|

|

Weekly Spotlight

In a much-awaited ruling on a cross-border environmental dispute, the International Court of Justice in The Hague has ruled overwhelmingly in Uruguay's favor in a case brought by neighboring Argentina, which had attempted to force the closing and dismantling of the UPM Fray Bentos pulp mill on the Uruguay River, whose course forms part of the border between the two nations.

Learn More...

|

Market Roundup

U.S. paper and paperboard capacity declined 2.5% in 2009 to 93.9 million tons, according to the AF&PA (Washington, D.C., USA) Fiftieth Annual Survey of Paper, Paperboard, and Pulp Capacity

Learn More...

|

Total fiber consumption by U.S. paper mills (including wood pulp, recovered paper, and non-wood fibers) declined 10.5% in 2009 to 80.0 million tons, reflecting the 10.2% reduction in paper and paperboard production.

Learn More...

|

According to the American Forest & Paper Association's (AF&PA) latest Kraft Paper Sector Report released this past week, total Kraft paper shipments in March were 137,700 tons.

Learn More...

|

Total U.S. printing and writing (P&W) paper shipments increased 12% in March compared with March 2009.

Learn More...

|

The global pulp market continues to be tight, Mark Wilde, senior analyst with Deutsche Bank, reports.

Learn More...

|

In the newsprint sector, all major North American producers have announced a $50/metric ton price increase, to be implemented in two installments of $25/metric ton each on May 1 and June 1.

Learn More...

|

The market direction for North American coated groundwood grades appears to be turning, aided by better volume comparison and supply cuts.

Learn More...

|

As with LWC, the tenor of the coated free sheet market is also improving.

Learn More...

|

Wood fiber costs rose in the U.S. South and in the Lake States during the first quarter because of improved pulp markets and a tight wood fiber supply.

Learn More...

|

Pulp & Paper

Asia Paper Resources International Limited (APRIL), Indonesia, this past week reportedly had its FSC (Forest Stewardship Council) controlled wood certification suspended.

Learn More...

|

Fraser Papers Inc., Toronto, Ont., Canada, together with its subsidiary, FPS Canada Inc., reports that it has obtained final approval from the Ontario Superior Court of Justice to complete the sale of its NBHK pulp mill at Thurso, Qué., Canada, to Fortress Specialty Cellulose Inc. of North Vancouver, B.C., Canada.

Learn More...

|

Georgia-Pacific, Atlanta, Ga., USA, this week reported that it has received approval from the Canadian Minister of Industry for the acquisition of Grant Forest Products' Englehart, Ont., Canada, oriented strand board (OSB) facility and associated operations at Earlton, Ont.

Learn More...

|

Sinar Mas, Indonesia, will buy the idled Pope & Talbot pulp mill in Mackenzie, B.C., Canada, with plans to export production to Asian markets by this fall.

Learn More...

|

Sonoco-Alcore S.a.r.l., Brussels, Belgium, plans to invest $4 million in its uncoated recycled paperboard (URB) mills in Italy and Greece to improve product range, energy efficiency, and overall cost competitiveness.

Learn More...

|

Suzano Pulp and Paper, São Paulo, Brazil, reports that it will plant more than 145 million eucalyptus seedlings throughout 2010 to develop its forestry base.

Learn More...

|

Union members from the Swedish paper industry have called a strike at six paper mills following a dispute over wage bargaining.

Learn More...

|

Verso Paper Corp., Memphis, Tenn., USA, was honored as the 2009 Southeast Regional Green Business Innovator of the Year in a ceremony this past week at the Green Business Summit hosted by Lipscomb University in Nashville, Tenn.

Learn More...

|

Weyerhaeuser Co., Federal Way, Wash., USA, this week reported it has received shareholder approval to issue a significant number of shares to enable the payout of its Earnings and Profits to shareholders in conjunction with its conversion to a Real Estate Investment Trust (REIT).

Learn More...

|

Containerboard/Packaging

For the fifth straight month, U.S. containerboard paper production has risen sharply compared with last year.

Learn More...

|

Mark Wilde, senior analyst with Deutsche Bank, notes that March U.S. containerboard and box numbers show that industry volumes continue to make a cyclical recovery.

Learn More...

|

U.S. Containerboard Inventories fell again in March, according to Wilde, though not by as much as they usually do.

Learn More...

|

U.S. containerboard operating rates eased slightly m/m, but this likely reflected fiber supply issues rather than any decline in demand.

Learn More...

|

Total U.S. boxboard production rose by 64,000 tons, or 6.0%, compared with March 2009.

Learn More...

|

Average basis weights of corrugated are now 20% lighter in Europe than in the U.S., according to a new study.

Learn More...

|

Reynolds Group Holdings, Auckland, New Zealand, this past week announced its intention to acquire the Evergreen Packaging group of companies and the Whakatane Mill from Carter Holt Harvey.

Learn More...

|

In anticipation of Confirmation Hearings that commenced April 15, Smurfit-Stone, Chicago, Ill., USA, announced this past week, through pleadings filed in the U.S. Bankruptcy Court, the voting results with respect to the plan of reorganization filed in the U.S. Chapter 11 proceedings and the CCAA proceedings in Canada.

Learn More...

|

On Wednesday, April 6 and Thursday, April 7, Walmart held its Fifth Annual Sustainable Packaging Expo in Bentonville, Ark., USA.

Learn More...

|

|

New Products

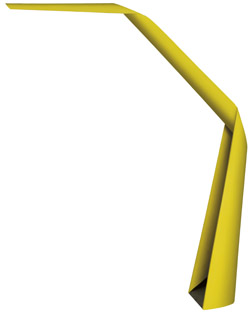

The Swedish lighting company Wästberg has launched a lighting fixture made with DuraPulp, developed in close collaboration with Södra and Swedish architects and designers Claesson Koivisto Rune.

