This report by Pöyry Management Consulting is the latest in an on-going series in Over the Wire Tissue Edition that draws on expertise from Pöyry's global offices to update readers on opportunities and challenges facing tissue producers today. The concluding section of this report was inadvertently omitted in the most recent (September 13) issue of the tissue edition, and so the entire report is being repeated below, with corrections, for the benefit of Over the Wire Tissue Edition readers.

The cost of fiber is a key value driver for both recycled and virgin producers of tissue. At current price levels for both virgin and recycled fiber, tissue profitability margins are being squeezed. As virgin pulp prices begin to fall from peak levels, the cost differential between virgin and recycled tissue producers may narrow.

In this From the Experts report, Pöyry analyzes the current pricing environment and estimates how much sorted office paper (SOP) prices need to increase by for recycled tissue producers to approach the cost of manufacturing for virgin producers. Finally, Pöyry takes a look at the impact of declining uncoated free sheet demand on sorted office paper prices.

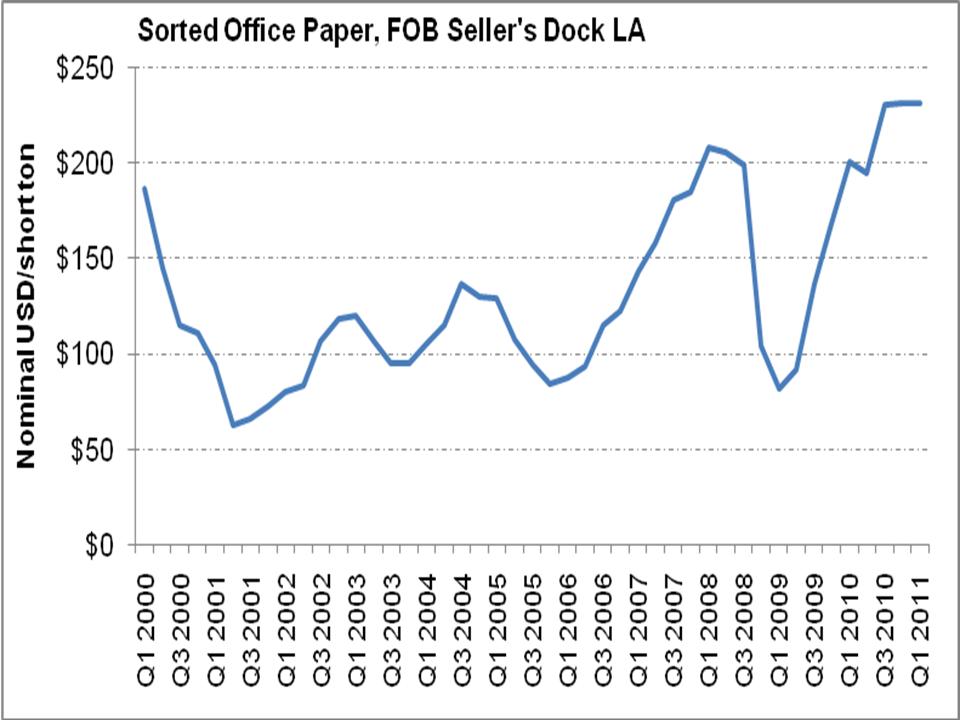

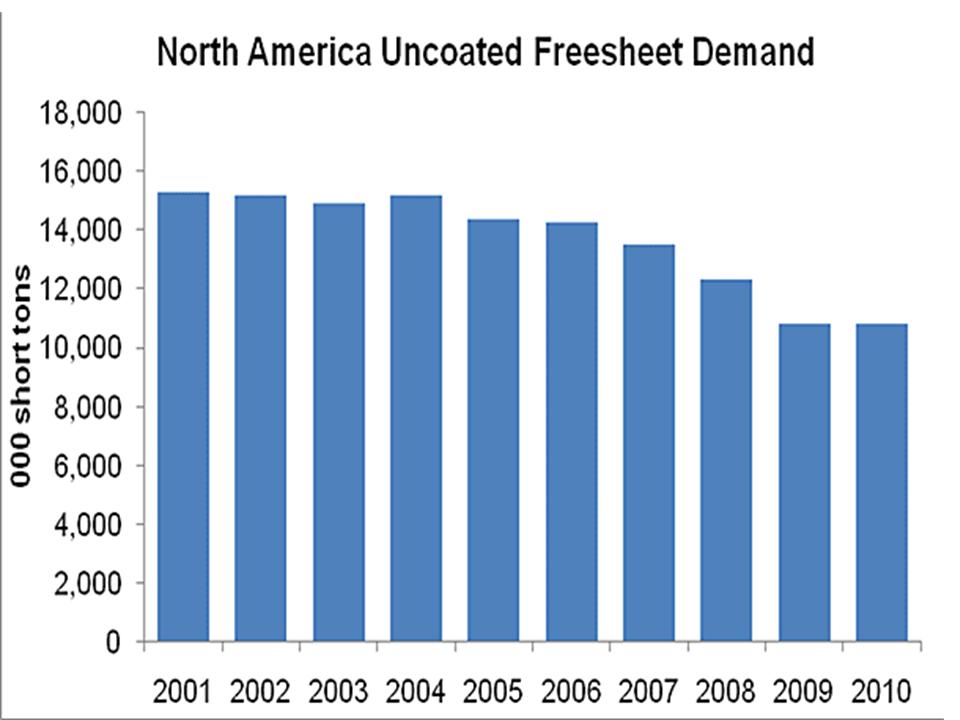

Historical SOP Prices

After falling rapidly at the end of 2008, sorted office paper prices have since dramatically recovered to levels that are higher than they were before the economic recession.

Figure 1. Historical SOP Prices Source: Official Board Markets, Pöyry Analysis

