Over the Wire

TAPPI

|

Pulp & paper industry focus and value creation logic have been largely based on production efficiency instead of top line revenue growth. However, the main driver for investment decisions in the future will be more focused on the search for new markets and growth, according to a recent article in Pöyry's Executive Wire titled "Mission Not Impossible: Growth in Mature Markets." Times of structural change often bring out market dictated needs for strategy change and force companies to direct attention to new opportunities, the article notes. When the demand development ticker starts to stay horizontal or move south, it means increasing competition for the remaining tons in the market. This basic premise is accentuated by the paper industry's high fixed cost structure and high exit/entry barriers which often lead to pushing tons into the already saturated market place. Feeble demand coupled with over capacity sets the stage for weak pricing—where supply side market power has not been established. Value is about to get destroyed--unless... Note: The following is excerpted directly from the Pöyry article. For more information or further discussion, contact Soile Kilpi, principal, soile.kilpi@poyry.com (646-651-1547), or Sanna Kallioranta, consultant, sanna.kallioranta@poyry.com (225-281-1366). Growth avenues for pulp and paper companies

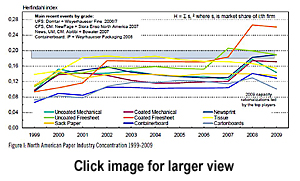

1. Market Dominance: From survival of the fittest to thriving of the biggest. Many sectors of the paper industry have already undergone a couple of "warm up" rounds of consolidation. The future rounds are about becoming the dominant player. We have seen pre-plays of that unfolding in several segments. In the uncoated free sheet (UFS) market, Domtar's acquisition of Weyerhaeuser's assets in 2007 doubled Domtar's capacity and placed the company on the top of the North American UFS market with 35% capacity share. In the current industry structure, only International Paper is in the same size league with Domtar, with 26% capacity share. The coated free sheet (CFS) market in North America has the highest consolidation level in the paper industry. NewPage, Sappi, and Verso are the sector captains with a combined 84% market capacity share, although, their dominance has been seriously pressed by the influx of Asian coated paper imports. Before the recent tariffs imposed on coated paper imports, the U.S. International Trade Commission estimated that the Chinese and Indonesian producers held more than a quarter of the market. Market dominance might sound like a straight-forward strategy but it is far from it, both in strategic planning and operational execution. One of the fundamentals is the decision to become the dominant player in the right market category and geography. Although AbitibiBowater is the dominant player with 35% newsprint capacity share in North America, it was unable to avoid Chapter 11, filing in April 2009. The second largest newsprint producer, White Birch (18% capacity share), followed suit in February 2010. 2. Market Segmentation: Not all rivers are created equal. A lot of market side attention should be given to identifying or creating pockets of sustainable demand opportunity. These pockets of opportunity may be found within the existing product grade markets through customer segmentation that targets specific end-uses, market needs, or buyer behaviors. Alternatively, these opportunities might be found from alternate product grade markets. We have seen moves by commodity players gradually gearing up in specialty segments:

Also bolder moves have taken place. International Paper has been changing its printing and writing paper focus history to a packaging focused future. In 2005, 52% of IP's asset base was in printing and writing grades. By 2010, that share has dropped to 29%. 3. New Markets: The developing world is your oyster. When markets at home have started to decline, but you possess strong capabilities in a market category, it is time to examine entry into new geographic markets to unlock value creation. Globalization was a hit theme in the paper industry in the 1990s. Especially European paper companies made big moves entering North America (Stora Enso acquired Consolidated Papers, UPM-Kymmene acquired Blandin and Miramichi mills) and emerging markets (UPM-Kymmene joined forces with APRIL, Norske Skog acquired mills in Thailand and Korea). Again, expansion to new geographies sounds like a straightforward strategy, but is anything but. Since the globalization boom, many of the grandiose moves have been scaled back for various reasons ranging from challenges in partnership selection to underestimating the complexity of entry and business integration involved. North American players were more prone to stay at home (could there be a correlation with 75% of Americans not having a passport?). Half of the 10 largest North American paper companies have production assets only in the domestic market. International Paper and Georgia-Pacific have been by far the most active companies in building if not world dominance, at least worldwide presence. International Paper has mills in eight countries, including Brazil, China, Mexico, and several European countries. Georgia-Pacific has mills in 11, mainly European, countries. 4: New Businesses: New seas, new fish. The pulp & paper industry, as an expert of fiber flows, inherently possesses many opportunities to enter new business areas, beyond paper. Some traditional paper industry companies have started corporate repositioning in new sectors. For example, UPM-Kymmene is building its future on strategy that integrates bio, energy, and forest industries into a newly coined term—"biofore" industry. Cascades is building up its waste management footprint through its subsidiary recycling operations—Metro Waste. In 2009 Cascades announced the acquisition of the Canadian assets of Sonoco Recycling and the recovery assets of Yorkshire Paper Corp., both which provide collection services for recyclable materials including corrugated containers, paper, and plastics. Some companies have chosen to acquire new positions within the paper value chain. Glatfelter's acquisition of Concert in early 2010 instantly positioned it as a leading global supplier of absorbent cellulose-based, airlaid non-woven materials, which are used in many consumer and industrial applications with growing global demand, including feminine hygiene, adult incontinence products, and specialty wipes. Also in early 2010, Mohawk Fine Papers announced the acquisition of LabPrints, which offers workflow integration solutions for professional photographers and photo labs. The LabPrints acquisition strengthens and widens Mohawk's position in the digital printing value chain. 2010 might become an interesting year of transactions and strategic moves. ##SHARELINKS##