Learn More...

|

Published Pricing

Botnia, Finland, reports that it will increase pulp prices in Europe as of May 1, until further notice.

Learn More...

|

Travels with Larry

Recyclable, corrugated coolers from E-cooler LLC make an earth-friendly entrance into the sustainable packaging market.

Learn More...

|

TAPPI News

TAPPI to partner with Pira International for the Specialty Papers Conference, November 10-11, in Chicago.

Learn More...

|

TAPPI Lean Manufacturing - Flexo & Die Cutters – Course is May 25-27 in Norcross,Ga.

Learn More...

|

Entry deadline for finest commercially produced corrugated packaging is August 27.

Learn More...

|

Division Technical Award and Leadership & Service Award nominees are requested.

Learn More...

|

Unique event to focus on practical ways for converting a broad range of biomass resources to renewable energy.

Learn More...

|

The TAPPI International Conference on Nanotechnology for the Forest Products Industry solicits program info for 2010.

Learn More...

|

|

Find us on Facebook Find us on Facebook

Network with us on LinkedIn Network with us on LinkedIn

Follow us on Twitter Follow us on Twitter

|

Weekly Spotlight

In a much-awaited ruling on a cross-border environmental dispute, the International Court of Justice in The Hague has ruled overwhelmingly in Uruguay's favor in a case brought by neighboring Argentina, which had attempted to force the closing and dismantling of the UPM Fray Bentos pulp mill on the Uruguay River, whose course forms part of the border between the two nations. The ruling by 14 judges from around the world expressly upheld Uruguay's right to continue operating the plant, finding that Argentina failed to prove that it discharged pollutants harmful to the river or its surroundings, or to the local flora and fauna.

The US $1.2 billion mill is the largest foreign investment in Uruguay's history. In December 2009, the Finnish paper, pulp, and forestry companies UPM, Metsäliitto Cooperative, M-real Corp., and Oy Metsä-Botnia Ab (Botnia) completed a transaction whereby the Fray Bentos mill and the eucalyptus plantation forestry company Forestal Oriental in Uruguay were transferred to UPM. As a result, UPM has a 91% ownership in the Fray Bentos mill, 100% in Forestal Oriental, and approximately 17% in Botnia.

Argentina brought the case to the ICJ, otherwise known as the World Court, in 2006. The two sides presented their final arguments last September. The case was only the second environmental dispute to be heard at the ICJ, and the first since the 1990s. The Court's ruling was eagerly awaited by governments, international organizations, investors, and environmental groups around the world. Uruguay was successfully represented by Foley Hoag LLP, led by Washington, DC-based partner and international law specialist Paul Reichler, who practices frequently before the ICJ.

The Court's judgment vindicated Uruguay's assurances that, based on a comprehensive Environmental Impact Analysis and strict monitoring of the plant's discharges, it was environmentally sound in all respects with no risk of harm to the river or its surroundings. The Court also relied on independent monitoring reports prepared by experts from the World Bank's International Finance Corp., which confirmed the clean operation of the plant, and the absence of any environmental harm. Uruguay prides itself on its commitment to environmental protection, and considered the mill a model of "sustainable development" which produced significant economic benefits to the country without threatening the local ecology.

Reichler, Uruguay's lead counsel, called the ruling a landmark decision confirming that "it is possible for a country to achieve its goal of sustainable economic development without compromising environmental protection. The Court performed a major service to the international community by setting the standards for determining when an industrial project may be considered free of risk to the environment."

The Court found that, although Uruguay gave Argentina advance notice of its intention to authorize construction of the plant and an opportunity to consult about its environmental impact, it did not do so in the precise manner prescribed in a bilateral treaty between the two States. However, the Court rejected Argentina's claim that a technical procedural infraction of this nature justified shutting down a plant that caused no environmental harm.

Back To Top

|

Market Roundup

U.S. paper and paperboard capacity declined 2.5% in 2009 to 93.9 million tons, according to the AF&PA (Washington, D.C., USA) Fiftieth Annual Survey of Paper, Paperboard, and Pulp Capacity. The decline took place against a backdrop of a severe global economic recession. Paper and paperboard production is rebounding from the recession-induced lows reached in early 2009, AF&PA reports.

The Survey also reported that 14 U.S. mills were permanently closed in 2009, shutting down 16 paper and paperboard machines, and an additional 11 machines were permanently shutdown at other mills. Furthermore, several mills and machines have been indefinitely idled in response to weak market conditions, but have not been removed from the Survey base because they may be restarted at some future date.

According to data reported to the Survey, total paper and paperboard capacity is expected to decline 3.4% this year, and then remain essentially stable in 2011 and 2012. The Survey reports U.S. industry capacity data for the years 2009 through 2012 for all major grades of paper, paperboard, and pulp, based on a comprehensive survey of all U.S. pulp and paper mills. Survey respondents represent about 90% of the U.S. industry capacity. The complete Survey with detailed tables can be purchased by contacting Michelle Gaskins at AF&PA (202-463-5162).

Back To Top

|

Total fiber consumption by U.S. paper mills (including wood pulp, recovered paper, and non-wood fibers) declined 10.5% in 2009 to 80.0 million tons, reflecting the 10.2% reduction in paper and paperboard production, according to AF&PA's recently released Annual Fiber Consumption Report. Consumption of both recovered paper and wood pulp dropped at almost the same rate.

Total fiber consumption is estimated to increase at an average annual rate of 2.2% during the three-year period 2010-12 as the U.S. economy recovers from the recession. Wood pulp consumption is estimated by the Survey to increase from 50.6 million tons in 2009 to 53.3 million tons in 2012, an average annual rate of 1.7%. Recovered paper consumption is estimated to increase at an average annual rate of 3.1% during the same period. The report provides consumption of wood pulp and recovered fiber in the manufacture of paper and paperboard in the U.S. for the period 2009-2012. It also provides data on consumption of pulpwood in the manufacture of wood pulp. All of these data are based on a comprehensive Survey of the paper, paperboard and pulp mills in the U.S. For additional information or questions, contact Sundar Mahadevan (202-463-2786).

