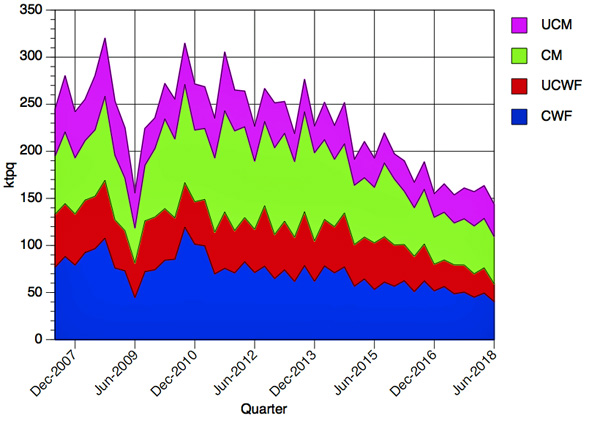

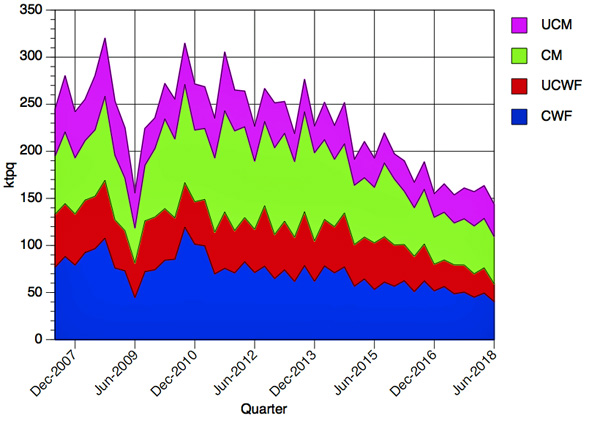

Australian P&W Paper Imports Plummet 43% Since 2010-2011

The 43% decline from peak year 2010-2011 to date cited at the time of this month's (Sept. 7, 2018) reporting by Print21 (Sydney, Australia) is to be somewhat offset by increased share of paper from Australian Paper’s local mills even as overall demand continues to track south.

According to the 27th annual edition of IndustryEdge’s Pulp & Paper Strategic Review, cited by Print 21's report, P&W, communication papers, office copy paper, etc. type document papers are under constant pressure for falling demand globally and domestically a now depreciated Australian dollar along with corresponding sharp rises in global pulp prices.

Past year imports fell by 5.5% compared to the year before. Since peaking at 1.090 million metric tpy in 2010-2011, imported printing paper has dropped to 621,000 metric tpy. At the peak level, imports accounted for close to 80% of total consumption of P&W grades intended for communication instead of packaging, other than newsprint... In 2017 in Australia, they accounted for less than 63%.

The figures and graphic (pictured above) are taken from the Review, which is described by the report as a regional comprehensive analysis of Australia and New Zealand’s pulp, paper, paper products, and related industries. The Pulp & Paper Strategic Review is described as a long-form report / special analysis that combines market detail with expert insight to provide a valuable and reliable business tool. For those interested in contacting the publisher for purchase (IndustryEdge), it will be officially available in the first week of Oct., 2018.

TAPPI

http://www.tappi.org/