|

A new report titled Sustainable Practices: a foundation of the forest products industry, released this past week by AF&PA, Washington, D.C., USA, shows that despite the severe impact made by the recession, continued investments by U.S. paper companies in more efficient processes and equipment have led to measurable progress on such sustainability indicators as recycling and air emissions. Among the reports key findings, are:

- In 2009, 63% of U.S. paper consumed was recovered, surpassing its 60% recovery goal three years ahead of schedule

- On an absolute basis, both direct and indirect greenhouse gas emissions at pulp and paper and wood products industry facilities have decreased

- In 2008, 65% of the energy needed to operate U.S. pulp and paper mills was produced from renewable fuels (at wood products facilities, renewable fuels produced 73.5% of needed energy)

- Compared with 2006, pulp and paper mill sulfur dioxide releases decreased 14.6% and total reduced sulfur releases were reduced 18.6%

- Companies have continued to make investments in new processes and equipment, with paper mill and allied product company capital expenditures totaling $7.6 billion in 2006 and $6.3 billion in 2008

- From 2002 to 2008, U.S. forest products exports grew by almost 50%, from $18.2 billion to $27.1 billion.

|

Total wood chip exports from Australia fell 32% in 2009, to the lowest levels in 10 years. Softwood chip shipments were down by almost 26% from 2008, reaching a low of 790,000 tons last year, as reported in the Wood Resource Quarterly (WRQ), Seattle, Wash., USA. Exports of hardwood chip exports were down by 41%, to four million tons. This year, however, export volumes have picked up and shipping schedules for the coming months indicate that the shipments in the first half will be substantially higher than last year and could very well be back to almost the same levels as the average for the past five years. During the first four months of this year, conifer chip exports were up 38% compared with 2009, with Japan and China being the only two destinations. Eucalyptus exports were 12% higher than last year with increased shipments to Japan and Taiwan, while exports to China were down substantially, WRQ reports. After having increased almost 300% from 2008 to 2009 when they reached an all-time-high of 670,000 tons, shipments to China have plunged 86% to date, reaching only 23,000 tons for the period January through April 2010. The negotiated Australian conifer chips price for Japan in the first half settled in late April at $151/BDU (FOB Portland, Ore., USA), which was up $19/BDU from the second half of last year. The Eucalyptus Globulus benchmark chip export price for 2010 is A$207.40/odmt. Australia hardwood chip prices delivered to Japan are now up 35% from a year ago in U.S. dollar terms. According to data from Japan Pulp and Paper Association, Australian Eucalyptus chips are currently the costliest imported hardwood fiber to Japan, compared with just a year ago when they were among the least costly, as reported in the WRQ. A new development in Australia is rising interest in the exportation of wood pellets. One company has been taking steps to ship wood pellets to the fast expanding biomass energy market in Europe. The first shipments departed in late 2009 for an energy company in the Netherlands, and 20,000 tons has been shipped to Europe so far this year. The three-year contract totals an estimated 300,000 tons of pellets. There are plans for continued investments in pellet production capacity in Australia, but because of high transportation costs to Europe, a source for a long-term reliable supply of low-cost fiber to manufacture pellets must be found. This has, to date, been quite a challenge, WRQ says. More information is available online. ##SHARELINKS##

|

|

The U.S. uncoated free sheet (UCFS) market is O.K., but not spectacular, says Mark Wilde, senior analyst with Deutsche Bank. In June, 50-lb offset roll prices rose $10/ton to $925 - $940/ton and 20-lb repro bonds rose $5/ton to $1,100 - $1,140/ton. In May, prices on various grades were up $30 - $40/ton. Producers have announced a $60/ton price increase. This is the second price increase of the year following the $40/ton price increase in both cut-size and roll grades in March. The recent price increase is driven by capacity cuts (Domtar, IP), low inventory levels (-17% y/y), and sharply higher pulp prices. ##SHARELINKS##