Back To Top

|

According to the American Forest & Paper Association's (AF&PA) latest Kraft Paper Sector Report released this past week, total Kraft paper shipments in March were 137,700 tons, an increase of 21.9% from February, and 32.5% compared with the same month last year. Total inventory was 4,200 tons less than January 2010.

Back To Top

|

Total U.S. printing and writing (P&W) paper shipments increased 12% in March compared with March 2009, the fifth consecutive year-ago increase and the second double-digit year-ago increase, according to the AF&PA's March 2010 Printing-Writing Paper Report released this week. All four of the major P&W grades posted increases compared with last March, and three recorded double-digit growth compared with 2009.

U.S. purchases (shipments + imports – exports) of P&W papers also increased in March, up 8% versus year-ago March. Total P&W paper inventory levels decreased slightly from February, down 1%. Some additional key findings include:

- Uncoated free sheet (UFS) shipments up versus year-ago for fourth consecutive month.

- Coated free sheet (CFS) shipment surge for fourth double-digit growth versus year-ago

- Year-ago shipments of coated mechanical (CM) "thumbs nose" at CFS shipments with bigger surge and fifth consecutive double-digit year-ago increase

- Increase of uncoated mechanical (UM) shipments passes 20% for second time in past three months.

Back To Top

|

The global pulp market continues to be tight, Mark Wilde, senior analyst with Deutsche Bank, reports. Major producers have now announced $30- $50/metric ton price increases for May across key markets. In North America, Domtar, Canfor, and Mercer International have slated NBSK at $1,000/metric ton for May, +$40/metric ton. If implemented, North American NBSK prices will be up approximately 13% from the July 2008 cyclical high and up some 57% from the May 2009 cyclical low, Wilde notes. In Europe, producers have announced a $30/metric ton May price increase. On the hardwood side, Fibria, Suzano, and Altri have announced a $50/metric ton global price increase on bleached eucalyptus kraft pulp. "While Arauco and CMPC plan to restart most of their mills by end-April/early-May, we believe the 'Chile effect' on global supply could easily stretch to six months. The recent labor strike at pulp mills in Sweden will further tighten supply (global impact = approximately 1%). With inventories expected to decline further in March, global demand still strong, North American mills taking spring maintenance downtime, and a sharp rise in North American NBSK spot prices (+$40-$45/metric ton to $850-$890/metric ton), we feel that prospects for the May hike look good," Wilde comments.

Back To Top

|

In the newsprint sector, all major North American producers have announced a $50/metric ton price increase, to be implemented in two installments of $25/metric ton each on May 1 and June 1, according to Wilde. With this, AbitibiBowater has now announced four consecutive monthly hikes totaling $100/metric ton during the first half of this year. AbitibiBowater attributes the hikes to rising fiber costs and a need to "provide an economic return."

Back To Top

|

The market direction for North American coated groundwood grades appears to be turning, aided by better volume comparison and supply cuts, according to Wilde. Domtar's recent announcement that it will shutter its Columbus, Miss., USA, mill and sell the inventory and brands to NewPage will trim North American LWC supply by 4.5%, he adds. Preliminary March shipment data show significant signs of improvement (+33.9% y/y, +18.1% m/m). "However, we caution that much of the gain owes to a 'lapping' of weak numbers from March 2009 (- 40.5% y/y). The North American industry is apt to see further restructuring in 2010 as European players have been re-assessing their NA operations. There are also a number of 'orphan' LWC mills that could change hands," Wilde says.

Back To Top

|

As with LWC, the tenor of the coated free sheet market is also improving. While March realizations were essentially flat on a m/m basis, producers have begun announcing pricing initiatives, Wilde explains, adding that the coated sheet market is apt to get the biggest bounce as restrictions on Chinese and Indonesian imports take effect. As with coated groundwood, Wilde emphasizes that "while preliminary March shipment data show signs of improvement, (+27.1% y/y, +16.7% m/m), much of the gain also owes to a 'lapping' of weak numbers from March 2009 (-32.6% y/y)."

Back To Top

|

Wood fiber costs rose in the U.S. South and in the Lake States during the first quarter because of improved pulp markets and a tight wood fiber supply, according to the North American Wood Fiber Review (NAWFR), Seattle, Wash., USA. In the Northwestern U.S., the picture was different, with reduced production of pulp and paper resulting in declining fiber consumption and lower prices for both wood chips and pulp logs.

The balance between wood fiber demand and supply varied throughout the U.S. in the first quarter, NAWFR reports. The fiber market in the South has become much tighter as a consequence of high fiber demand coupled with historically low sawmill residual supply. Many pulp mills producing market pulp have been running close to full capacity through the first months of the year because they wanted to take advantage of record-high prices for both NBSK and HBKP market pulp. The South experienced an unusually wet first quarter, resulting in access to the forests being extremely difficult. Many logging companies were forced to search further away from consuming mills for harvestable areas. There were even shipments of eucalyptus chips from Brazil coming into the region as a supplement to the domestic hardwood fiber sources. As a result of the improved pulp markets and difficult logging conditions, fiber prices have risen dramatically, particularly in the South Central states where softwood fiber prices were up 12% from a year ago and hardwood fiber prices were up 16% from the first quarter of 2009.

