This report by Pöyry Management Consulting is the fifth in an on-going series that draws on expertise from Pöyry’s global offices to update readers on the opportunities and challenges facing tissue producers today. The first report in August 2010 issue of Over the Wire-Tissue Edition focused on changing consumer behavior in North American tissue markets .The second report in October 2010 issue examined the impact of Clearwater Paper’s acquisition of Cellu Tissue on the tissue market in North America .The third report in November 2010 issue explored supply side perspectives and global tissue trade. The fourth report in December 2010 analyzed which tissue makers in North America are in the best financial position to pursue growth initiatives.

This fifth and latest report is the first in the series to look outside of North America. It updates readers on the domestic tissue markets in China with the latest available data on consumption and growth rates. Comparisons of rural versus urban centers in China show that it will take five or more years for urbanization to reach levels similar to western countries. Also, as further detailed below, low per capita income and wealth are also limiting factors in the growth of certain tissue products in China.

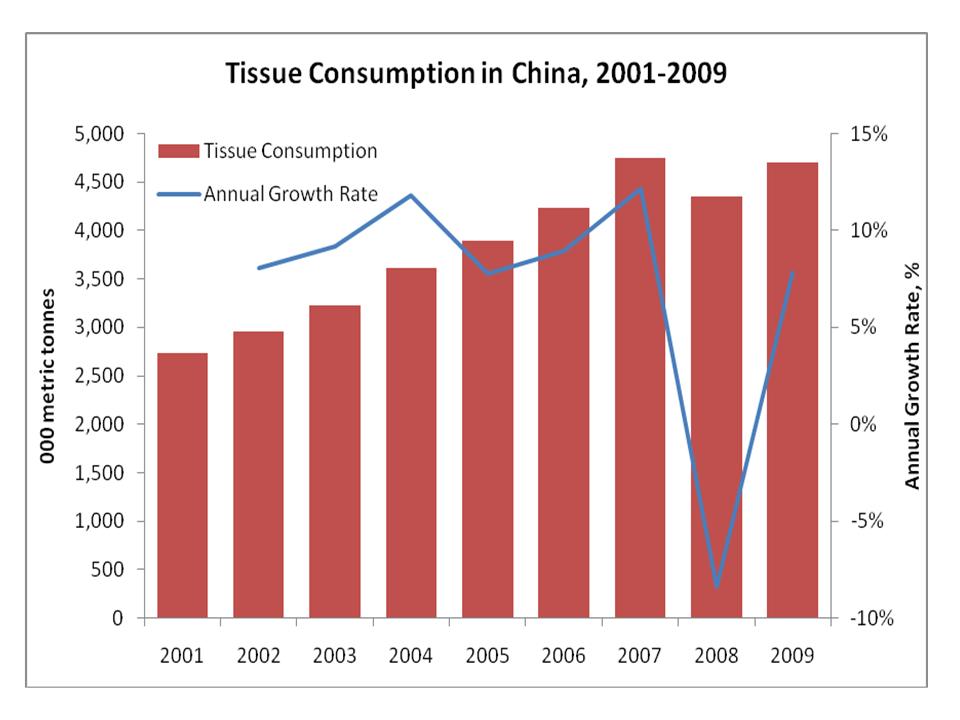

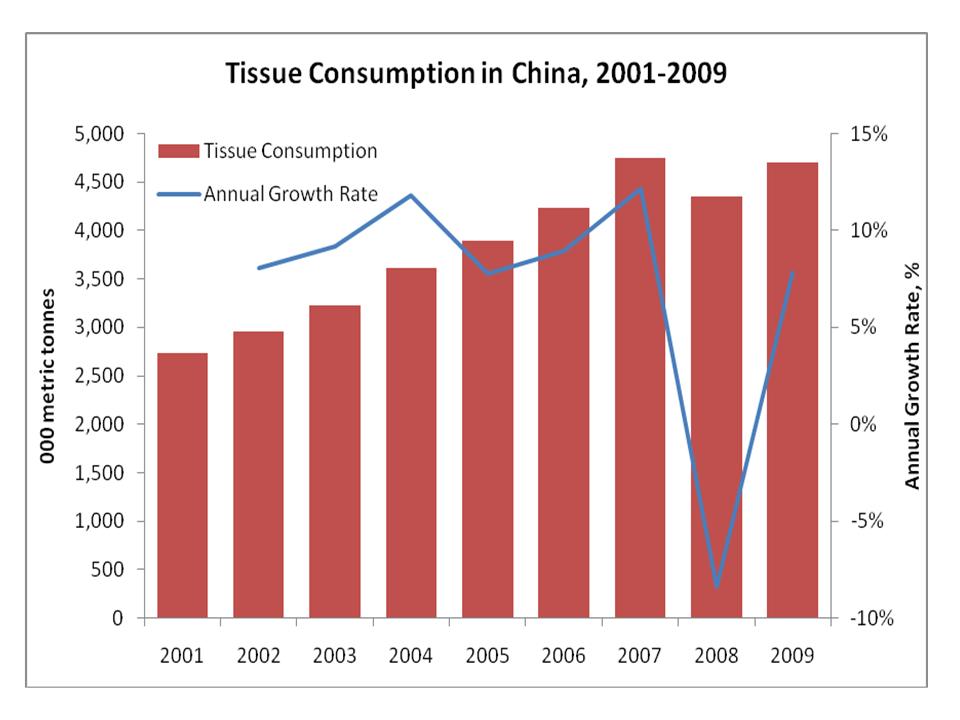

In 2009, tissue consumption in China totaled nearly 4.7 million metric tpy and is one of the largest and fastest growing tissue markets in the world, ranking second in size only to the U.S. As shown in the following graph, since 2001 tissue consumption has grown at an average annual rate of 7%. After contraction in 2008, consumption has since returned to high growth, increasing by 8% in 2009.

Demand Drivers

With a staggering population of 1.35 billion, strong economic growth, improving living standards, and higher wealth of the urban population, the domestic Chinese tissue market has enormous potential for growth. However, significant macroeconomic challenges exist before the tissue market can achieve its full potential.

China continues to have a relatively small percentage of its population living in large urban centers. Just over half of the population is concentrated in rural regions of China, creating significant logistic challenges for product distribution and overall market penetration. This compares with fewer than 20% of the population in the U.S. being located in rural areas, and has also limited the development of the away-from-home market segment that is estimated to account for less than 10% of total tissue consumption.

Urbanization in China will continue to accelerate. However, it is estimated that it will take at least until 2015 before the percentage of people living in urban centers begins to exceed those living in rural areas. For tissue products to fully penetrate these rural areas, transportation and distribution logistics will have to improve significantly.

Low per capita income and wealth have also created difficulties for major at-home product categories such as towel. Currently, towel is estimated to account for less than 3% of total tissue consumption and is only purchased by high-income households. Toilet tissue is the largest tissue segment, representing an estimated 70% of demand. Other market segments such as facial and napkins are still in their infancy and will develop as urbanization continues.

Finally, product quality continues to be a significant challenge as the market is characterized by a large number of very small, dispersed payers. Tissue produced with recycled fiber, and other non-wood pulps have a large share of the market. This is substantially different than North America, where virgin fiber continues to be the main raw material. Quality has improved slightly as a result of new paper machine installments and closures of smaller machines, but structural changes will have to further develop before higher quality standards are met.

Takeaway

Although the strong growth in Chinese tissue demand is among the highest in the world, there are key limiting factors that create significant challenges for current competitors and new industry players. Interestingly, U.S. tissue giants Georgia-Pacific and Procter & Gamble have both exited the Chinese market.

TAPPI

http://tappi.org/