|

|

As with LWC, the tenor of the coated free sheet (CFS) market is improving, Wilde reports. List prices in June were +$10 - $15/ton (+$5/ton in May). Producers announced a $40/ton price increase that went into effect in May and June. Recent data suggest a pick-up in activity (preliminary May shipments +32% y/y). However, these figures possibly benefit from a "lapping" of weak numbers from May 2009 (-29.7% y/y), according to Wilde. ##SHARELINKS##

|

|

June list prices for unbleached kraft boards in the U.S. rose $30/ton to $855 - $915/ton—the first increase since August 2008 and the first price change since June 2009, Wilde points out. The current price increase is driven by a pick-up in activity and improved order backlogs. This increase will help restore the spread with coated recycled board (CRB) prices, which rose in September 2009, January 10, and April 10. ##SHARELINKS##

|

|

Bleached kraft board/SBS (solid bleached sulfate) is a tight market in the U.S. right now, Wilde says. Prices for 14-pt polyethylene-coated cupstock rose $20/ton in June to $1,320 - $1,375/ton. Producers announced a $50 - $60/ton price increase on cupstock, platestock, and bristol grades, effective June/July. The current price increase is driven by seasonally stronger cold cup demand and steady hot cup demand. This is the second price increase after the $40/ton March increase. SBS remains very tight with strong demand (unmade orders = 568,000 tons for the week ending June 9), high operating rates, and reduced supply from IP's Franklin, Va., and MWV's Evadale, Texas, mill/machine closures. Folding carton grade prices remained flat at $1,040 - $1,090/ton. ##SHARELINKS##

|

|

Catalyst Paper, Richmond, B.C., Canada, announced yesterday that it is permanently closing its Elk Falls paper mill near Campbell River, B.C., Canada, in September. This facility has been indefinitely curtailed since February 2009. "Today's news is a disappointing outcome for mill employees and families, for the community, and for our business," said Catalyst president and CEO Kevin J. Clarke. "The steep decline in commodity paper markets, coupled with uncompetitive labor and tax costs, were contributing factors that could not be overcome. "Adaptation has always been the key to survival," Clarke noted, "and the uncertainty regarding the future of this mill was detrimental to all of our operations and had to come to an end. With this difficult decision behind us, we can now focus our sales and marketing strategies and production planning around mills that still have the potential to operate competitively, which is a better basis to future-focus our business overall." In a related decision, Catalyst also announced the permanent closure of its paper recycling operation in Coquitlam, B.C. The facility, which supplied the company's Crofton mill, was indefinitely idled in February due to reduced recycled pulp requirements, combined with higher cost and constrained availability of quality recovered paper. All employees were laid off at the time. The associated asset impairment charge, including severance costs, is estimated at $302 million and will be reflected in the company's second quarter results. Only a small number of employees will continue to be required to manage and decommission the facility, resulting in approximately 100 Elk Falls employees being immediately impacted by the permanent closure. The Elk Falls mill began operation in 1952, and at its peak, produced 784,000 metric tons of pulp, paper, and kraft paper annually. With five mills located in British Columbia and Arizona in the U.S., Catalyst has a combined annual production capacity of 2.0 million metric tons. ##SHARELINKS##

|

|

Domtar Corp., Montreal, Que., Canada, this past week completed selling its Forest Products Business to EACOM Timber Corp., Richmond, B.C., Canada, for C$80 million plus elements of working capital of approximately C$46.5 million. Domtar received 19% of the proceeds in shares of EACOM, resulting in an ownership interest of approximately 11.74%. The transaction includes five operating sawmills: Timmins, Nairn Centre, and Gogama in Ontario, and Val-d'Or and Matagami in Quebec, as well as two non-operating sawmills—Ear Falls in Ontario and Ste-Marie in Quebec. The sawmills have approximately 3.5 million cubic meters of annual harvesting rights and a production capacity of close to 900 million board feet. Also included in the transaction is the Sullivan remanufacturing facility in Quebec and Domtar's interests in two investments—Anthony-Domtar Inc. and Elk Lake Planing Mill Ltd. In conjunction with the closing, EACOM issued 48,070,712 common shares to Domtar as partial consideration for the sale by Domtar Inc. and Domtar Pulp and Paper Products Inc., both wholly-owned subsidiaries of Domtar Corp., of their Forest Products Business pursuant to an Asset Purchase Agreement entered into as at March 26, 2010. In its financial statements for the quarter ended June 30, Domtar says it will record a charge of approximately C$37 million related mainly to the loss on disposal of the Forest Products Business and related pension curtailments. Domtar will incur further charges of C$15 to C$20 million in future periods related to pension settlements resulting from the transaction. Domtar is the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity, and is also a manufacturer of paper grade, fluff, and specialty pulp. ##SHARELINKS##