For more than five years, pulp mills in the U.S. South have had lower wood fiber costs than most mills in the other major pulp-producing region of the U.S., the Northwest. This condition changed in the first quarter when wood costs in the South Central region were practically the same as in the Northwest, and it is even conceivable that pulp mills in the West may have lower wood fiber costs than plants in the South later this year. The closure of two large pulp mills in Oregon and Montana is expected to reduce the demand for wood fiber by almost 15% in the Northwest. As a result of the closures, a number of pulp mills will be less reliant on chips manufactured from roundwood in the future and will consume a larger share of less expensive residual chips. The weighted average Douglas-fir fiber prices for the Northwest fell 9% in the first quarter, according to NAWFR. Wood fiber costs have trended downward for almost two years and are currently almost 40% lower than in 2008.

In the Lake States, softwood prices were moving up in the first quarter, while hardwood prices have stayed flat the past 12 months. Pulp mills in the region have passed through the winter season with stable supply and no dramatic changes in fiber demand. Softwood fiber prices, which have generally been more volatile than hardwood prices, have gone up the past year and are currently the highest in the U.S. More information about this issue of NAWFR is available online.

Back To Top

|

Pulp & Paper

Asia Paper Resources International Limited (APRIL), Indonesia, this past week reportedly had its FSC (Forest Stewardship Council) controlled wood certification suspended. Issued through the Rainforest Alliance's Smartwood certification program, the certificate was said to have been temporarily revoked after APRIL was found to have violated FSC's controlled wood standard, including prohibitions against conversion of rainforests to create acacia plantations and destruction of High Conservation Value Forests, including peatlands. With loss of the FSC certification, Indonesia's top two pulp and paper companies that account for 80%-plus of the country's production capacity have failed to meet the third party certification. FSC reportedly disassociated itself from Indonesia's top pulp and paper producer, Asia Pulp and Paper (APP), in 2007.

Back To Top

|

Fraser Papers Inc., Toronto, Ont., Canada, together with its subsidiary, FPS Canada Inc., reports that it has obtained final approval from the Ontario Superior Court of Justice to complete the sale of its NBHK pulp mill at Thurso, Qué., Canada, to Fortress Specialty Cellulose Inc. of North Vancouver, B.C., Canada. The company and Fortress expect to close the Transaction within the next few weeks.

Fortress says that it will convert the Thurso operation into a world class, low cost, specialty cellulose operation. Concurrently, it intends to build a 25 MW biomass-based cogeneration plant at the mill that will produce green electricity resulting in material net energy savings. The specialty cellulose mill is planned to have an annual production capacity of more than 200,000 air dried metric tpy and is expected to be completed in mid-2011.

In entering into the specialty cellulose sector, Fortress Specialty will focus on producing dissolving grade cellulose for the textile industry, primarily targeting viscose fiber (rayon) products that have shown strong growth of approximately 10% in China and 7% worldwide over the past five years. Fraser Papers is an integrated specialty paper company that produces a broad range of specialty packaging and printing papers. It has operations in New Brunswick and Québec, Canada, as well as in Maine, and New Hampshire in the U.S.

Back To Top

|

Georgia-Pacific, Atlanta, Ga., USA, this week reported that it has received approval from the Canadian Minister of Industry for the acquisition of Grant Forest Products' Englehart, Ont., Canada, oriented strand board (OSB) facility and associated operations at Earlton, Ont. The Minister reviews significant foreign investments in Canada to determine their likely net benefit to Canada. This follows earlier approvals of the acquisition by the Canadian court overseeing the Grant Forest Products Companies' Creditors Arrangement Act filing, the Canadian Competition Bureau, and the U.S. Federal Trade Commission (FTC). Further approval is pending in U.S. bankruptcy court.

G-P says it plans to continue operations at Englehart without any major changes in employment levels. The company adds that it will source all timber for Canadian operations from Canadian forests using Canadian-based logging contractors, will take steps to promote sustainable forestry practices, will make efforts to expand sales to a broader range of customers, and also will make substantial investments in the Englehart facility to enhance its competitiveness.

Back To Top

|

Sinar Mas, Indonesia, will buy the idled Pope & Talbot pulp mill in Mackenzie, B.C., Canada, with plans to export production to Asian markets by this fall. According to a Reuters news report, Sinar Mas officials said last week that the company's Netherlands-based unit, Paper Excellence BV, will pay C$20 million ($19.8 million) for the mill, and invest between C$30 million and C$40 million to restart it, plus additional costs. The mill's union reportedly has signed a contract for the more than 240 workers, and the McLeod Lake Indian Band, which holds resource rights in the area, says it will ensure the facility receives sufficient fiber supplies.

Sinar Mas plans to market about 80% of the mill's NBSK pulp production in Asia, Peter Wardhana, a director of Paper Excellence, stated in the Reuters report. Wardhana said the company, which already owns a mechanical pulp mill in Meadow Lake, Saskatchewan, is interested in more acquisitions in Canada. It is in final talks with Tembec to buy two of its mills in France. Sinar Mas tried to buy the Mackenzie mill in 2008, but the deal fell through partly because of the international credit crunch. That proposed transaction had also included two other Pope & Talbot mills.

Back To Top

|

Sonoco-Alcore S.a.r.l., Brussels, Belgium, plans to invest $4 million in its uncoated recycled paperboard (URB) mills in Italy and Greece to improve product range, energy efficiency, and overall cost competitiveness. Completion of the upgrade projects is scheduled for the third quarter of this year.

The company's Cirie (TO), Italy, mill will get a dryer section rebuild, including a new hood and advanced steam system. An automated slitting system also will be installed on the mill's rewinder. Upgrades at this mill are aimed at improving product output, especially high-strength coreboard, as well as reducing energy use and boosting environmental performance. Investments at the Kilkis, Greece, paperboard mill will involve replacement of a pulper and rebuilding of a dryer section. Kilkis, located some 50 km north of Thessaloniki, is the only mill in the region that can produce high-grade coreboard for the high-end industrial carrier markets.

