper mills to produce dissolved wood pulp, also known as chemical cellulose. It is now the world’s largest manufacturer and seller of this high-margin product, widely used in making textiles and clothing. Chemical cellulose has delivered 50% of Sappi’s profits in recent years.

In the interim the company has, like Mondi, also turned to speciality packaging, seeing this as a much bigger part of future output. It is converting some of its graphic paper mills in Maastricht in the Netherlands and in Maine in the U.S. to produce such products. Capex of $78 million in the third quarter to June 2017 is related mainly to these paper machine conversion projects and also to de-bottlenecking chemical cellulose production at its Ngodwana and Saiccor mills in South Africa.

"Part of our longer-term strategy is to reduce exposure to high-end graphic paper," CEO Steve Binnie said. That means the existing profitability ratio of 35% output of coated paper and 15% speciality packaging production will be closer to a ratio of 25% each by 2020.

Binnie said the benefits of such conversions will become apparent in 2018. Speciality packaging margins are twice those of graphic paper, he said — at around 14%. Growth in world speciality packaging markets is between 2% and 3%/year, while markets for graphic paper are declining at this rate.

Meanwhile, markets for chemical cellulose are predicted to grow at about 5%/year. Sappi supplies about 20% of the global market — much of this to China, India, and Indonesia. The product is also widely used in cigarette filters, cellophane, pharmaceuticals, and foodstuffs.

Mondi’s Hathorn relinquished the reins of the group in May 2017, passing the mantle to Peter Oswald, who is based in Vienna. Oswald, former CEO of the group’s Europe and international division, has been on the boards of dual-listed Mondi Ltd and Mondi Plc since December 2007. He says he is frequently in Johannesburg and will continue to maintain high levels of capital expenditure in plant and machinery and to invest in acquisitions. This has enabled the group to become energy self-sufficient while it expands a portfolio of world-class assets that are based mostly in fast-growing developing markets that also sell into global value chains.

Oswald says investors in Mondi appreciate its competitive business model and the focus on value. He says the group generates a lot of cash, with about 75% of overall revenue coming from packaging operations, which deliver around 70% of profits.

Sappi, meanwhile, has reduced net debt to below twice earnings before interest, tax, depreciation, and amortisation, having nearly halved debt during the past four years to $1.3 billion.

"I think the firm is very comfortable with regard to its balance sheet position at the moment," said Wade Napier, diversified resources analyst at Avior Capital Markets.