|

|

The board of directors of OJSC Ilim Group, St. Petersburg, Russia, has approved an investment project involving installation of a new paper machine at its mill in Koryazhma, Russia. Estimated project costs exceed $270 million. Project implementation will start this year, and the new paper machine is scheduled to startup in 2012. The new paper machine will produce cut-size papers, uncoated free sheet (UFS) offset, and base papers for coated free sheet. It will produce more than 150,000 metric tpy of cut size and 50,000 metric tpy of offset papers. In the future, instead of offset paper a base paper for 70,000 metric tons of coated free sheet papers will be produced. An off-machine coater also will be installed. Ilim Group's CEO Paul Herbert says that the key project objective is to continuously integrate pulp in manufacturing of value-added products. "The strategic decision of the board of directors to approve the paper mill for Koryazhma along with approval of the Bratsk investments will secure Ilim's long-term development prospects and strengthen our positions on our key markets," he noted. ##SHARELINKS##

|

|

KapStone Paper and Packaging Corp., Northbrook, Ill., USA, together with MAJIQ Inc., Redmond, Wash., and Enterprise Performance Solutions Inc. (EPS), Atlanta, Ga., has implemented the EPS ELIXIR Product Cost Management system at its mills in Charleston, S.C., and Roanoke Rapids, N.C., to obtain more accurate, timely, complete, and consistent grade costing data and to consolidate to a central, harmonized costing system to better manage profitability decisions. The new, integrated system eliminates reliance on offline tools and increases cost transparency between the company's mills. At the two KapStone mills, ELIXIR Product Cost Management provides centralized recipe and grade specifications management, standard and actual costing, cost forecasting, and support for cost-to-serve reporting with respect to products, customers, and markets. With these advanced capabilities, KapStone anticipates increased accuracy and timeliness in cost management processes, improved decision support, and efficiency gains in managing recipes and price lists, and enhanced profitability forecasting. The Product Cost Management system is closely integrated with the ELIXIR sales order processing and manufacturing execution system delivered by MAJIQ. Through interfaces within ELIXIR, gross and net production statistics are available for actual costing. Additionally, block schedule snapshots from the ELIXIR system are used for advanced short-term cost forecasting. "The ELIXIR system has made the grade costing process much more efficient and we have eliminated our reliance on offline and inconsistent spreadsheet tools." said Christophe Deslandes, CIO of KapStone. "The close integration between the new costing system and ELIXIR has significantly reduced the manual components in the costing process while improving its accuracy and consistency." ##SHARELINKS##

|

|

Myllykoski's MD Plattling mill, Plattling, Germany, has agreed to outsource its maintenance operations to Metso, Finland. The multi-year agreement will become effective January 1, 2011. ##SHARELINKS##

|

|

OpenGate Capital, Los Angeles, Calif., USA, this past week closed its acquisition of the Kotka Mills division of Stora Enso, Finland, along with Stora's laminating paper operations in Malaysia. The transaction also includes Stora's related business operations in Tainionkoski, Finland. OpenGate reports that it has unified and rebranded these entities under the name Kotkamills, allowing it to continue selling specialty papers and wood-based products to the global laminate, plywood, construction, and magazine industries under one new company. Kotkamills will be headquartered in Kotka, Finland. Kotkamills President Tuija Suur-Hamari said that "we are thrilled to be partnering with OpenGate Capital, which shares our long-term commitment to the business and pride in our 135-year heritage. Our team is eager to initiate new capital investment projects and new product developments with the support of OpenGate to ensure our future growth plans and continue to meet our customer needs around the world for years to come."

##SHARELINKS##

|

|

Stora Enso, Helsinki, Finland, reported yesterday that it will permanently close down newsprint and directory paper production at Varkaus mill in Finland by the end of the third quarter. Reasons for the planned capacity closure announced on April 22 have not changed, the company notes—the European newsprint and directory paper market is strongly and structurally oversupplied and sales prices have fallen significantly. As a result, newsprint production at Varkaus is expected to remain unprofitable in the long term. "The overcapacity position in the European newsprint and directory paper market has persisted in 2010. Consequently, sales prices have fallen significantly. In the longer term, demand in Europe is expected to decline further, as has been happening in North America. In addition, the competitiveness of Varkaus is weakened because newsprint production at Varkaus relies on less-competitive virgin fiber, the availability of wood raw material in Finland is not stable, and Varkaus is far away from most of its customers and main markets," says Juha Vanhainen, executive VP, Publication Paper Business Area, and country manager, Finland. The closure of the two newsprint machines PM 2 and PM 4 at Varkaus Mill will reduce newsprint and directory paper annual production by 290,000 metric tons. The co-determination negotiations at Varkaus were concluded at the end of June. As a result of the ending of newsprint production, 175 employees will be made redundant. There are currently 506 employees at Stora Enso's Varkaus Mill. The Varkaus mill site will continue to produce pulp and fine paper after newsprint and directory paper production ends. The operations of the sawmill and the NSE Biofuels Oy biofuel joint venture with Neste Oil and its demonstration plant will also continue. The ending of newsprint production will not substantially affect the amount of renewable energy produced at Varkaus. Stora Enso will support redeployment of those affected by the plans through efficiently offering jobs internally and eligibility for outplacement services. The Group works closely with local employment and economic development centers to find new job opportunities for people affected.Stora Enso will also support financially those who would like to start their own business. ##SHARELINKS##