Back To Top

|

Suzano Pulp and Paper, São Paulo, Brazil, reports that it will plant more than 145 million eucalyptus seedlings throughout 2010 to develop its forestry base. The eucalyptus trees will supply the industrial units currently in operation and the new growth cycle, allowing the company to reach, over the next decade, an annual production capacity of 7.2 million metric tons of pulp. This investment cycle encompasses two new mills, one in Maranhão State and another in Piauí State, which should startup in 2013 and 2014, respectively, and a third site yet to be determined, in addition to the Mucuri Unit expansion.

With this forestry investment, the company will plant approximately 398,000 trees a day. In 2009, it planted approximately 73 million eucalyptus seedlings on its own properties, 21 million of which were allocated for the two new mills. Currently, the company has met 75% of its needs for land to supply the Maranhão mill and 100% of the land to ensure production in Piauí beginning in 2014. More than 1,700 direct employees and outsourced personnel are already working in the states of Maranhão and Piauí to meet labor requirements needed to set up the forestry base for the units contemplated in the new growth cycle.

Back To Top

|

Union members from the Swedish paper industry have called a strike at six paper mills following a dispute over wage bargaining. Employers say the strikes may cost SEK 50 million per day, according to the newspaper Dagens Nyheter.

"This risks hurting the entire industry and the Swedish model," Marie Arwidson, president of the industry employers' organization, told the newspaper. Talks broke down earlier this month between the Swedish Paper Workers' Union (Svenska Pappers) and the employers' Forest Industry Association (Skogsindustrierna, SFIF), with members rejecting a salary increase of 3.2% over 22 months, which employers say is in line with the industry average. An overtime and new staff ban and a blockade of temporary workers started at all Swedish papers mills April 12, and selective strikes began at the six mills on April 16.

The mills affected by the strike are SCA Munksund, Iggesund, Korsnäs Gävle, Stora Enso Skoghall, Billerud Skärblacka, and Södra Cell Värö. Around 3,000 union members are taking part in the strike. Negotiations between Svenska Pappers and Skogsindustrierna have been going on since the middle of December last year. The previous collective agreement ended March 31.

Back To Top

|

Verso Paper Corp., Memphis, Tenn., USA, was honored as the 2009 Southeast Regional Green Business Innovator of the Year in a ceremony this past week at the Green Business Summit hosted by Lipscomb University in Nashville, Tenn. Verso was recognized for its continued efforts to work with customers and suppliers as partners, often sharing environmental performance data, to enable the evaluation of sustainability throughout the supply chain and promote forest certification and recycling programs.

"Verso has made tremendous strides in addressing sustainability throughout the supply chain," said William Paddock, co-founder of WAP Sustainability, a business sustainability consultant based in Nashville, and cairman of the Tennessee Sustainability Roundtable's Green Business Leadership Award Committee. "Verso went above and beyond, strategically evaluating their environmental impacts through effective collaboration with core customers such as National Geographic. As chairman of the awards committee, we felt this approach to sustainability exhibited the highest level of institutional practices and led to innovative learning that has helped the company address its most important environmental and social goals."

Lipscomb University President L. Randolph Lowry explains that the Green Business Awards were established to recognize businesses, individuals, and organizations that have demonstrated unusually exceptional leadership in green business practices and to encourage others to exceed their example. "Each honoree succeeded in establishing institutional practices, a policy framework, new products or services, or a vision resulting in precedent setting business practices in Tennessee in 2009," Lowry says. Other notable honorees include Tennessee Governor Phil Bredesen and the Nashville Metropolitan Transit Authority.

Back To Top

|

Weyerhaeuser Co., Federal Way, Wash., USA, this week reported it has received shareholder approval to issue a significant number of shares to enable the payout of its Earnings and Profits to shareholders in conjunction with its conversion to a Real Estate Investment Trust (REIT). No timetable has been set for the conversion and Earnings and Profit payout. However, the Board of Directors has previously stated that the earliest and most likely timing would be in 2010.

The Weyerhaeuser Board of Directors also announced that when the Earnings and Profit payout occurs, it intends to distribute the maximum amount of stock allowable under the Internal Revenue Code. For 2010, the IRS allows a 90% stock distribution of Earnings and Profits. "The REIT structure best supports our strategic direction," said Dan Fulton, president and CEO. "We appreciate the approval by shareholders, which will allow us to take the necessary steps to complete the conversion process."

.

Back To Top

|

Containerboard/Packaging

For the fifth straight month, U.S. containerboard paper production has risen sharply compared with last year, according to AF&PA's March 2010 U. S. Containerboard Statistics report released this past week. Current total production saw an increase of 379,100 tons or 15.6% over March 2009. Although total production amounts also increased compared with February 2010, average daily production was down slightly due to the number of days in March. Year-to-date production has increased 13.2% over 2009.

The containerboard operating rate for March 2010 rose 16.3 points over March 2009 to 93.6%. Additional key findings from the report include:

- Linerboard production posts large increase over same month last year

- Corrugating medium production follows the trend and increase over March 2009

- Operating rates also reflected the year-over-year increase.

Back To Top

|

Mark Wilde, senior analyst with Deutsche Bank, notes that March U.S. containerboard and box numbers show that industry volumes continue to make a cyclical recovery. Box shipment volumes rose 6.8% y/y, he says, adding that, adjusted for one more shipping day this year, box volumes rose 2.1% on an "average week" basis.

"We think that the 'real' number is a blend of the two, or a y/y increase of 4.5%. This compares with blended y/y comps of +6.0% in February, -1.6% in January, and +3.3% in December. March 2009 represented a particularly easy comp, with the blended y/y comp down 12.1% y/y, compared with blended y/y comps down in the 10%-11% range in the surrounding months. Throughout the second half of 2009, box volumes were lagging broader economic indicators such as the ISM manufacturing index. It now appears that box volumes are starting to catch up," Wilde explains.

