Online Retail and the Tissue Industry

By Lindsay Gervais

A $175 billion-plus industry, non-travel online retail has shifted the way consumers purchase everyday essential products, including tissue paper products. Large players such as Amazon, which purchased Quidsi (owners of diapers.com, soap.com, wag.com, and other e-commerce sites) in 2010, have targeted traditional products such as laundry detergent, pet food, and tissue paper products as good candidates for online purchases.

The paths-to-market are changing, which has impacts across the tissue industry’s value chain. How will the Away-from-Home market channel adapt as small offices turn to convenient online-purchasing? How can tissue manufacturers leverage this new sales channel? What products and which packaging are the most appropriate for online sales channels?

In this issue of From the Experts, Pöyry analyzes how online sales of tissue products have developed and discusses the impacts for the tissue industry.

Online Consumer Products Growth

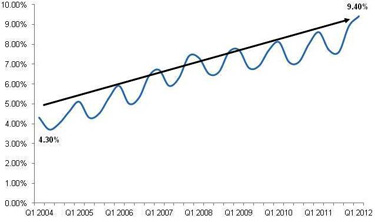

Online consumer spending was estimated to grow 4 times faster than total consumer spending last year and, as such, it is not surprising that retailers have targeted this channel to drive sales growth and is approaching 10% of total consumer spending in the U.S. However, consumer packaged goods still represent a small percentage of the non-travel online consumer spending (~1%). Online sales of drugstore products, such as bath and towel tissue, also have a small share. When Amazon-owned Quidsi launched soap.com in 2010, only an estimated 6% of drugstore products sales were distributed through online channels. Major hurdles to growth for online sales of consumer products have been expensive delivery, out-of-stock, and consumer sentiment towards wanting to see the product before making a purchase.

However, retailers are now offering short delivery times of 1-2 days and even same-day options, convenient auto-replenish programs, and lower-cost shipping options for frequent shoppers, helping to eliminate many concerns that consumers have about purchasing tissue paper products and other essentials online. This has spurred fast growth in these consumer packaged goods product categories. In a recent study completed by comScore, online sales of consumer packaged goods were estimated to be on a 20% per year growth track.

Figure 1: Online Spending as a Percent of Total Consumer Spending – U.S.

Source: comScore

Implications for the Tissue Industry

Among the top categories of consumer packaged goods that are sold online are diapers, with consumer products giants Kimberly-Clark and Procter & Gamble topping the list of top brands sold online through online-retailers in the health product category. The success of diapers penetrating the online channel is attributed to the product characteristics itself. Consumers typically purchase bulky, multi-pack items online as it is more convenient than in-store. As consumers continue the shift to more spending online, there is an implication on the way goods are packaged and priced to maintain a low cost of delivery as well as cater to consumer preferences towards purchasing multi-pack items online.

In addition, sales channels are overlapping between Away-from-Home and At-Home end-uses. Small offices and traditional Away-from-Home customers and the average consumer can purchase through similar sales channels online which may create an opportunity to reach more end-users with a product that caters to both Away-from-Home and At-Home customers.

About the Author

Lindsay Gervais is a Consultant at Pöyry Management Consulting. Contact: lindsay.gervais@poyry.com

TAPPI

http://tappi.org/