|

|

Tembec, Temiscaming, Que., Canada, reports that a fire this past week at its Chetwynd, B.C., high yield pulp mill, caused no injuries, with damage primarily concentrated in the log storage and chip pile area of the mill site. There was also some damage to the scales, chip receiving and unloading equipment, chip conveyors, and related electrical services. Assessments by mill personnel and outside resources have indicated that damage to the pulp production area of the mill is relatively minor. In terms of direct loss, it is estimated that roughly 40,000 cubic meters of fiber (chips and logs) were destroyed. While the chip and log piles continue to smolder, the situation is considered well under control. Site personnel and outside resources are already beginning their work at the mill to address electrical and mechanical repairs, with procurement and delivery of necessary materials and equipment already well underway. Current estimates are that the mill will be out of service for between 14 and 18 days from the date of the fire (late afternoon of June 30), resulting in lost production of approximately 10,000 metric tons. The company indicated that there will be no disruption of supply to contract business, given the fact that it has two other high yield pulp mills from which to supply the needs of its customers. Tembec noted that it maintains property and business interruption insurance on all of its facilities and the deductible to be absorbed by the company on large claims is $5 million. This event will likely exceed this deductible limit. ##SHARELINKS##

|

|

UPM, Finland, reported this week that Voith Paper, Germany, will start manufacturing cotton rolls used in graphic paper production at UPM's Jokilaakso mills in Jämsä, Finland. The new unit will manufacture cotton rolls in the old thermomechanical plant of the Kaipola production unit starting in October. Installation of the production equipment will begin this month. The new production unit will start operations with four employees. Cotton and hard rolls are used in paper calendering to improve the printing properties of paper. According to the contract, UPM will source cotton rolls from Voith for its Finnish graphic paper mills, with a significant number going to the Jokilaakso mills as well as the Jämsänkoski, and Kaipola operations. UPM says the new usage of empty premises at Jokilaakso mills is a good example of innovative cooperation. ##SHARELINKS##

|

|

Verso Paper Corp., Memphis, Tenn., USA, has announced the launch of a $43 million Renewable Energy Project that will position its mill in Quinnesec, Mich., to meet more than 95% of its energy needs using renewable biomass sources. "The implementation of the Quinnesec Renewable Energy Project is in alignment with Verso's three-pronged energy strategy, which is to reduce overall energy consumption, generate more green energy from renewable biomass, and reduce our carbon footprint, all while reducing costs," said Mike Jackson, Verso's president and CEO. "Expanding the capacity to generate electricity from biomass is one of the ways in which the State of Michigan is increasing our leadership in clean energy technology," said Governor Jennifer Granholm. "Clean energy projects supported by the state are leading America's drive to energy independence with bold initiatives to develop energy technologies and new fuels from renewable resources." Mike Sussman, Quinnesec mill manager, added that "Verso is fortunate to have active partners in the Michigan Governor's Office, the Michigan Economic Development Corp., Dickinson County, and Breitung Township, who are working diligently to help make our Renewable Energy Project a reality." A direct result of the state-wide partnership is the designation of a Forest Products Processing Renaissance Zone, which allows a company within the zone to operate free of virtually all state and local taxes over the life of the designation. The Project scope includes design upgrades to the Quinnesec Mill's existing combination boiler, which burns biomass from waste wood sources, the addition of a new biomass handling system, and the installation of a new turbine generator supplied by Siemens. Verso is partnering with AMEC Engineering to begin detailed design for the Project, which is estimated to startup by December 2011. ##SHARELINKS##

|

|

Chesapeake, U.K., has installed a new Mark Andy press at its Kunshan Jiangsu, China, factory, allowing it to now supply cartons, leaflets, and labels aimed specifically at the pharmaceutical sector as well as positioning it for growth in other markets. The company notes that the Mark Andy Performance Series machine has an innovative print platform that produces consistently high print quality. Mike Codington, GM at Chesapeake Kunshan, explains that "our team visited Mark Andy's print technology center in Switzerland and witnessed impressive machine setup and changeover times. The operator was able to complete all changeover tasks while maintaining high quality standards. This is the first P7 press in China and this investment further reinforces Chesapeake's position as a leading global supplier of pharmaceutical packaging." ##SHARELINKS##