Back To Top

|

U.S. Containerboard Inventories fell again in March, according to Wilde, though not by as much as they usually do. Combined mill and box plant inventories fell 40,000 tons m/m. "Looking over the past 10 years, inventories typically fall by an average of 86,000 tons m/m in March, suggesting that this year's decline was 46,000 tons less than typical. However, inventories started the month this year at a much lower-than-typical level. Total inventories now stand at 2.08 million tons, near the low end of a normal historical range. Since we still have three more months of typical seasonal declines (by an aggregate amount of 100,000 tons), we could see inventories getting extremely tight by the middle of the year. Strong export demand and tight fiber supplies at many mills also point in the same direction," Wilde points out.

Back To Top

|

U.S. containerboard operating rates eased slightly m/m, but this likely reflected fiber supply issues rather than any decline in demand, according to Wilde. The total containerboard rate was 93.6%, compared with 94.3% in February. Total production was 1,999,000 tons, roughly flat with other recent months with 31 days (e.g. January = 1,993,000 tons, December = 1,957,000 tons, October = 1,998,000 tons). The linerboard rate was 92.6% (93.1% in February), and the corrugating medium rate was 96.0% (97.1% in February).

Wilde adds that containerboard trade flows moderated noticeably. Total containerboard exports rose just 12.2% y/y. This compares with y/y increases of 48.9% in February and 68.7% in January. Net exports of 210,000 tons compare with net exports of 252,000 tons in February, 302,000 tons in January, and 349,000 tons in December. The 139,000 ton decline in net exports since December is about 7% of March production. "Again, we think that this reflects tight conditions in the domestic market rather than any decline in export demand. Export prices continued to rise in March," Wilde says.

Back To Top

|

Total U.S. boxboard production rose by 64,000 tons, or 6.0%, compared with March 2009, according to AF&PA's March 2010 Boxboard Report. Compared with February 2010, boxboard production in March increased by 7.5%. However, the average daily production was down 2.5%, AF&PA notes. Additional Report findings include:

- Solid bleached folding production up over last year

- Unbleached kraft folding decreased compared with February 2009

- Recycled folding production increased over 2009.

Back To Top

|

Average basis weights of corrugated are now 20% lighter in Europe than in the U.S., according to a new study by RISI, Brussels, Belgium, titled The Future of Lightweight Containerboard in North America. This reflects a proactive cultural change in Europe, with sustainability high on the agenda and government environmental initiatives with targets and penalties for non-compliance implemented across the supply chain and supported by trade groups and NGOs, RISI notes.

Sarilee Norton, author of the study and industry expert, says that "a critical look at the geographic factors, the fiber considerations, and the supply chain drivers that distinguish Europe from North America are not different enough to continue to explain a 20% differential in average basis weights. Sustainability, packaging efficiency, and cost savings are vitally important considerations to North American corrugated users as well as those in Europe."

Since 2000 only three new machines have been built in North America, compared with 32 in Europe. Modern machines, or conversions of existing machines, can produce extra-lightweight containerboard (under 26 lb) more quickly and economically. Many corrugators currently operating in North America are fully capable of running extra-lightweight constructions, and an analysis of current North American and European containerboard machine capabilities is included in the study. The evolution of 'lightweighting', including the technology developments of board machines, corrugators, and converting capabilities, provides the containerboard producer and converter perspectives in the study, alongside what the trend towards lighter basis weights means for end-users.

The containerboard market is customer-driven and with the largest global retailer, Walmart, aiming to reduce 5% of packaging across its supply chain by 2013, the report anticipates that the 'lightweighting' trend will continue, providing an opportunity for corrugators that invest in modern machines that offer the speed, quality, and versatility needed, to help their customers realize their packaging strategies. The Future of Lightweight Containerboard in North America provides a detailed analysis of the trend towards 'lightweighting', a history of corrugated, and capacity forecasts of the North American Containerboard market until 2014.

Back To Top

|

Reynolds Group Holdings, Auckland, New Zealand, this past week announced its intention to acquire the Evergreen Packaging group of companies and the Whakatane Mill from Carter Holt Harvey, also of New Zealand, which is ultimately owned by the owner of Reynolds Group Holdings, Graeme Hart. The acquisitions are expected to occur this month.

The Evergreen Packaging group of companies manufacture fresh carton packaging systems for beverage products, primarily serving the juice and milk end markets. The Whakatane Mill is a paper mill located in New Zealand. The acquisitions are expected to be financed with approximately US$1.75 billion of new debt guaranteed by Reynolds Group Holdings and certain of its subsidiaries as well as certain members of the Evergreen Packaging group of companies.

Back To Top

|

In anticipation of Confirmation Hearings that commenced April 15, Smurfit-Stone, Chicago, Ill., USA, announced this past week, through pleadings filed in the U.S. Bankruptcy Court, the voting results with respect to the plan of reorganization filed in the U.S. Chapter 11 proceedings and the CCAA proceedings in Canada. The plan of reorganization, Smurfit-Stone notes, received overwhelming support from its voting creditor constituencies both in dollar amount of claims and in number of claim holders who voted on the plan, and meets the confirmation standards under the Bankruptcy Code, except with respect to Stone Container Finance Co. of Canada II, a special purpose financing subsidiary that the company has excluded from the plan of reorganization. The exclusion will not affect the timing of the company's confirmation of the other Chapter 11 plans or delay its emergence from the Chapter 11 and CCAA proceedings.

Back To Top

|

On Wednesday, April 6 and Thursday, April 7, Walmart held its Fifth Annual Sustainable Packaging Expo in Bentonville, Ark., USA. The Expo is sponsored by the Walmart and Sam's Club Packaging Sustainable Value Network (SVN) and is designed to provide attendees with resources and information to learn about making product packaging more sustainable.