Historically, there has been a strong correlation between prices of SOP and market virgin hardwood pulp. However, as virgin pulp prices have begun to fall from peak levels and SOP prices remain high, there may be a decoupling effect. As the gap between virgin and recycled fiber costs narrows, manufacturing costs may drive a shift in fiber furnish in favor of virgin pulp.

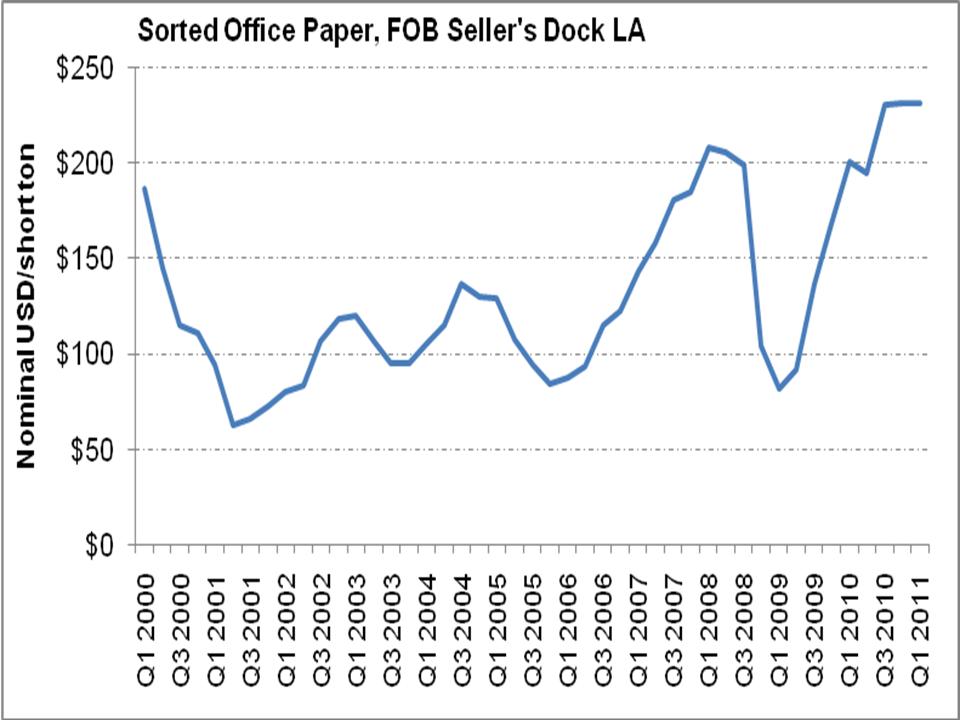

Manufacturing Cost Perspectives: Recycled vs. Virgin At current price levels, North American virgin tissue producers' costs are estimated to be almost $300/short ton higher than for recycled tissue producers (on a weighted-average basis). Despite myriad manufacturing process differences between the two, the cost of fiber accounts for more than 90% of this differential. As such, changes in furnish cost and wastepaper quality will be the main drivers in closing the gap between the two. Given current trends for virgin pulp and SOP prices, the gap between virgin- and recycled-tissue manufacturing costs will likely narrow in coming years.

Figure 2. Weighted-Average Manufacturing Costs for AFH Bath Tissue

For example, Mill A produces virgin and recycled bath tissue on a crescent-former tissue machine. Equipped with a deink plant, their pulper-to-reel yield is approximately 65%. At current fiber price levels, the cost of producing tissue at Mill A is 50% higher for virgin tissue than for recycled tissue. But what might the cost differential look like in 2015?