|

|

Greycon Ltd., London, England, a global supply chain optimization company for the paper, printing, film, and nonwovens industries, this past week reported that Nine Dragons Paper Industries Co., the largest producer of containerboard products in China, signed a five-year agreement to use its X-Trim to optimize trim efficiency for its paper machines. X-Trim was chosen after an evaluation process that spanned more than two years and included extensive on-site trials. "These trials clearly demonstrated the benefits X-Trim provided in both trim efficiency and planner productivity," Constantine Goulimis, CEO of Greycon, said. Implementation of X-Trim has already begun, with the first phase scheduled to go live in August. "A critical factor in Nine Dragons' decision to use X-Trim was the tight integration with SAP," Goulimis added. "Building on top of the certified, Powered-by-NetWeaver integration between X-Trim and SAP's SCM (APO), Greycon was able to demonstrate dynamic pegging to finished and semi-finished inventory. This new feature allows Nine Dragons to optimize its paper machines by consuming just the right amounts of stock. The dynamic nature of the pegging means that inventory reservations are kept as flexible as possible." Nine Dragons has announced ambitious growth plans to increase the company's capacity by 26%, to 11.1 million metric tpy in 2011, positioning it to take advantage of opportunities related to the developing economic recovery in China and around the world. To get the greatest leverage from this investment in plant and equipment, and help the company achieve its production goals, Nine Dragons is also investing in technology, replacing its current systems with state-of-the-art solutions, Greycon notes. ##SHARELINKS##

|

|

Smurfit-Stone Recycling, Chicago, Ill., USA, was recently named T.G.I. Friday's restaurants Supplier of the Year in recognition of the company's customer service and ability to execute cost savings on recycling and waste solutions. Smurfit-Stone provides its customers with a single point of contact to meet their recycling and waste management needs and conducts end-to-end audits of their processes to identify where and how they can turn costs into revenue. In this way, it helps its customers create operating efficiencies, reduce waste removal costs, generate revenue through recycling, and contribute to the impact of corporate and environmental responsibility programs. ##SHARELINKS##

|

|

Otmetka Log Marking AB, Stockholm, Sweden, reports that following 10 years of development work it is now ready to introduce its new Woodpecker timber marking system, which can guarantee full traceability of timber from where the tree grew in the forest to the saw. The system can even be linked with existing bar code systems and create traceability all the way out to the retail trade. This makes it possible to mark every log with an automatic ID code when it is felled with a harvester, the company notes. Otmetka is launching this technology at a time when there is huge demand for reliable traceability of timber. This week the European Parliament is deciding legislation to prevent the trade of illegal timber. According to Otmetka, critics fear that the demand for traceability will lead to higher costs, complications, and bureaucracy. But, instead, it can lead to the opposite, it says. Only practical testing of the technology remains, and the company says it is now looking for proactive partners, clients, and investors. "If all goes well, the system is expected to be up and running in connection with next year's international forestry trade fair, Elmia Wood, in Sweden," Otmetka explains, adding that the name Otmetka is Russian for "mark" that can loosely be translated to "approved." ##SHARELINKS##

|

|

RockTenn, Norcross, Ga., USA, this week announced a $40 per ton price increase on its Classic News, Angelcote, and Millmask coated recycled paperboard products. The increases are effective with shipments beginning August 2. RockTenn manufactures paperboard, containerboard, and consumer and corrugated packaging, with annual net sales of approximately $3 billion. The company has some 10,000 employees at locations in the U.S., Canada, Mexico, Chile, and Argentina. ##SHARELINKS##

|

|

Kemira Oyj, Finland, reports that Randy Owens, currently president, Kemira Oil & Mining, Kennesaw, Ga., USA, has additionally taken on the role of region head of Kemira North America (Kennesaw, Ga., USA), replacing Hannu Melarti, SVP, Region North America, who left the company July 1 to pursue career options outside of Kemira. Owens was in sales at Nalco Chemicals from 1987-91., and was business manager, Sales/Product Management/Marketing Management at Vinings Industries from 1991-02. He joined Kemira in 2002 as VP, Strategic Business Unit Additives, Kemira Pulp & Paper, serving in that position until 2008. He has been president, Oil and Mining Business since 2008. Melarti has a lengthy history in the global pulp and paper industry, beginning in 1984–88 as legal counsel for SCA, 1988-91 as general counsel for Sunds Defibrator, 1991-94 as legal counsel for Rauma USA, 1994-95 as general counsel for Sunds Defibrator, 1996-99 as president of Sunds Defibrator, 1999-02 as president of Metso Paper USA, 2002-05 as president of Metso USA, 2005-08 as president of Kemira Chemicals, and 2008-10 as region head of Kemira North America. ##SHARELINKS##

