More Countries Climbing Personal Care Pyramid

Print this article | Send to Colleague Print this article | Send to Colleague

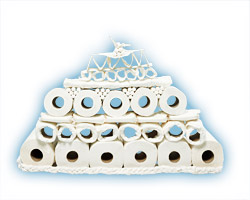

Consumption of personal care products has a strong correlation with income level, according to a new report by SCA, Stockholm Sweden. The report pictures a pyramid with toilet paper on the bottom and incontinence products at the top. More and more countries, it says, are now climbing up the personal care pyramid.

Countries whose citizens are raising their quality of life and rapidly climbing the pyr amid include Brazil, Colombia, Turkey, Saudi Arabia, Russia, Mexico, Malaysia, South Africa, Chile, India, and China. When people have income of even two U.S. dollars a day, they start using their money for more than food and housing—for personal care products in particular. amid include Brazil, Colombia, Turkey, Saudi Arabia, Russia, Mexico, Malaysia, South Africa, Chile, India, and China. When people have income of even two U.S. dollars a day, they start using their money for more than food and housing—for personal care products in particular.

"There is a very strong correlation between GDP per capita and consumption of personal care products, and all of these countries are experiencing strong growth right now," says Ian Bell, head of home care, tissue, and hygiene research at Euromonitor International, London, U.K.

A study by the Japanese personal care company Unicharm, the report notes, found that purchases of feminine care products rise sharply when GDP per capita exceeds $1,000. As the level reaches $3,000, people also begin to buy diapers and wet wipes, and at $8,000 – $10,000, demand for incontinence products rises.

"There is, of course, considerable variation within countries," Bell says. "Many high-growth and developing countries have relatively high use of personal care products in cities, whereas use in rural areas is almost nonexistent. That’s the case in China, for instance, where many personal care products are generally available in Shanghai and eastern China but not at all in the interior of the country."

A great many people in the world deal with daily budgets and have to shop for everything they need that day, every day. The main reason for this is that their incomes don’t cover anything beyond their daily bread. There is a major difference between earning a dollar a day and 10 dollars a day. "With just one dollar, people have to put all of their money towards food and housing costs," says Victor Niembro, SCA’s category portfolio director feminine care, Americas, MEA & Asia.

"But as soon as they make two dollars a day, there’s something left over that can be used for entertainment and consumer goods. If you make 10 dollars, that portion is fairly large. And priority is often given to hygiene products rather early on," Niembro adds.

In high-growth and developing countries, products are often sold in smaller packages, the SCA report continues. In Asia and in Latin America, the company sells diapers in small packages. More than half of sales are to consumers in "mom-and-pop" stores, local service outlets with behind-the-counter sales.

Another project also sells feminine care products in single packs in Peru and three-packs in Nicaragua. Many people can’t afford diapers every day but buy them for use at night or at a wedding, party, or other festive occasion when they want to be sure to avoid leaks. The same is true for feminine care. In the past, small corner shops often sold sanitary products one at a time, opening the packages and selling the items over the counter, but nowadays feminine care products are sold in small packages.

Consumers with low incomes also look for products that can be used for multiple purposes. "One example is when packaging can be reused as a container or for storage afterwards," Niembro explains. "It’s easy to draw the conclusion that people with the lowest incomes would choose low-priced products and the chain stores’ own brands, but that’s not the case at all," he says. "If they’re going to put their money into personal care products, they want to be able to rely on the quality. So most people choose the best-known brands."

The full report is available online.

|

|