If all input costs are held constant with the exception of the cost for SOP, an average increase of 18%/yr would be sufficient to push the manufacturing cost of recycled tissue above that of virgin tissue. Given that SOP prices have increased at an average rate of 20%/yr over the last five years, this scenario is not inconceivable.

Conversely, holding all input costs the same with the exception of virgin fiber costs, an average decrease of 13%/yr would be required to have a break-even between the cost of manufacturing recycled and virgin tissue. However, this scenario is neither probable nor is it in line with current virgin price forecasts. Using current market-pulp price forecasts, SOP prices would have to increase at an average rate of 12%/yr for the cost of recycled tissue to surpass the cost of virgin tissue at Mill A.

An increase in SOP price of 12-18 %/yr over the next five years is possible given current trends. However, the Pöyry forecast for SOP prices does not indicate that this is a probable outcome. And although furnish cost will be the main driver in narrowing the manufacturing cost gap, it is important to note that recycled tissue production also has greater chemical needs, requires more energy and personnel, and is burdened by the challenge of degrading quality in their raw material.

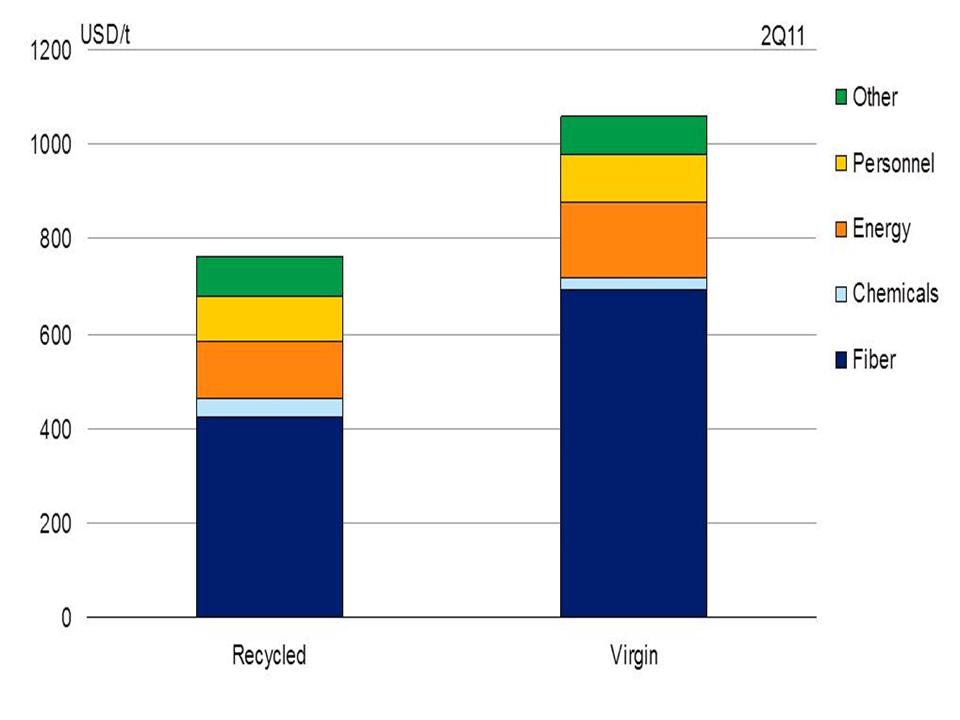

The Drivers: Impact of Declining Uncoated Free Sheet Demand

What factors may push SOP prices to continue on a steep upward trend? A key factor is the availability of sorted office paper, which is impacted by the production of and demand for uncoated free sheet (UCFS) papers. Demand for UCFS has fallen at an average annual rate of 4%/yr since 2001. Pöyry's current forecasts indicate that demand will continue on this structural decline at an average rate of -3%/yr until 2015.

Figure 3. Uncoated Free Sheet Demand in North America, 2001 – 2010

As a result, the availability of recycled office papers will decline accordingly. Potentially an offset to this adverse impact, the collection rate of recycled office papers may improve. Currently, the SOP collection rate is around 50%, which is very low in comparison with OCC (old corrugated containers), for example.

Final Thoughts

As pulp prices decline from peak levels, the manufacturing cost differential between virgin and recycled producers will likely narrow. Under one scenario using current market-pulp price forecasts, SOP prices would have to increase at an average rate of 12%/yr for the cost of recycled tissue to surpass the cost of virgin tissue for a hypothetical mill example.

As a tissue producer facing rising input costs, it is imperative to prepare for the future and manage product pricing strategies accordingly.

TAPPI

http://tappi.org/