|

|

On Tuesday, July 6, Max Moskal became the third TAPPI member to be featured in the new website addition, Member Spotlight. Debuting in May, Spotlight previously featured members Chuck Klass and Jeffrey (Jeff) A. Smith. A pioneer in the metallurgical field, Max has spent more than 50 years (40 of them as a member of TAPPI), in the industry. During this time he authored more than 40 papers and contributed articles, and considers his membership in TAPPI an invaluable resource for on-the-job problem solving and professional networking. And after a half-century, that's a lot of problem solving! Spotlight participants are often recommended by fellow members and staff. If you would like to nominate a member, simply send their name (or names) to MemberSpotlight@tappi.org. We will send them a Spotlight Questionnaire to fill out and return. We look forward to seeing you in the Spotlight! ##SHARELINKS##

|

|

Check out the recently published "Fundamentals of the Kraft Recovery Process," by Jeff Empie. It details the chemical engineering fundamentals of the kraft recovery process, including mass and energy balances, thermodynamics, fluid dynamics, phase separations, heat and mass transport phenomena, and reaction kinetics. Each kraft recovery unit operation, including multiple effect evaporation, recovery boiler operations, green liquor processing, causticizing, and white liquor processing is discussed in detail. Sample problems are posed and detailed solutions are presented. Additional instructive process problems are included at the end of each chapter for analysis and solution. Academicians, Mill Engineers: This book is ideal for senior or graduate level courses for pulp and paper, chemical, and mechanical engineers, as well as a valuable reference resource for practicing pulp mill engineers who want to better understand the kraft recovery process they operate each day. View the Table of Contents. ##SHARELINKS##

|

|

Dr. Hadi Mahabadi will make a keynote presentation at the 2010 International Conference on Nanotechnology for the Forest Products Industry. This event is sponsored by TAPPI and hosted by VTT. It will take place September 27-29, 2010 at the Dipoli Congress Centre in Espoo, Finland. The theme of this year's event is "Getting Down to Business with Nanotech Products." Dr. Mahabadi will present "Bio Based Nano Particles and a Greener Printing Industry" on Wednesday, September 29, 2010. He is the Vice President and Center Manager for the Xerox Research Centre of Canada (XRCC). XRCC is part of the research and technology organizations in the Xerox Innovation Group. Dr. Mahabadi joined Xerox in 1981 and has held a variety of managerial positions at XRCC. He has been instrumental in creating an environment to increase innovation and successful commercialization of many breakthrough materials technologies at XRCC. Examples include novel solid inks for Xerox ink jet printers and Emulsion Aggregation toner for many Xerox products introduced into the market after 2000. This Nanotechnology Conference brings together leading researchers, industry experts, government representatives and other stakeholders. In technical sessions and face-to-face meetings, they share developments, perspectives and discuss new ideas and breakthrough concepts on nanotechnology-based advances. Visit www.tappi.org/10nano for additional keynoters and presentation updates. ##SHARELINKS##

|

|

Mark your calendar for July 13, 14 and 15 for the TAPPI PRESS Three-Day Summer Sale. Selected TAPPI PRESS products will be marked down as follows: July 13 – 30 percent off July 14 – 20 percent off July 15 – 10 percent off The sale will include many of TAPPI's new releases and best sellers, plus a number of other titles from our extensive selection. ##SHARELINKS##

|

|

Early registration for the TAPPI Introduction to Kraft Pulping and Bleaching course is coming up soon - July 12. The course will be held August 9-10, 2010 in Kennesaw, Ga., USA. This course offers an overview of all kraft mill fiber line operations. TAPPI's ever-popular Kraft Pulping course includes a comprehensive introduction to kraft pulping, pulp processing, bleaching and wood and chip preparation -- in only two days. See the preliminary course schedule for the full curriculum. Just think what you'll be taking home with you: - More confidence that will enable you to interact with other experienced process engineers and operators - A better overall understanding of kraft pulp mill operations and bleaching processes - The ability to troubleshoot product-quality problems - Better awareness of how one part of the process affects other operations - An understanding of how kraft processes affect pulp quality - You can view the Preliminary Course Schedule here to see the day-by-day instruction that you'll be gaining. Register by July 12 to save. ##SHARELINKS##

|

|

You can't get it in a store. But, you can earn it. CONFIDENCE! Whether you have it or you don't, everyone can appreciate the value of confidence and would admit that it's worth every penny. Gain confidence for your work with the TAPPI Introduction to Tissue Manufacturing course set for August 11-12. The course is ideal for those new to tissue making or who want to gain a better understanding of mill operations in order to produce better, more competitive products. "One of the most significant benefits of this course is the confidence attendees will enjoy once they leave the training room," says Dr. Kocurek. "They can in turn use that confidence and knowledge to help influence positive changes within their workplace because they'll understand their roles better, and see the bigger picture of production." View the Preliminary Course Schedule to find out exactly all that you can learn. The TAPPI Introduction to Tissue Manufacturing course will be held at the Kemira Training Room in Kennesaw, Georgia, USA. Seating is limited to 30, so be sure to register before the July 14 early-bird discount deadline if possible. ##SHARELINKS##