The expo included 186 booths consisting of packagers, packaging suppliers, trade associations and academia. More than 464 Sam's Club/Walmart associates were registered, as well as 1,742-plus product suppliers. The Expo also featured educational sessions that addressed the Sustainable Packaging Scorecard, environmental claims, transportation optimization strategies, recycling, paper packaging fundamentals, plastic packaging fundamentals, and sustainable packaging successes implemented at Walmart and Sam's Club. More than 4,700 seats were pre-registered to attend these sessions.

Members of Walmart's Packaging Sustainable Value Network (SVN) met on Thursday morning to re-emphasize Walmart's sustainability goals and receive updates on several on-going projects. SVN members were updated on the Global Packaging Project, Walmart's Supplier Sustainability Assessment, an update from the SVN subcommittee on Materials Metrics, and an update from the Packaging Scorecard Support Team (PSST).

TAPPI is active in Walmart's SVN, and TAPPI staff member Dr. Colleen Walker sits on the SVN Steering Committee and participates in their monthly conference calls.

Back To Top

|

New Products

The Swedish lighting company Wästberg has launched a lighting fixture made with DuraPulp, developed in close collaboration with Södra and Swedish architects and designers Claesson Koivisto Rune. Last year Claesson Koivisto Rune and Södra developed the Parupu children's chair made of DuraPulp, thus proving it possible to make a real chair of paper. The two groups have now teamed up with Wästberg to challenge themselves even further: merging electricity, paper and light, using paper, not only as a component or for casing, but really fully integrated. The Swedish lighting company Wästberg has launched a lighting fixture made with DuraPulp, developed in close collaboration with Södra and Swedish architects and designers Claesson Koivisto Rune. Last year Claesson Koivisto Rune and Södra developed the Parupu children's chair made of DuraPulp, thus proving it possible to make a real chair of paper. The two groups have now teamed up with Wästberg to challenge themselves even further: merging electricity, paper and light, using paper, not only as a component or for casing, but really fully integrated.

"Combining old wisdom with ground-breaking technology is elementary to Wästbergs philosophy" says Magnus Wästberg, founder and CEO of Wästberg. "Paper has been used throughout history for making lamp shades. Now we are using paper for the actual structure of the fixture adding advanced LED technology."

Karin Emilsson, director of technology at Södra and head of Södra Innovation, adds that "one principal mission for Södra, together with innovative partners, is to develop and supply tomorrow's raw materials based on renewable forest resources. The DuraPulp lamp by Wästberg meets high customer standards of functionality and design although it's made out of a new totally renewable material."

DuraPulp is made from selected pulp from Södra combined with PLA (Polylactic acid, a renewable biopolymer produced from starch). The two components in combination provide special properties that can be reinforced through hot pressing. DuraPulp has high wet strength, high water resistance, high dimensional stability, as well as high tensile strength and bending stiffness.

Back To Top

|

Published Pricing

Botnia, Finland, reports that it will increase pulp prices in Europe as of May 1, until further notice. The new prices are: Northern Bleached Softwood Kraft $960/metric ton, and bleached birch sulfate pulp $890/metric ton.

Back To Top

|

Travels with Larry

Recently, I had the opportunity to witness a demonstration of a new and innovative product that has been 15 years in the making! What was it? A recyclable, water-resistant cooler made from corrugated paper with a moisture barrier coating! Recently, I had the opportunity to witness a demonstration of a new and innovative product that has been 15 years in the making! What was it? A recyclable, water-resistant cooler made from corrugated paper with a moisture barrier coating!

This unique product is made by E-cooler LLC, an earth-friendly packaging company and also a sister company to the PackPros Alliance Group. This alliance began in 1943 with just one company that manufactured and distributed corrugated packaging in Detroit, Mich. Over the years, it gradually expanded and now operates seven different corrugated manufacturing facilities throughout the Midwest. Its mantra has been and still is: Adapt, Survive and Thrive.

As an industry innovator, E-cooler LLC developed and now markets e-cooler® products, which were designed as cost effective, environmentally responsible packaging solutions. The applications for e-cooler® products are two fold: retail coolers and industrial boxes. The industrial boxes are a recyclable alternative to conventional, non-recyclable, wax coated boxes currently being used in the seafood, produce and poultry industries.

Another important goal for E-cooler LLC was to develop the retail e-cooler® as a sustainable, economical alternative to polystyrene coolers. Across the retail industry, polystyrene (commonly known as Styrofoam) has been regarded as a dangerous material for the environment. The vast majority of Styrofoam containers end up in landfills because they cannot be easily recycled. For this reason, e-cooler® products are the perfect "green" solution to conventional polystyrene coolers. The e-cooler® products are:

- Sustainable, recyclable products made from corrugated paper

- Durable and reusable

- Water and moisture resistant

- Possess comparable thermal performance to Styrofoam

- Are 100% wax free and 100% polystyrene free

- Made in the USA and are U.S. Patent Pending

Finally, a solution exists that gives industry leaders and consumers the option to support Sustainable Packaging Initiatives. The e-cooler® products are revolutionizing the packaging industry!

For more information on these products, please go to www.e-cooler.com.

For more information on TAPPI, please go to http://www.tappi.org.

There are two types of people in our industry: TAPPI members and those who should be.

Until next time - Larry

Back To Top

|

TAPPI News

TAPPI, in partnership again with Pira International, is pleased to announce the second annual Specialty Papers Conference, scheduled for November 10-11, 2010, at the Hotel Allegro Chicago, in Chicago, Ill. This year's program will focus on the current state of the market and the latest technology and application developments in the specialty papers arena.

Specialty Papers 2010 will feature approximately 18 expert presentations assessing market trends, technical developments, and application-related advances through presentations, question-and-answer sessions, and panel discussions. Topics new to this year's agenda include an update on the Chinese specialty papers market; choosing specific market pulps for various grades; and in-depth looks at packaging paper markets and developments; life cycle assessment; and regulations and certifications. Learn more at www.specialtypaperconference.com.