|

|

Designed to help you learn 'why' things happen on a paper machine, the 2010 TAPPI Paper Machine Operations Course is a three-day course, to be held in Norcross, Georgia USA on August 24-26, 2010. The course will focus on improving your understanding of the overall paper machine operation and improving paper machine operations and product quality. Participants of this course will gain an improved understanding of the overall paper machine operation. In addition, a fundamental understanding of fiber properties and the way the mechanical components function on the paper machine will give the participant the tools needed to more quickly troubleshoot operational problems and improve paper machine operations and product quality. After successfully completing this course, participants should be able to: • Describe how the mechanical components and operations of the paper machine affect the structure of paper and thus the quality. • Identify design and operating features of the paper machine that affect machine performance. • Identify ways to improve paper machine efficiency and product quality based on a new understanding of the overall operation. To learn more about this course and to register, visit the online course information. ##SHARELINKS##

|

|

Nominations for the major TAPPI 2011 awards are due by August 1, 2010. The awards that may be presented in the upcoming year are: • Gunnar Nicholson Gold Medal Award - The Association's highest technical honor may be presented annually to recognize an individual or individuals for preeminent scientific and engineering achievements of proven commercial benefit to the world's pulp, paper, board, and forest products industries and the other industries that TAPPI serves. • Herman L. Joachim Distinguished Service Award - The Association's highest award for service, may be presented annually to recognize leadership and service which have significantly and demonstrably contributed to the advancement of the Association. • Paul W. Magnabosco Outstanding Local Section Member Award – The highest honor for Local Sections may be presented annually to recognize an individual for outstanding leadership and exceptional service to one or more Local Sections, which have resulted in significant and demonstrable benefits to the Local Section members. • TAPPI Fellow - TAPPI Fellows are Individuals who have been members of TAPPI for not less than 10 years prior to the nomination, and who have contributed meritorious service to the Association and/or the paper and related industries. Retiring members of the TAPPI Board of Directors become Fellows automatically at the end of their term. The TAPPI Awards and Honors page has links to these awards which will show the qualifications required and links to the nomination forms that must be completed. You may submit all nomination forms by email to standards@tappi.org, or you may fax them to the attention of the awards department at +1-770-446-6947, or send by mail to TAPPI, Awards Department, 15 Technology Parkway South, Norcrosss, GA 30092, USA. ##SHARELINKS##

|

|

The 2010 TAPPI Extrusion Coating Course will be held August 24-26, 2010 in beautiful Charleston, South Carolina USA. TAPPI invites you to sponsor this exciting event. This course is one of TAPPI's most well-attended courses and is sure to deliver top prospects to your company. There is no better way to build your network and grow your business than to sponsor and attend a TAPPI course, where top industry professionals go to find the latest information and technology! Whatever your goals are, you are sure to find success and valuable new connections—not to mention the beauty and charm of Charleston. Besides being affordable, your sponsorship of the Extrusion Coating Course will enhance your company's position as a leader in the industry. By supporting TAPPI events, you also demonstrate your company's commitment to a strong industry and the personal relationships that it relies on. Please review the Sponsorship Prospectus and select the package that best meets your needs. ##SHARELINKS##

|

|

Online registration just opened for Corrugated Week 2010. Everyone's invited from the corrugated industry from packaging to printing. There's only one show like this in 2010 – offering two days of trade show exhibit opportunities, training and insight from the best in the industry, a technology showcase exhibit of innovative trends and design in production, and TAPPI sessions featuring safety, innovations, energy and sustainability and color consistency. And, floor space for exhibitors is just shy of only a few booths remaining. This means even greater exposure to global expertise, products and services than ever before. TAPPI, the leading association for the worldwide pulp, paper, packaging and converting industries, and AICC, the Association of Independent Corrugated Converters, joined forces this year to deliver one powerful conference in one venue. This means more networking and sales opportunities found here in 2010 than anywhere else in the industry. For more information, visit www.corrugatedweek.org. And, enjoy Baltimore this fall! ##SHARELINKS##

|

|

The TAPPI Biorefinery Committee, the planning organization for TAPPI's International Bioenergy and Bioproducts Conference (IBBC), has created four new subcommittees to provide for a more focused review of specific technical advances and industry issues. The new subcommittees will focus on the following areas: • Biomass Supply, Demand & Handling • Thermo Chemical/Chemical Catalytic Conversion • Biochemical/Yeast & Microorganisms • Policy, Tax, Legislation & Incentives If you are a TAPPI member and interested in participating in one of these subcommittees, please contact Mary Anne Cauthen for further details about how to join ##SHARELINKS##

|

|

August 3-5 August 9-10 August 11-12 August 17-18 August 24-26 August 24-26 ##SHARELINKS##

|