Back To Top

|

If there's a best time to implement lean manufacturing into your operations, this is it. TAPPI is offering – 2010 TAPPI Lean Manufacturing - Flexo & Die Cutters – May 25-27 at TAPPI headquarters near Atlanta – an intensive three-day course focused on running Die Cutters and Flexo Folder-Gluers at maximum efficiency. The course is led by Dick Target, one of the industry's most well-respected and knowledgeable experts in lean manufacturing.

Target will concentrate on proven methods, such as Centerlining, "Time and Register" calibration, vendor certification, and Ink management. Other topics include zeroing the gear train in the press, implementing a successful Five-S program, tools for effective Waste Reduction, tooling use and purchase, and anilox roll care and maintenance. Presented in a direct, easy-to-understand manner, this course is valuable for everyone from senior operators and maintenance technicians to plant management.

Early bird registration ends at the end of this month, April 30. And, with a $200 savings for early registration, this course is just too important to miss. CEUs are available.

Back To Top

|

The corrugated industry's esteemed CorrPak® 2010 Competition is open to ALL corrugated manufacturers worldwide. Entries for corrugated package products manufactured between August 1, 2008 and August 1, 2010 are now being accepted. The competition identifies and recognizes the finest commercially produced corrugated package products in the industry. Sponsored by TAPPI's Corrugated Packaging Division, the CorrPak® 2010 Competition is held every other year. Don't miss this one: Deadline for entries is Friday, August 27, 2010.

View or print the rules and entry requirements.

Individuals or companies may submit more than one submission for consideration, even in the same category. The CorrPak Competition is an exceptional way to showcase outstanding creativity and ingenuity. The CorrPak Competition entries on display at the 2010 Corrugated Week conference will provide an enlightening glimpse of some of the industry's finest work. For previous examples, view photos from the 2008 CorrPak Competition.

Winning entries will be displayed during the TAPPI 2010 Corrugated Week conference held October 4-8 in Baltimore, Maryland, USA and the winner will be announced during the TAPPI conference. This event offers the most effective networking opportunity possible – where attendees can meet with all the sales and technical reps from their suppliers – in the convenience of one place, where, as one past attendee put it, "you get away from the shop for a couple of days and really focus on broadening your knowledge base."

Good luck to all 2010 entries!

Back To Top

|

The Awards Committee of the TAPPI Pulp Manufacturing Division is requesting nominations for the Division Technical Award (and Johan Richter Prize), and the Division Leadership and Service Award (and Joseph Perkins Prize). Nominations are requested for both awards, but only one will be selected to be awarded at the Fall PEERS (formerly EPE) Conference to be held in Norfolk VA.

The Division Technical Award is intended to recognize outstanding accomplishments or contributions, which have advanced the pulp manufacturing processes and methods. It was last awarded to Dr. Richard Berry of FPInnovations at the 2009 EPE Conference in Memphis, Tenn., USA. The Division Leadership and Service Award is intended to recognize an individual for outstanding leadership and exceptional service to the Division. The Division Leadership award was last presented to Dr. Gopal Goyal of International Paper Company at the 2008 EPE Conference in Portland, Ore.

Completed nomination forms should be sent to Alan Rudie at arudie@fs.fed.us or by mail to Alan Rudie, Forest Products Laboratory, One Gifford Pinchot Dr., Madison, WI 53726. The form may also be downloaded here.

Back To Top

|

Early discounted registration is now open for the 2010 BioPro Expo™ and Conference, slated for August 24-26 at the Cobb Galleria Centre in Atlanta. Providing program content and comprehensive exhibits created with multiple industries in mind, BioPro Expo™ explores practical methods for transitioning a variety of biomass feedstocks into energy and biofuel. This unique event will bring together diverse communities ranging from forest, agriculture, and biorefinery operations to power companies and technology suppliers – offering the Southeast's most powerful educational and professional networking experience in the bioenergy arena.

BioPro Expo will include in-depth case studies and technical sessions from experts in a variety of industries. In addition, there will be a comprehensive tradeshow and hands-on technology interaction. Additional input from governmental agencies will supplement this experience with perspective on the rapidly changing regulatory and funding environment impacting renewable energy efforts.

Registration fees are $485 for TAPPI members and $746 for non-members, if confirmed by July 2, 2010. Onsite registration is $735 for TAPPI members and $1,125 for non-members. Registration information is available at www.bioproexpo.org.

Back To Top

|

A Call for Presentations/Posters has been issued for the 2010 TAPPI International Conference on Nanotechnology for the Forest Products Industry, 27-29 September, 2010, in Espoo, Finland. This annual, internationally recognized event brings together leading researchers, industry experts, government representatives, and other stakeholders to share advances and perspectives on nanotechnology-based products for the forest products and related industries.

To leverage research advances and offer participants new opportunities for knowledge sharing, the 2010 Technical Program Committee invites contributions from participants working with nano-enabled bio-materials, products, and their processing. Analysis of challenges and trends in emerging markets for forest products that are based on nanotechnology are sought to provide a foundation for new research and industrial activities. The organizers also encourage submissions on other aspects of nanotech products including law, policy, economics and environmental health and safety. View the Call for Papers.

Back To Top

|

"Vision is not enough; it must be combined with venture. It is not enough to stare up the steps, we must step up the stairs..."

-- Vaclav Havel, Czech playwright, essayist, dissident, politician and first President of the Czech Republic

Share YOUR favorite advice or interesting ideas -- about life, business, the industry, work or leadership -- by sending in a quote to share with other Over the Wire readers. Email your quote suggestions, along with your name and company information, to mshaw@tappi.org. We value the input of our OTW readers.

|

|

|

|

TAPPI Over the Wire | 15 Technology Pkwy. S. | Norcross, GA 30092 USA | Voice: 770.446.1400 | Fax: 770.446.6947

|

|